Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Anglo Platinum results this morning, for the half year to June. Gross sales increased to 24.972 billion ZAR, and profits of 3.383 billion ZAR. EPS three percent lower at 1273 ZAR cents. HEPS at 1236 cents, higher by 20 percent. The "strong Rand", which moved from 7.54 to the US Dollar in the period last year, 6.90 to the US Dollar average in this period. Gross profit margins for the period were 19.2 percent, higher from the last reporting period (19.1 percent) and much higher than the last full year (17.5 percent). A dividend was declared, 500 cents per share, which as the announcement says is two and a half times dividend cover.

Production was 13 percent higher at 1.23 million ounces, that I guess is the most pleasing to see. Hmmm.... explanation here on full year production: "Despite lower production in the first half of the year, we maintain our refined production target of 2.6 million ounces of platinum for 2011. This implies production volumes of 1.4 million ounces of platinum in the second half of 2011 given that we produced 1.2 million ounces in the first half."

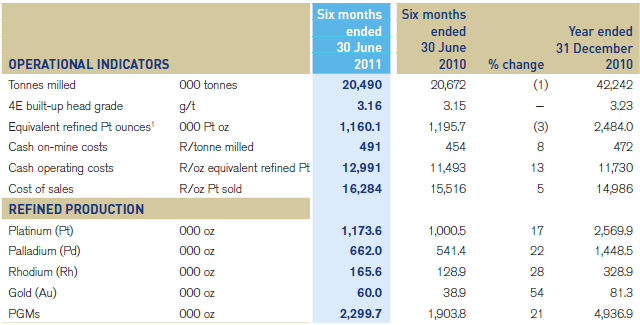

Here is a nice overview of production, from the results report, which you can find here ANGLO AMERICAN PLATINUM LIMITED - (formerly Anglo Platinum Limited) - INTERIM REPORT.

What you don't see there is the big jump in the prices achieved. The average basket price increased by 15 percent, in Rand terms, notwithstanding the headwinds from a firmer exchange rate. Of course we would like to think that metals prices are determined by supply and demand, but often the gold price is the anti-dollar if you will. So Dollar up, gold down, the prices that is. Gold price up, Dollar down. And remember that that would work for the South African Rand too, if the Dollar price "goes down", the Dollar index, that means that the Rand should strengthen. It is not often like in the last few weeks that we get the ongoing weaker exchange rate and increasing metal prices, but all that is around the US debt issues. So money would flood back to the US.

But what does the demand side look like from their perspective? Vehicle production is expected to grow 3 percent this year to 75 million vehicles. New. Out the box. Without the earthquake and tsunami in Japan, it would have been much higher than that, around 2.8 million units is the estimate. So vehicle demand and subsequently autocatalytic convertor demand should be alright this year. Industrial demand and jewellery demand looks strong. Fuel cell technology continues to grow *nicely*. Platinum jewellery demand in China has said to have increased by 20 percent this year so far.

The investment side is strong though, in parts. ETF's have increased their holdings by 15 percent. At the same time though, "speculative" positions have plunged, in what the company terms, (and I do not know what to think of this) "... exhibiting a lack of general confidence in the world commodity markets." Perhaps. I am left feeling indifferent about that statement.

But cost of sales up 19 percent to just over 20 billion ZAR, cash operating costs up. The base is being set higher by tough negotiating from NUM and electricity costs are rising. With regards to costs, in the outlook segment there is "stuff" in there that we have seen and heard before: "We have restructured our mining and process teams to increase focus on safety, costs and productivity. Our restructuring continues with the separation of Union mine into two separate mines to improve management's efficiency and focus on costs and productivity." I remember an old mining analyst who said, how could Anglo Platinum (Anglo American Platinum) go from least cost to highest cost producer in a decade, something has to be wrong there.

The reason why the share price trades at around 600 ZAR a share is because the market analysts expect the company to make around 60 ZAR worth of earnings next year and around 65 ZAR the year after. So the stock looks cheap at these levels. The concerns that we have are the same ones everyone has. Costs. Let me leave it there.