Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Sasol have released half yearly results this morning. We have owned this company in the portfolios since inception of our business, but did drop it briefly for concerns over the firming currency. We have matured in our approach to investing over time and roll with the punches. Of which in late 2008 and early 2009 it felt like we had gone 15 rounds with Joe Frazier. And then another 15 with Ali. Remember that? I do, it hardens resolve. Makes you appreciative of the good times. And as a friend in the industry often says, it gives the fresh entrants into the market little reference point, to lift the existing participants.

How do Sasol see the current environment? Here goes: "Signs of recovery have been seen in some developed economies, albeit at a sluggish pace, and downside risks remain. Financial stability experienced a setback as market volatility increased and investor confidence decreased, especially in the European markets with the selling off of sovereign debt. However product prices and the demand for chemical products have shown significant improvement. Crude oil prices have been increasing steadily supported by geopolitics in the Middle East/North Africa and growing risks to supply, offsetting the negative impact of the rand/US dollar exchange rate. The further strengthening of the rand/US dollar exchange rate remains the single biggest external factor exerting pressure on our profitability." Sounds cautious to good to me.

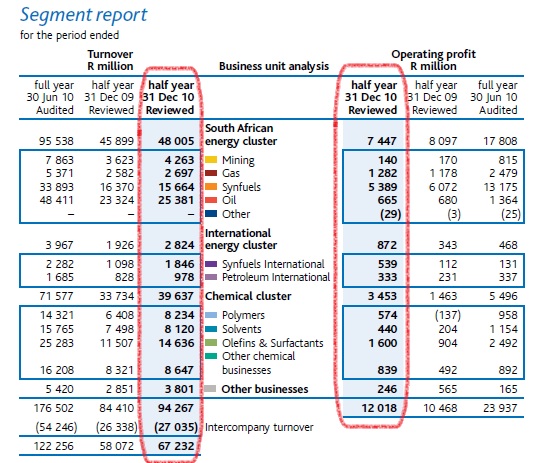

The score sheet. Revenue for the half year, when measured against the half year to December 2009, increased 16 percent to 67.2 billion ZAR. In 2005 the full year number was 69.2 billion, so basically it is safe to say that revenue at Sasol has doubled in 5 and a half years. Headline earnings per share for the half year clocked 12.97 ZAR, 22 percent better than last year. The dividend per share payment increased by 11 percent to 3.10 ZAR, good signs as cautious approach starts to pay off.

Phew, a massive tax contribution to the country, mostly through indirect taxes, but 13.4 billion ZAR deposited at SARS should be cheered. Thanks chaps. Like I said, most at the customs, excise and fuel duty level, 9.265 billion ZAR there. Over the last five years Sasol has paid 114 billion ZAR in taxes. Excluding this half, the full year numbers. Be careful, because this includes payroll taxes too. Sasol employs nearly 33 thousand people. It looks like a headcount reduction of around 450 folks there over the comparative period.

Here is a nice segmented view, where you can get a sense of just how profitable South African Synfuels are to the whole mix. And how, if they can get it right at a bigger scale in other parts of the world, how amazing that would be for shareholders. Here goes:

Estimated capex for this year is 23 billion ZAR, the biggest project is wax expansion and mine replacement, and Secunda growth phase 1. That is local, don't forget the acquisition of the Canadian gas reserves, that is about the same size as these other projects.

There are reports that their environmental thumbs up has been given by the Chinese government for their huge project. Both Bloomberg and Reuters reported as such, I struggled to find it in the results. All that I can find, it terms of the whole project is as follows: "In December 2009, the Project Application Report for the China coal-to-liquids (CTL) plant was submitted to the Chinese Government for approval. Pending the outcome of this decision, all further project activities have been delayed."

But this is not the environmental approval. Reuters suggests that this is a giant leap. This is awesome news. The Indian and Uzbekistan project feasibility studies are progressing well. Again, this is welcome.

Investment case for Sasol. Massive margins on Synfuels. And let us be honest, higher oil prices are almost a given in the future, the current elevated levels which are a direct result of major tensions in the Middle East is good news for Sasol. I suspect that once tensions subside that we might see the price decline. The expansion projects are exciting, geographical diversification is going to be key to attracting a whole bunch of new shareholders and perhaps attraction from the majors, don't count that out. I think that the recent foray into the gas area is hugely encouraging, gas is an area that everyone from Exxon Mobil to General Electric have been getting excited about. And they have to.

Investment case against Sasol. The environmental issues are huge and potentially could stall a whole lot of progress. Also, some of these mega projects that we thought would happen sooner rather than later have not happened. So there are worries. And lest we need reminding, government have perhaps not been as friendly as they might have to Sasol. Let us be honest, you want to protect the golden goose.

Conclusion, the one man jury. We like the company. The recent surge in oil prices has meant that patient shareholders have been rewarded. Sure the environmental issues are concerning. And sure the carbon capture methods are open for debate, and again, could be an expensive exercise. But the technological innovations that Sasol are famous for are well documented. We like it, even at current levels.