Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

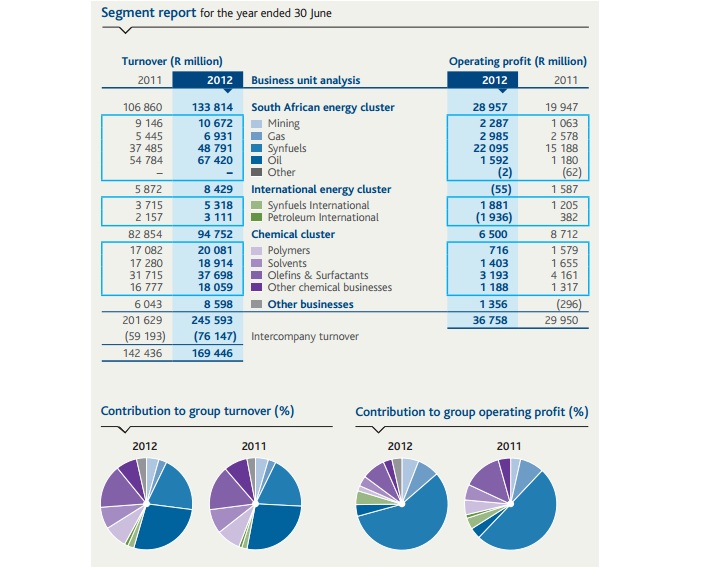

Sasol have released their full year numbers for their financial year to end June 2012 this morning. At face value they certainly look good. Turnover increased sharply to 169.4 billion Rands, costs rose, but the group seems comfortable with that, they say in-line with inflation, 8.6 percent. Production was much better in the second half, full year production was basically the same as last year. Operating profit increased 23 percent to 36.8 billion Rands, the average crude oil prices received increased 17 percent and the exchange rate weakened by 11 percent inside of the financial year. Headline earnings increased by a little more than that to 42.28 Rands per share, the dividend, and this is a big surprise, increased by 35 percent to 17.5 Rands for the full year. Dividend cover has been lowered (that is good) to 2.3 times. The final dividend has clocked 11.80 ZAR, expect just over 10 ZAR after dividends withholding tax. Listen to this, in direct and indirect taxes, Sasol paid 28.2 billion ZAR to the South African government. Anyone who calls for the nationalisation of the business (in my view for what it is worth) should be gagged immediately.

The best performing segment, as per usual is the Synfuels business which is obscenely profitable. On turnover of 48.791 billion ZAR the division manages an operating profit of 22.095 billion ZAR. Astonishing. See what the group operating profit is above (36.8 billion ZAR), and you can quite quickly see that Sasol Synfuels is 60 percent of the overall group profitability. And therefore, by far and away the most important division. To put it into perspective, inside of the chemicals cluster, the Olefins & Surfactants segment is the second most profitable unit for the group, clocking 3.193 billion in operating profits, nearly one billion Rands less than this time last year. Here is a screen grab from their Sasol audited financial results presentation, page 2:

There were some well telegraphed once off charges, which totalled 2.121 billion Rands. The largest of these were the partial impairments of their Canadian shale gas assets, an amount of 964 million Rands. Byron wrote about this when Sasol released a trading update last month, in a piece titled Sasol take a write down on their gas business. Whilst this is disappointing, the timing of these purchases, we certainly think that this is the future of the business. We will deal with this in a tick.

OK, so is the share price expensive? It is clear that we like the company as an investment theme, they are a mix between an energy and chemicals company, as well as being a technology company. Technology in the sense that they are able to posses these extraordinary skills at that sort of scale, which makes the company sort of unique globally. On that basis I often think that one should expect to pay a premium. But this is not the case, the stock trades on less than 10 times historical earnings, but this is not out of line with the broader oil and gas sector globally. The dividend yield (after tax) is around four percent as at the close of business Friday. That sounds appealing to me.

One of the reason why the market is reluctant to afford the broader sector a higher valuation is simple, at least in my mind, the oil price is volatile. From their release: "For forecasting purposes, a US$1/barrel increase in the average annual crude oil price results in an increase of approximately R580 million (US$72 million) in operating profit with a similar negative consequence if the average annual crude oil price decreases by US$1/barrel (This is based on assuming an average rand/US dollar exchange rate of R8,01)." If the average price per barrel remains at these elevated levels and the Rand remains weak, then the expectation would be for the company to be much more profitable than last year. In fact the last two months have already been good for the company.

The outlook column is as you would expect, I think, cautious, you can read it on page 8 of the analyst booklet, Profit Outlook* - strong management focus in challenging environment. There are uncertainties of course, but production at Synfuels should improve. Oryx is going to be just fine, the Canadian shale gas production should grow, after initially disappointing. Their very important and not talked about enough chemicals division should continue to perform steadily.

The company is shifting gears. And whilst they have been criticized for looking a little slow in making decisions, this has not been the case recently. There are three sizeable gas-to-liquids projects and exploration on the go right now, the one with perhaps the quickest conclusion is the Uzbekistan Gas-to-Liquids plant. The government in that region themselves have started developing the surrounding infrastructure where the proposed plant is expected to be built. The two other major gas-to-liquids projects are in Louisiana and Western Canada, but they are further away than the Uzbek one. These plants, should they go ahead, will be the future. The dirty coal to liquids past is being shifted. And therein lies both many risks and rewards. We continue to buy the company, they look cheap at these levels, even though the stock has had a good run recently. Over the last five and a half years, the stock price reached 515 Rands, but then plummeted to 212 Rands, currently at 380 odd ZAR. Buy.