Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Friday Naspers reported their highly anticipated full-year results. The company has a huge following here in SA for obvious reasons. Before we look at the separate businesses, let's first look at the numbers.

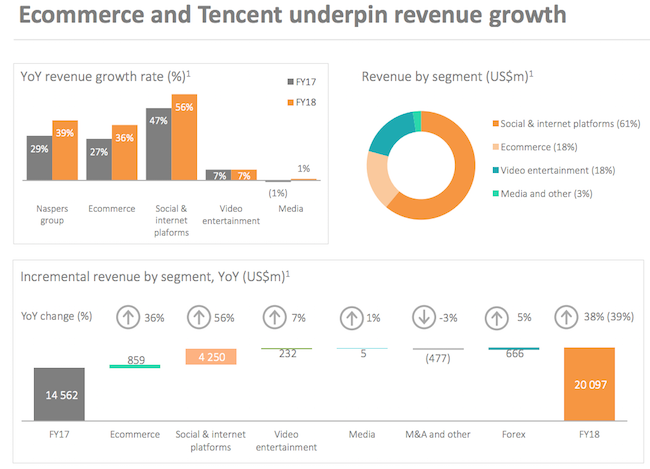

Revenues were up 38% to $20bn while trading profit improved by 47% to $3.4bn. This resulted in core headline earnings per share increasing 72% to $5.81. That equates to R78.50 at the current exchange rate. The share currently trades at R3 100 a share or 39 times earnings. I remember a time when Naspers traded at 100 times earnings at R1 000 a share and analysts thought it was far too expensive. Let's not focus on the PE though, we all know this is a sum of the parts game.

The below image looks at the big revenue drivers within the business.

Let's look at each division and then do a sum of the parts valuation after that.

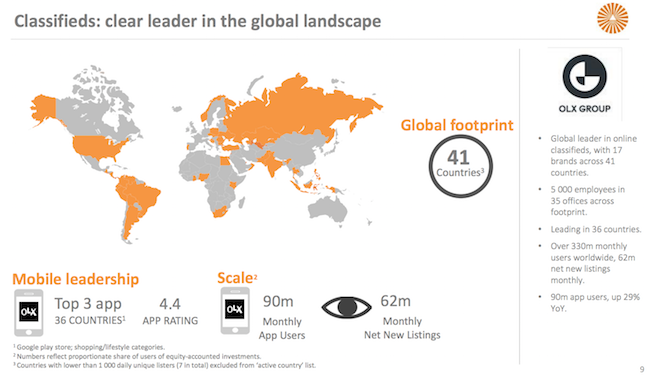

Classifieds.

They see this as a very important growth area. If you exclude letgo (A classified startup operating in the US and Turkey) this division was profitable for the first time. The image below tells a good story of their classified business. This business is extremely profitable once scale is achieved. The current EBITA margin for OLX is 49% with an average revenue per user of $1.44, up 33% from last year. OLX contributed $63m of trading profit for the year.

Payments

With the expertise they can get from Tencent, they have realised that payments are key to their model; especially when they are facilitating so many online transactions through their sites. They are now processing 2 million transactions a day through their various brands. This equated to $25.5bn in payment value for the year. They have stakes in core payments systems, credit services and even crypto traders like Luno. Payments grew revenue to $294m but lost $56m for the year.

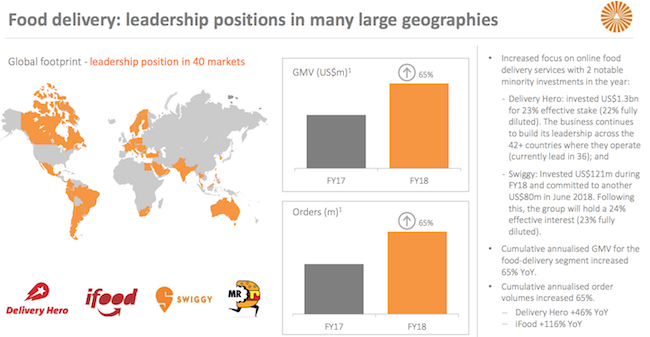

Food delivery.

They see this as another huge growth area. Millennials do not like fetching their food, but they do like having their food cooked for them; I can attest to that. The below slide explains the year they had in food delivery. This division had revenues of $283m and lost $36m.

Ecommerce

They divested from this division by selling their Flipkart stake for $2.2bn. But at the same time they now basically own all of Takealot with an extra $74m investment. Takealot grew sales by 57% but still made a loss of 17% of sales.

Video entertainment

Despite this being a business that is in its sunset phase, subscribers to Multichoice increased by 13% to 13.5m. Events like the Soccer World Cup, The Olympics and Survivor SA (jokes) make it hard to unsubscribe from this service. The division contributes $369m to trading profits which is still significant. They are well aware of the competition in this market and have decent streaming services. It is only a matter of time until they have a sports streaming service. They will do it when it makes financial sense.

Listed

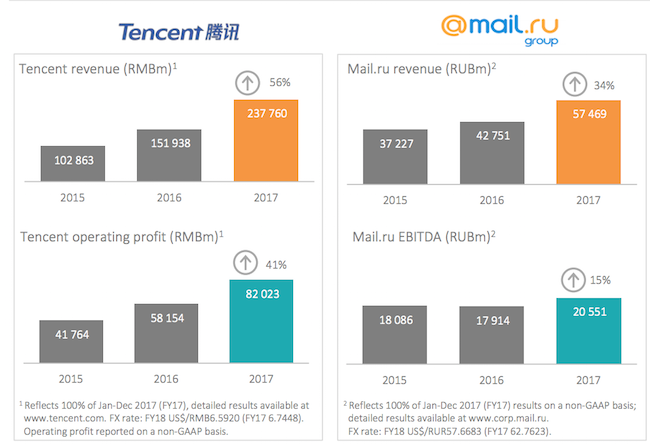

We often cover Tencent separately so I won't go into too much detail. This is still the rump of Naspers and rightfully so, it is an incredible business. The image below shows the financial performances of their 2 listed stakes (Delivery Hero falls under food delivery). During the year they sold down a small portion of their Tencent stake to raise $9.7bn which they will use to diversify.

Ok let's look at the sum of parts calc quick.

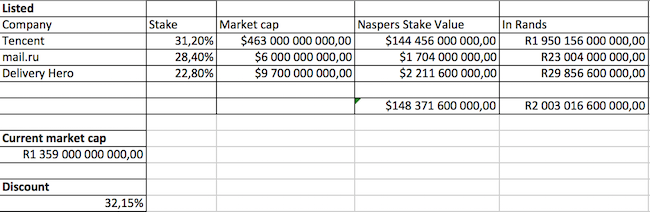

I have done the calcs on the value of the listed businesses in the spreadsheet below. These valuations come from highly liquid, collective market forces. These market forces account for all risks of ownership structures, future profits, current profits etc. According to the calcs, the listed assets are worth R2 trillion. The current market cap is R1.36 Trillion. The share is currently trading at a discount of 32.15% to it's listed assets. Everything else we have discussed above is for free.

Conclusion.

This is a fabulous business, every direction they are going seems to have a positive future. Some of them will fail, some of them will explode. I doubt any of them will ever be the next Tencent. They have net cash of $8bn to continue investing in revolutionary businesses. What a privilege to have access to this tech juggernaut on the JSE. The only issue of course is that glaring discount. Management have ruled out any secondary listings or a separate Tencent listing for now but they are still exploring all avenues. Eventually market forces will close the gap. We still see this as the best investment opportunity on the JSE.