Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Kumba Iron Ore released results this morning, for the full year to end December. Normally Byron would have jumped all over this one, but I said that I wanted to cover them and work in resource nationalism, whatever that means. Because I had heard a radio interview with John Robbie and Prof. Ben Turok this morning, and in fact the first lines of the results nail what I am talking about. Record production of 43.1 million tons, that is excellent. Wait for it, export sales volumes increased to 39.7 million tons. The difference between the two is obviously what we use here, a total of 3.4 million tons. Wow. This is a 27 percent reduction in domestic sales, perhaps another sign that the local steel industry is in crisis mode. So, more than 90 percent of what is produced here is sold elsewhere. Why? Because someone else needs it more than we do.

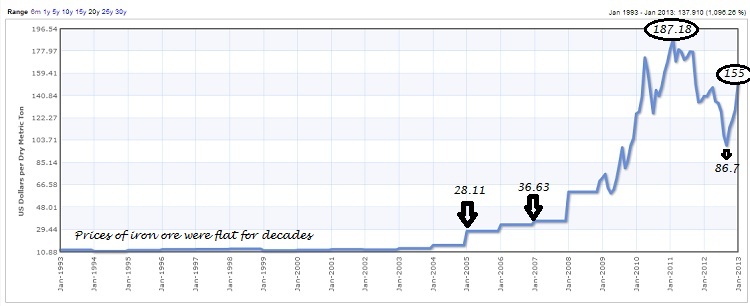

If our market was completely closed to the rest of the world and Kumba Iron Ore was selling iron ore at cost plus a small percentage amount to state owned steel mills. I am just guessing that they would employ a whole lot fewer folks and almost certainly wobble from one period to another. But, because of the great Chinese economic miracle of our time, South Africa has benefitted already from rising iron ore prices and greater tax collection. Kumba Iron Ore is a company that it could be argued is in the right place at the right time. Let me try and quantify that with a few graphs, first, the 20 year Iron Ore price from Index Mundi:

The whole idea I am trying to explain is that iron ore prices used to be negotiated once a year and then that changed to a spot market. It is amazing to think that 8 years ago the iron ore price was 28.11 Dollars a ton. Nowadays the price is around 155 Dollars per ton. The average price that Kumba Iron Ore received in a very volatile year last year was 122 Dollars per ton, a decrease of 23 percent from the year prior. If the iron ore maintains these current levels then expect the first six months of this year to be a record half. Production will be up, the rand will be weaker and the average price will be near records. However, as you can see, predicting the iron ore price is about as easy as predicting climate change and where the next natural disaster will happen. Or even harder, will Lindsay Lohan ever act in another movie?

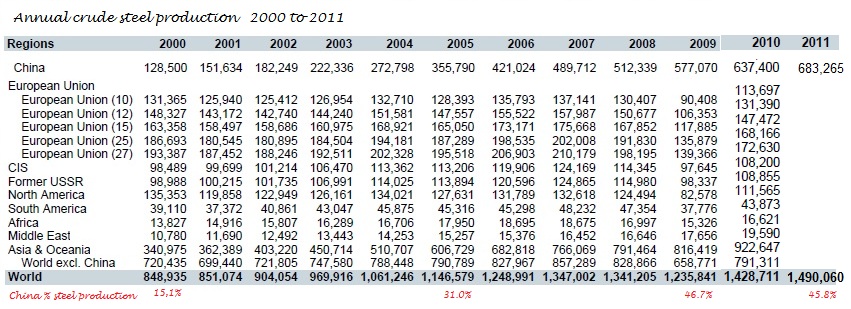

But, this is a more important table than any other here, and is taken from this document: Annual crude steel production, 2000-2009. I have then stuck on and hacked a column from this table, Annual crude steel production, 2010 mainly because 2010 saw a bounce back in demand for iron ore and metallurgical coal. So, I have tried to stick that onto the table, to give an extra year, and then I plugged in the 2011 results, that document you can find here: Crude steel production 2011.

OK, just to introduce the pieced together table, the total global steel production has risen 75 percent in the period from 2000 to 2011. Of that increase, China accounted for 86.5 percent. Strip Chinese steel production out of the equation and you see only 10 percent growth. Exclude the whole Asian continent and growth over that 12 year period would have been a mere 3 percent. Three whole percent. This is the whole point that I am trying to make. The new customer on the block and the other growing ones in Asia, South Korea and to a larger extent India have fuelled the increase in the underlying commodity prices. Iron ore and metallurgical coal prices have not increased because the Australian, Brazilian and South African governments suddenly "got so clever". No. It has nothing to do with you, the rising prices. The rising demand was fuelled and is fuelled by the Chinese decision to industrialize heavily. In fact, as far as I can tell from those longer dated tables, out steel production is lower. That now has something to do with us.

And you can see the amazing figure of how much China accounts of annual steel production. It is fair to say that the Chinese have changed the fundamentals for global iron ore and metallurgical coal trade. Nobody else has changed the industry as much as the Chinese have over the last decade plus. So, with the companies paying much higher taxes across the globe as a result of bigger investments (and risks) that private companies and their shareholders took on. And now the state wants to tax those companies higher, everywhere. Leeches. If we can go back to that quote from yesterday. Capitalism has lifted humanity out of the dirt and is greatest value creator in history of the world: