Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

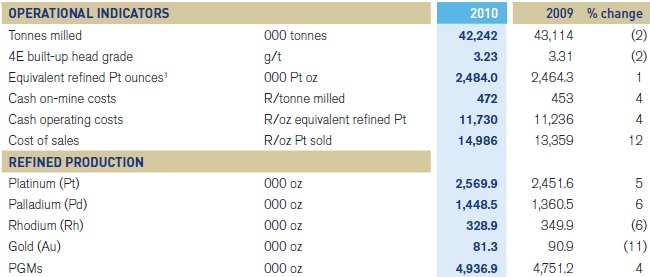

As promised, a closer look at Anglo Platinum, their results presentation was released midday here, a more reasonable time to hook investors up from all around the world. After dinner in Asia, and pre lunch in our time zone. And early morning for North America, there is a lot to be said for living in this time zone. For the full release, check it out: ANGLO PLATINUM LIMITED ANNUAL RESULTS PRESENTATION. I have taken a few key graphics and published them. First, operationally, how did they do compared to 2009:

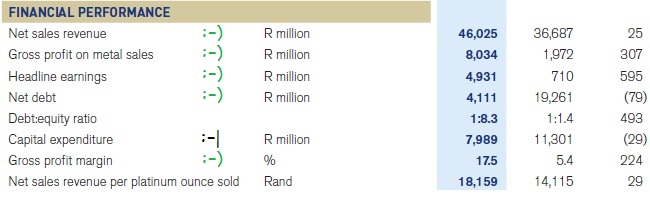

Not great shakes, but the best year from a production point of view since 2006. So I guess that is pleasing. And then a scorecard of their financial review, green smiley faces next to their improving outlook and the follow through from a better operational performance is testament to the groups turn around. And management? What has Cynthia Carroll achieved and is she really friends with Minister of Mineral Resources Susan Shabangu? The second is an important if not trivial seeming question. Minister Shabangu referred to Carroll as her friend at the mining Indaba that is in full swing. I see. The plot thickens.

That financial scorecard, only Capex lower, understandable, but a neutral face. Not smiley, not bad.

There is quite a nice summary of the PGM's market in the presentation where they talk about auto catalytic convertor demand, and the general state of last year, here is some verbiage: "The PGM markets had a strong year in 2010, with a significant recovery in demand from the autocatalyst and industrial markets, healthy demand from the jewellery sector and increasing investor interest in the platinum and palladium markets primarily via Exchange Traded Funds (ETFs)." Good news for all the producers I guess.

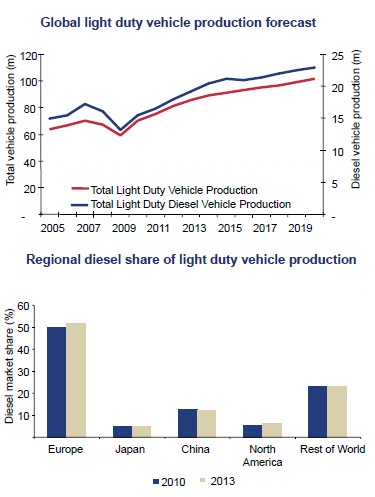

And then the market itself: "Supply increases from the industry were largely delivered to plan and as a result, the platinum and palladium markets remained essentially in balance. The rhodium market saw a reduced surplus due to improved autocatalyst demand." Nice, and both of these have delivered nice underpins for the metals prices. And here is a cool outlook of the autocat market, the diesel vehicle outlook all the way through to 2019.

Basically what this graph tells you is that annual global production of light motor vehicles will move from around 60 million units a year in 2005 all the way through to say 95 million units per annum. So I guess that platinum production from the majors will have to move up accordingly. All in all the results are encouraging, the stocks across the sector look expensive, but the markets participants buying them at current levels are banking on a improving outlook. Two years out for instance, the platinum majors are trading on low teen earnings multiples, hence that comment from last week, when is the best time to buy a platinum major on a 30 times earnings? Well, right now.