We still have over 200 clients that own Naspers (or its sister company Prosus). Tencent remains their largest asset and biggest influence over their share prices despite management selling the stake down in recent years. Tencent, fortunately, is still a very good business.

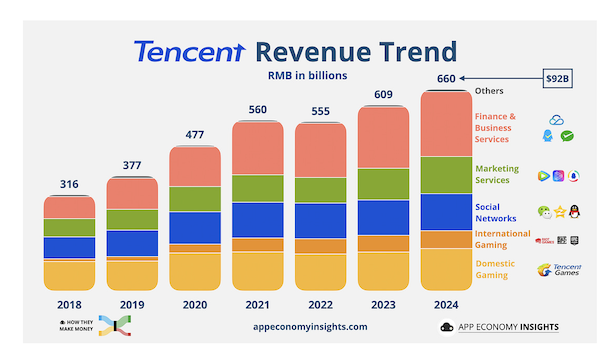

Take a look at Tencent's revenue trends over the last 7 years courtesy of App Economy Insights. Gaming, social networks, advertising and banking have all shown steady growth. With over 1.4 billion WeChat users, those divisions have a massive client base to tap.

As with most tech companies of this size, AI is central to the businesses' future. AI tools will be used to unlock growth within their core operations and to build platforms, software and infrastructure that can be used by outsiders.

The only reason to feel anxious about owning Tencent is the prospect of left-field regulations from the Chinese Communist Party. That risk will never go away.