Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Monday evening we received results for the year ending 31 March from our preferred technology stock, Naspers. And what an incredible business this is, with moving parts all over the world in what we believe are the right sectors. The report splits the business into 3 segments, Internet, Video and Print. If you are interested in this company I strongly suggest you read the results titled Naspers Provisional Report.

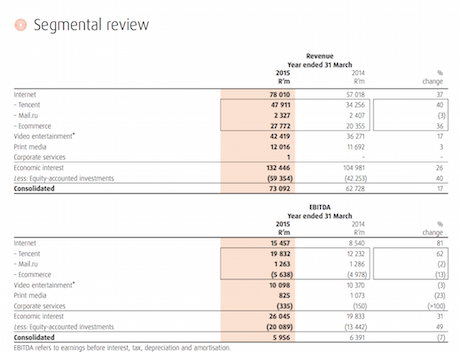

I have taken a screen grab of the segmental review. Don't be confused by the equity adjustments. They account for the entire Tencent Revenue and EBITDA and then subtract the part of the business it doesn't own in a different line entry. As you can see, Tencent is a well established cash cow already, Naspers' heavy investing in other businesses has impacted earnings. More on that later.

Core headline earnings grew 30% to R11.2bn, that is the important metric you need to take note of. I'm not even going to attempt to value the business on earnings. This is a sum of the parts business. Lets look at each division now.

Internet. This includes their stake in Tencent and Mail.ru as well as their ecommerce businesses. As we well know, Tencent has been flying. The shift to mobile has been huge and Tencent have been able to monetise this. 85% of internet use in China is now through mobile. Revenues grew 31% and profits increased 43%. The Naspers stake in Tencent is worth R765bn. That is determined by the collective and efficient market in Hong Kong.

Mail.ru is listed in the UK. It is a Russian site (similar to Google) so the currency had a negative impact. Sales were flat but on a constant currency basis they grew by 15%. Naspers stake in this business is worth R16bn.

The ecommerce business is very exciting but sucking up large amounts of cash. They spent R8bn on developments which resulted in a balance sheet loss of R6.1bn. They have some incredible assets with leading ecommerce sites and online classifieds in India, Brazil, Indonesia, Turkey, South Africa and many others. Their dominant online classified OLX served 240 million users a month globally. It's hard to value this business because it makes no money yet. But neither does Amazon at this stage. Amazon trades on about 2 x Revenues. If that is the case for Naspers then this business is worth R55bn. That's conservative in my view.

Video Entertainment. This is the new name given to Pay TV which is an industry evolving fast. This is a solid business. It grew revenues by 17% but profits contracted by 6% to R8bn because of development spend. Locally and throughout the continent they have had very little competition. Now we are getting international competition from the likes of Netflix, Amazon, Apple and Google. Multichoice have created streaming options but they will have to be at the top of their game in terms of content. At least they know what they are facing and they are dealing with it. There is even a cool Mnet app now where you can tape shows on your PVR using your phone from anywhere in the world. I'd give this a conservative valuation of 15 times earnings, R120bn.

Print Media. Is this even worth talking about? I guess it still has value. But even Media 24 are exploring more online alternatives. Profits here of R314 million, lets value the business at R3bn (they did just realise R1.1bn from listing a portion of this business).

If we add all of this up we get to R959 billion. The current market cap is R794 billion. Not only are you getting a discount to the sum of the parts valuation but you are also getting the potential future growth of this incredible business which is being very well steered by Bob van Dijk and Koos Bekker. I am confident that these guys know the trends of the fast moving technology sector and they will continue to place themselves at the forefront, especially in large populous developing markets. Naspers is an incredible story and a global business South Africa should be truly proud of. Not all bad news coming from the Southern tip of Africa. We continue to buy at these levels.