Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Standard Bank released their results for the full year to December, and we are starting to see a flurry of results here at the beginning of the year. Again, another personal irritation of mine, I can sit here in the office and watch the presentation on Summit TV (channel 412 on the DSTV bouquet), why is there a need to go there. If I want to ask a question to management, I can submit a question on the web, send in an email, or on the conference call. There were a total of three or four questions asked. I don't eat sausage rolls and don't need to rub shoulders with anyone there. Are you feeling my new age style contrasting with the old style waste of time? I get that there needs to be some people there, but wouldn't shareholders of Standard Bank rather the fellows set up at HQ and deliver a webcast. Much cheaper and better usage of time, don't you think?

I mean, I can sit at my desk and download the same presentation ---> Standard Bank Group - Financial results presentation for the year ended 31 December 2010. I can also listen in. And rewind (thanks PVR) if I wanted to hear something again. Just saying again.

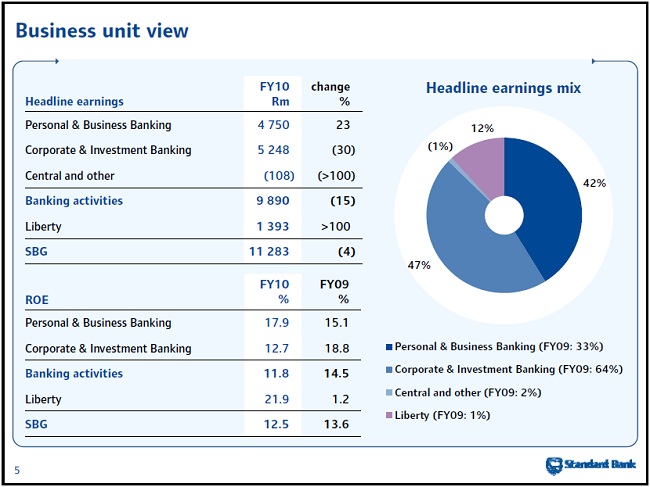

The score sheet. Headline earnings lower by four percent to 11.283 billion Rand, that translates into ZA cents per share of 715.9. The dividend has been maintained at 386 ZA cents for the full year. Return on equity is lower at 12.5 percent, capital adequacy ratio has improved, in anticipation of higher reserves requirements no doubt. Operating expenses increased 9 percent. Net interest income fell 8 percent whilst non-interest revenue decreased 4 percent. In the big plus column both the credit loss ratio improved as credit impairment charges fell 38 percent to 7.524 billion ZAR. Gross loans and advances is 730 billion ZAR, 2 percent lower than last year, mortgages was the only segment across the book that grew, by five percent. Is that more a market share thing, or more likely an improving mortgage market. Although I heard yesterday that our local mortgage market could be under pressure again this year.

Check out the different business segments:

Again you see the retail bank is in improvement mode. The theme runs across all the banks, deposits higher and loans and advances lower. Both marginally, but that tells you something about the consumer.

Investment case for Standard Bank. Their positioning as a champion emerging market bank has kind of ebbed, in fact Sim Tshabalala, one of the many deputy CEO's (that could have changed today) said that Standard Bank was aligning themselves as the biggest bank in Africa. I think that this is a great outcome. Non-performing loans are decreasing and you get the sense that the consumer is well through the worst. I like this repositioning, and I think that tie ups with Chinese companies looking for finance across Africa is GOOD for them. Our banks are well regulated and have stayed out of trouble. This is a big plus, not underscored enough.

Investment case against Standard Bank. What about their Argentinean business? Jacko Maree suggested that they would not buy that business if presented with that same opportunity today. What about that hulk of a business in London? There actually have been a few folks added to that office, perhaps at a much lower cost, I am presuming as much. I guess investors are going to be asking themselves, what about lower return on equity going ahead? It is going to be lower, higher reserve requirements and less risk taking is going to be a must. As such lower returns, in the face of higher regulations, for the time being. Plus, the rate cycle might turn quicker than you think, and hence stick the consumer with another punch in the guts. Or not.

Conclusion, the one man jury. I am not going to go with the same line on this one, as I have with the other "local" banks. I suspect that returns must be lower for a couple of years and as such the stock is probably well priced, just below 100 ZAR a share. 13.8 times historical earnings. A decent enough dividend yield of 3.9 percent. Consensus is for 885 cents worth of earnings this year and 1062 cents in 2012. Well priced. We will stick to the easier to understand and preferred stock in sector for us, African Bank.