Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Sasol (SOL) reported numbers this morning for the half year to end December 2011. And it is a whopper, in part the currency weakened (average price for the period was 7.63 to the US Dollar) and in part attributable to the stronger oil price (average price for Brent crude was 111.41 Dollars per barrel), so for this company that is the perfect storm so to speak. Remember that for their chemicals business the input price is oil, so it is a double edged sword. But remember, for the time being the business is about Synfuels. Their synthetic fuels business, the part of the business that is the most famous one for them I guess. The part that most people know also happens to be the bulk of the profits. We like the company because they are a technology company and not a oil producer, but yet still have the same valuations as their "sector" peers.

If you want to check it out in details for their half year, here goes: Analyst Book for the half-year ended December 2011. We will use this presentation as well as the numbers from the press release to analyze this company and their results. Headline earnings per share rose 81 percent to 23,50 Rand, the interim dividend was higher by a similar amount to 5,70 Rand per share. Turnover grew by 24 percent to 83.3 billion Rand, that of course lifted by the first two factors that we talked about, the perfect storm for the company. Their operating margin for the half is the best seen since the full year in 2008, which had an incredible second half, remember that the oil price reached nearly 150 Dollars per barrel. Operating margins are the best that they have been since 2008 too!

There is a piece that they always include in their results, the fact that they are the single biggest corporate tax payer in South Africa, mostly through indirect taxation in the form of taxes on their finished products, but shelling out a whopping 13.5 billion Rand for half is an amazing number. There, hand over half of that to SAA to keep their business afloat. Quite astonishing if you think about the efficiency of private and public businesses, granted they are worlds apart in terms of their businesses.

There is a line in the presentation that is amazing. For each 10 cents the Rand moves to the US Dollar in 2012, where the assumptions are 109.2 Dollars per barrel of oil (average over the year), the impact is 955 million Rands on operating profit. Wow. That is around five percent on 180 days worth of current operating profit, which clocked 20.5 billion Rand for the first half. That was the point that I was trying to make about the perfect storm for them in the last half, in terms of their price received for their product.

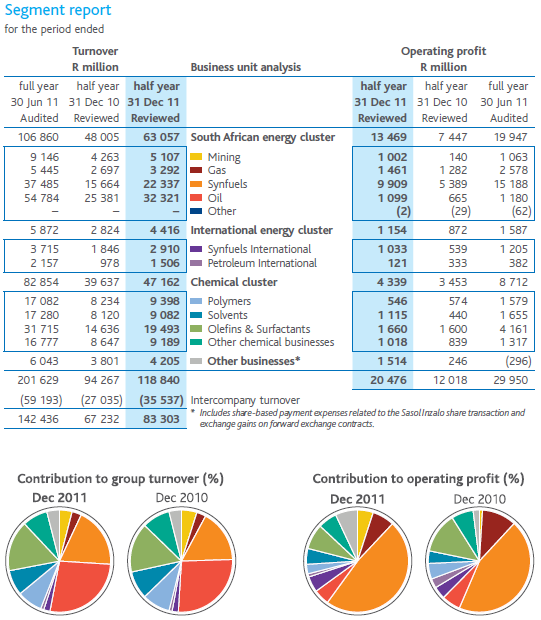

This is an important screen grab:

It underscores the importance of Synfuels to the overall mix, both the international Synfuels of the business and the original part of Sasol, the synthetics fuels part of their business. But, the business is a diversified one, and becoming even more so geographically that is. Gas, gas and more gas, Canada, Mozambique and in the USA, Louisiana, there are big moves afoot to develop these assets. Goodbye Karoo (that permit expired and was not renewed), hello the rest of the world. Uzbekistan too. And, Sasol are using their own feedstock to have a gas turbine power station (140 megawatts) powering their own needs no doubt. That will be a pilot to see if future electricity generation and feeding back into the grid is feasible. Paul, who knows a lot about electricity generation, tells me that it is an expensive exercise, although immediately available and is mostly used in a developed world context when needed.

Sasol seem to be getting on top of some of the concerns that we had about them, carbon capture technology is improving, or so we are told of course. More importantly is how the business is positioning themselves with sending the good coal out via the export market, the lower grade stuff for Synfuels and most important, the gas to liquids global push globally. There is no doubt that is going to be the big driver of the business, but as we know, this is a tough old market. But we continue to accumulate the stock of the business on the basis that they will continue to execute their big projects abroad.