We still have many clients that own Naspers and Prosus locally, so we pay close attention to the Tencent numbers every quarter because it's still their dominant asset.

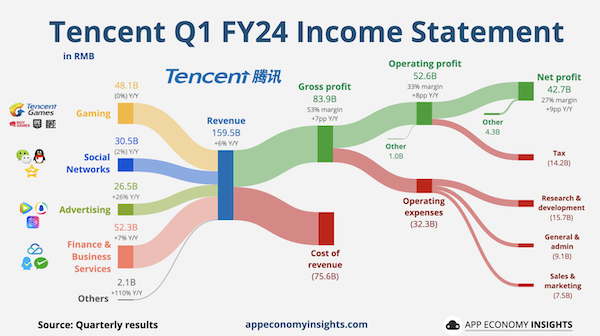

Our friends at App Economy Insights have done a great job summarising Tencent's last quarter in the image below. Revenues beat expectations with sales growth of 6% thanks to a solid advertising beat.

As you can see, this is an incredibly profitable business, operating in fast-growing areas of the connected economy which usually ticks all our boxes. Sadly it's a Chinese business stuck in a very tough regulatory environment which we do not approve of.

We advise Naspers/Prosus shareholders to keep their shares. There is still a lot of value unlock potential. Let's hope new CEO Fabricio Bloisi has some fresh ideas.