Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Sasol, the largest company of its kind, anywhere in the world, reported their full numbers to June 2011 this morning. I was quite astonished that the average Rand to the Dollar exchange rate was the strongest seen for five years plus, since 2005. So this is where the notion of the strong Rand comes from. Although 2004 saw a much stronger currency, if I remember right, 5.65 to the US Dollar in latish 2004, around the same time as Hurricane Katrina.

Results, the company reported record turnover, up 17 percent in ZAR to 142.4 billion, profit for the year clocked 20.2 billion ZAR, translating to Headline Earnings per share up 27 percent to 33.85 ZAR, and the dividend a pretty handsome 13 ZAR for the full year (9.9 ZAR in the second half), matching the record set back in 2008. 2008 remember was a record year with much higher oil prices than we see now.

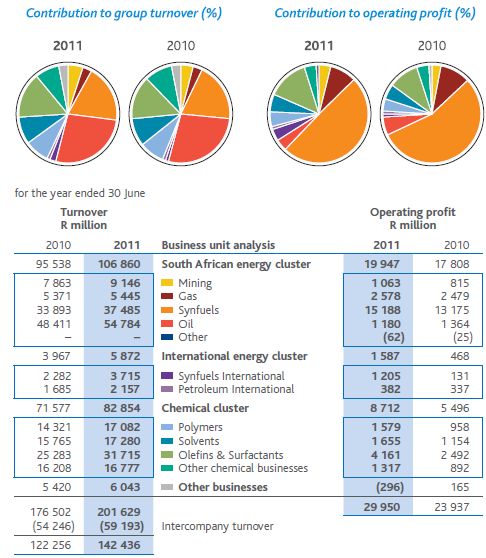

South African Synfuels is still powerful, but I am happy to say that the reliance is being reduced (very slowly) on this specific hugely profitable business. An amazing business with awesome margins, that is just over half of all operating profits. Synfuels international is starting to become a serious contributor. But let a picture tell more than a thousand words, here is a segmental report, comparing last year to this year. Hacked from the report, which you can download here ---> Sasol limited financial results:

This is certainly a South African favourite, over 70 thousand different shareholders tells you that. Lots of interesting snippets of information about the ownership of the company, the ADR shareholders are 5.3 percent, the employees 4.1 percent of the total issued shares. Pension funds, provident funds and unit trusts own nearly half of the company. Wow. The PIC owns 9.4 percent of the company, Allan Gray 7.9 percent, these are the two biggest shareholders. Black Rock, the world's biggest asset management firm owns 2.2 percent of the company and Vanguard (Think Jack Bogle and the ETF people in the USA) 2 percent.

Where is the excitement? Well, I can tell you where there is an immediate disappointment in the news from China, from the project update piece: "Given the delay in the approval from the Chinese government for our CTL project in China, we are developing other investment strategies and growth opportunities, both in South Africa and abroad. We have reallocated planned project funding for the China CTL project and redeployed staff to other projects. We remain committed to growing our other businesses in China." What I read into that is that Sasol will revisit the Chinese project at a later date, but fee dragging means the expertise will be allocated to other projects.

And those other projects are likely to be places like India, where it is still early stages, Uzbekistan, which is more advanced, a bigger focus on natural gas in Canada, Mozambique, Australia as well as Papua New Guinea. More interesting (but less exciting) was that during the financial year, in July 2010, Sasol concluded an agreement with a Norwegian SOE which is currently building a carbon capture facility, expected to come online this time next year. Why is this so important? I suspect for the North American Gas to Liquids plants to get the thumbs up, you will need to tick all the right boxes from an environmental point of view. We all know that Sasol is a huge polluter, but at the same time the company in their South African Synfuels division has probably done more to reduce imported inflation than any other single company. Probably. And they are a massive tax payer. Huge. Check this out: