Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we had full year results from Africa's biggest bank, Standard Bank. It's always tough analysing a banks financials because there are lots of moving parts and it can get very complicated. I'll try and simplify it as much as possible to get a better picture. Firstly let's look at the highlights.

Like the rest of the big four, earnings improved considerably. These came in at R13.6bn, up 21% from 2010. This equated to 860.4c a share with a handsome dividend of 425c, nearly a cover of 2. From a valuations perspective this put's the company on a historic PE of 12.6 and a dividend yield of 3.9%.

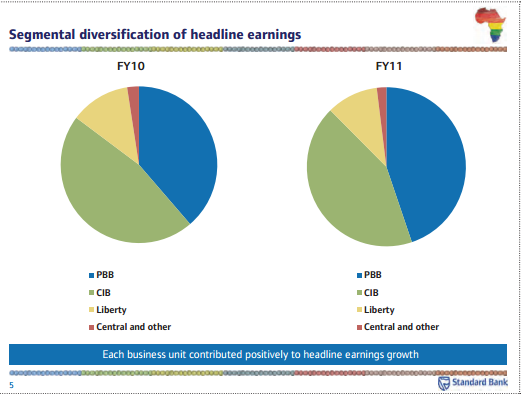

Where did this growth come from? To get a better perspective here is a breakdown of the business.

Personal banking (PBB) grew by 40% to contribute R6bn (44%) of the overall mix, corporate and Investment Banking (CIB) grew 11% and brought in R5.8bn (42.6%) of earnings and Liberty grew 3% bringing in 10% to the earnings mix. The rest came from discontinued operations in Argentina and Russia.

A lot of the commentary covers global issues such as European debt, Middle East protests and the Japanese tsunami. But the commentary on Africa was interesting. "Africa's performance continued to improve on the back of strengthening internal markets and more robust external relationships and was second only to Asia in the resilience demonstrated throughout the financial crisis. However, the region was not immune from the global difficulties and in the second half of 2011 there were dramatic increases in interest rates and weakening of currencies in Kenya, Uganda and Nigeria." Not without its issues but resilient and on the right path. Organic growth in the rest of the continent clocked in at 38% for Standard.

The South African consumer also looked strong with debt levels actually decreasing contrary to what most people believe. "Following the relatively brisk growth rate of 4,6% recorded in early 2011, real growth in the South African economy declined during the year and growth of 3,1% was recorded for the year. Real household disposable income continued to grow in the second and third quarters, but more slowly than in early 2011. This was reflected in weaker real household consumption spending. While households took on additional debt, growth was lower than the increase in disposable income, bringing down the household debt-to-disposable income ratio to 75% from 78% in 2010." Household savings remained at very low levels.

So what about their prospects? Reading their financials it is very clear what their strategy is. Africa, Africa, Africa. I'm sure this has a lot to do with The Peoples Bank of China. It is no secret that Africa is extremely under banked and the potential for growth is massive off a very low base.

This is why we prefer Standard Bank to the rest. They have been first movers in a lot of African countries. We are still very cautious about the corporate and investment banking division which still contributes 42.6% to earnings. A lot of these activities will be regulated out of any abnormal gains of the past is our opinion. Because of this we prefer African Bank's micro lending model which indecently, all the big four are trying to target to improve ROE.