Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

I keep looking at the results of Tesla day after day and promising Michael that I will hammer them out tomorrow. And then of course something else happens. The company reported this time last week, at least I have the whole day over California, so it is not quite a week late: Tesla Fourth Quarter & Full Year 2015 Update. There are some pretty powerful things in there, that letter from Elon Musk to his fellow shareholders. The fact that the business is unique as a motor vehicle manufacturer, in that they still know everything about their car once it has left the assembly line. How many manufacturers of any sort can claim to know everything about their products (provided the user wants that) once they have sold it? I can't think of too many. Tesla continues to collect data from their users, with the Autopilot learning at a rate of 1 million real-world miles a day. That is pretty astonishing.

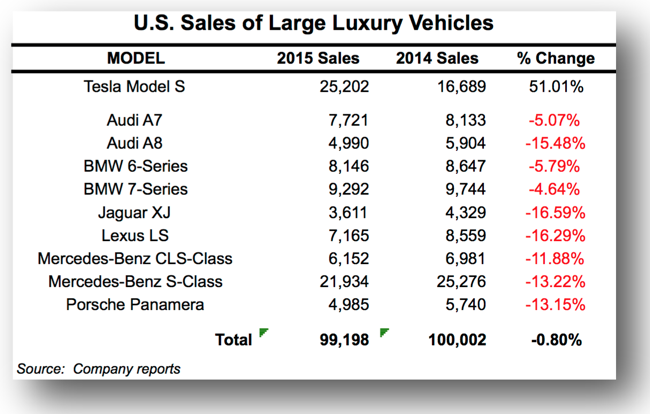

The market enjoyed the fact that the company produced strong operational cash flows, notwithstanding the fact that the costs per vehicle are still significantly higher than before. What I found very interesting is that in the luxury segment of the motor vehicle in the United States, Tesla saw stronger sales than any of their competitors. We chuckled on the comparison when no BMW models were included in the "large luxury vehicle" category, it is what it is. Here goes, 2015 compared to 2014:

When comparing this company however to their competitors, you can see that they operate in one specific market currently. People who have genuine concerns about the state of the environment globally, i.e. aware of climate change, and most importantly, have the ability to switch over to a very expensive and niche product. Motor vehicles in most parts of the world where the company operates face stiff competition. Their advantage is simple. They are looking for specific customers, their cars have very few moving parts, as as such require little or no maintenance. The updates are done through the night whilst you are sleeping, via the internet. The product is revolutionary and very different from before.

As an investor however, the basics still apply. You part ways with your hard earned money and supply the company with the capital to be more profitable than the prior year, over a long period of time. With a company of this nature, who are looking to revolutionise transport and supply home solutions (the Powerwall battery) that use the best power source known to man (the sun), you are going to have to expect major volatility and expect a wild and bumpy ride. We continue to accumulate as a speculative investment that should not carry a significant weighting in your portfolio. You are essentially buying the future and often you have to (as is with the likes of Amazon) pay up for that privilege. I mean, the CEO of Tesla wants to go to Mars and settle there with his other business and he is serious about that. The company as an investment is not for everyone, and still forms a small part of spec picks. It is still however in our opinion a buy at these levels.