Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

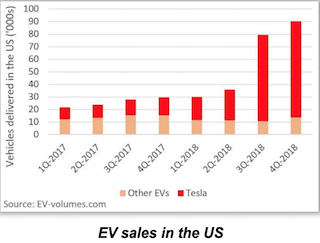

On Wednesday after the US market closed, Tesla reported their Full-Year and Q4 numbers. It was the first time in the history of the company that it reported a profit for two quarters in a row. This feat was all thanks to the massive ramp-up of the Model 3 production. The graph below shows you just how impressive the accomplishment is.

There are two benefits to growing production, the first is the obvious increase in revenues, where automotive sales are up 134% to $6.3 billion from $2.7 billion 12-months ago. The second benefit is the drop in production costs, which will allow Tesla, in time, to introduce their targeted $35 000 Model 3 version. Showing the benefits of scale, Tesla now needs 65% fewer man hours to produce a Model 3 when compared to 6-months ago.

The very exciting target for 2019 is for their Shanghai factory to be operational by the end of 2019, and for the factory to be producing 10 000 cars a week by the middle of next year. For reference purposes, the goal for the US factory is 7 000 Model 3's per week by the end of 2019.

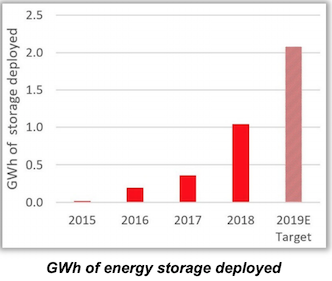

While most of the focus for 2018 was on the car side of the business, their energy business continues to grow exponentially. In 2018 they installed 57% higher energy capacity, and in 2019 they plan to double the 2018 number.

All the growth means that Tesla has swung from burning cash to making some. In the Q4 2017, it made a loss of $770 million. In Q4 2018 it made a profit of $210 million. To justify their $53 billion market cap though, the company will need to continue with their current growth trajectory. No doubt, it will be a steep hill to climb. Given that last year only 2% of cars sold were EV, there is more than enough room for all car makers to play and grow sales.