Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

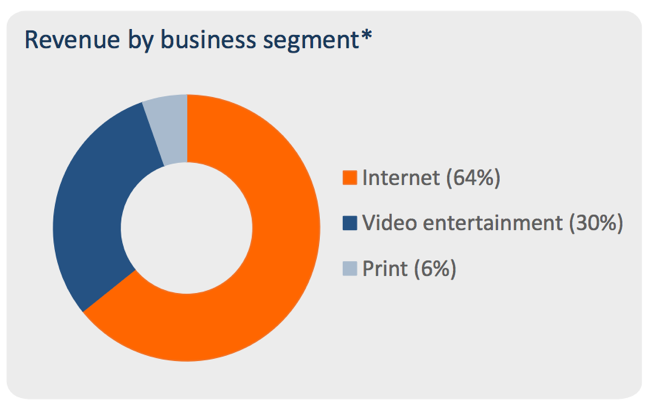

Naspers, one of our most widely and largest holdings across our client base reported their half year numbers on Friday afternoon at 4. Forget Thanksgiving and the half day in the US, forget that we are in festive season, at least for the office and school segment, this is Naspers time. If you were not there to see it, you missed out. Revenues for the half increased 24 percent to 74.29 billion Rand, trading profits increased 34 percent for the half, the metrics at face value look amazing. Core HEPS increased by 40 percent to 21.33 Rand, up from 15.28 Rand this time last year. Revenues have now grown at a compounded annual growth rate of 33 percent for the last four full financial years, it is pretty astonishing. Where are the revenues coming from? Here goes, a series of graphics from the investor presentation all through from segment, geography and then a further breakdown of revenues by type of activity.

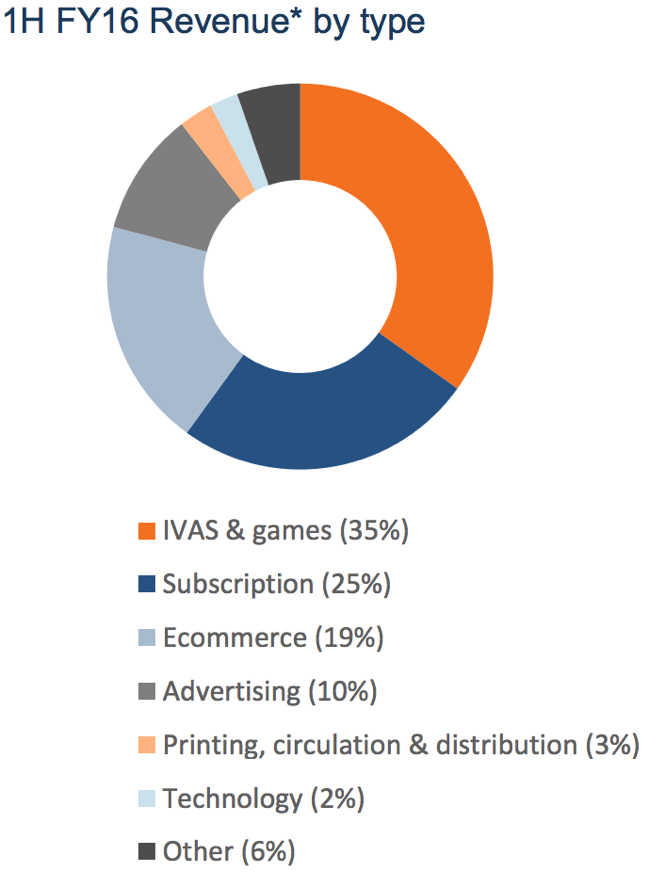

What is amazing to notice is that print has been left in the dust, it is becoming a smaller and smaller part of the overall business. It is now all internet and all video entertainment. Breaking down that even further, see the image below, you see the sticky subscription business is one quarter (your DSTV subscription is included in there).

What is IVAS and games? IVAS = internet value-added services. Which is related too your entertainment experience. Wikipedia has the value-added services as the following: "A value-added service (VAS) is a popular telecommunications industry term for non-core services, or in short, all services beyond standard voice calls and fax transmissions. However, it can be used in any service industry, for services available at little or no cost,[citation needed] to promote their primary business."

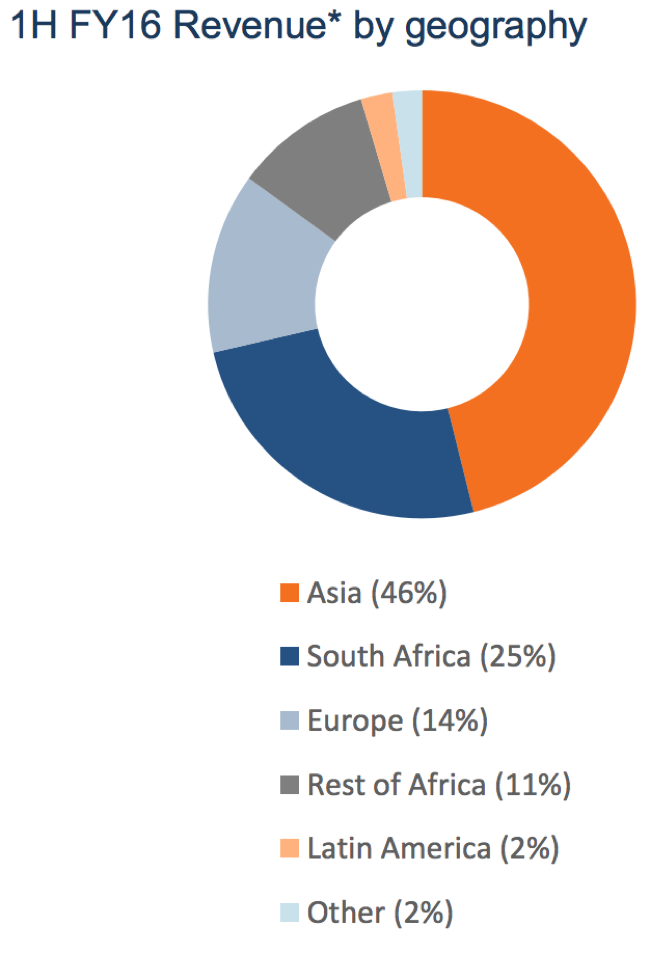

And then below, revenue by geography, obviously the picture is skewed towards Tencent, in other words Asia. And then here locally, the business is 25 percent South African. In other words, the prospects of the group will be determined by the fortunes of Tencent in the short term.

What is also very important to note is how much money the company is spending in their newer business segments that don't necessarily make money. They spend 37 percent of all development spend (3.5 billion Rand in the last half) on Etail, 31 percent of classifieds and 17 percent on other ecommerce ventures. Only three percent on print, whilst they realise that tv is changing, Michael at his new home only has Showmax. No sport. Ag shame. Video entertainment constitutes 12 percent of all development spend.

I think that the reason why the stock may have sold off on Friday, after this earnings announcement is twofold. One, the share price has obviously been on a tear since the Tencent results, as well as the trading update, both those two events were favourably received and perhaps a little wind out of the sails after the announcement. Secondly, and perhaps more of the reason, was that the company announced that they were going to be thinking about a 2.5 billion Dollar capital raise, dates as of yet unknown. In part to use for the purchase of part of Avito, 1.2 billion Dollars of that. Avito is the leading classifieds website in Russia, a bold move in itself, things are hardly "settled" there.

Why own this business? It has so many moving parts, as well as being nearly completely correlated to a single business, and that obvious share price, Tencent. I noticed the shift to the internet even over the weekend, the so called Black Friday sales in the US. Traditional old school retailer Walmart did the unthinkable, shifting discounts to their website, even before their doors had opened. We are continuing to move more and more to an online platform for entertainment, classifieds, shopping, news and all sorts and increasingly more so on our mobile phones. I think that you just have to learn to live with the volatility of the newer business segments, that continue to burn cash at heavy rates, those are going to be the businesses that compete at a global level with the likes of Amazon, just not in the english speaking world. We continue to recommend Naspers, even at these elevated levels (there will be a PE unwind in the coming years) as a core part of your portfolio.