Market scorecard

US markets spent most of yesterday in rally mode before giving up some gains late in the session. A better-than-expected private payroll report from ADP and the prospect that the Supreme Court might overturn the Trump tariffs kept traders in an upbeat mood.

In company news, Google and cybersecurity firm Wiz moved closer to completing their $32 billion merger after the US government concluded its review of the deal. Elsewhere, second-string EV maker Rivian jumped 23.4% thanks to a sharp increase in revenue and new model announcements. Finally, Novo Nordisk cut its outlook for the fourth time this year as slowing sales of Wegovy and Ozempic weighed on performance. Eli Lilly is a much better option for GLP-1 investors.

In summary, the JSE All-share closed up 1.32%, the S&P 500 rose 0.37%, and the Nasdaq was 0.65% higher. A nice rebound from Tuesday's sell off.

Our 10c worth

Michael's musings

Last week, Amazon released very strong third-quarter numbers, and the share price shot 10% higher. Revenue rose 13% to $180 billion, with the two most profitable divisions, AWS and advertising, expanding 20% to $33 billion and 24% to $17.7 billion, respectively.

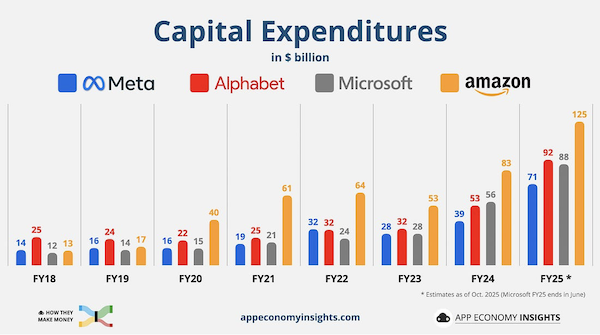

AWS's growth is significant because it is reaccelerating, even though it is coming off an already large base. Amazon has doubled its 2022 AWS data crunching capacity and expects to double it again by 2027. The company has led the way in CapEx spending and is now reaping the rewards.

Amazon is another company that has developed its own AI-focused chip. Theirs is called Trainium, and the demand has been off the charts. Revenue growth from companies paying to access the AI computing power of the Trainium2 chip was up 150% quarter-over-quarter. The Trainium3 will be available next year, and it offers 40% improved performance.

As a reminder, Amazon has its fingers in many pies. In the last quarter, they launched 150 internet satellites, with the expectation of launching over 1 000 in the coming year. This is project Kuiper, which has ambitions of going head to head with SpaceX's Starlink service.

Amazon's share price had been drifting a bit, lagging the other tech titans, and not really breaking away from its 2022 highs. These strong results, and the subsequent share price jump, have reestablished its upward momentum. We are happy shareholders.

Bright's banter

Eli Lilly just reported another mega-hit quarter as demand for its GLP-1 weight-loss drugs continues to soar. Revenue jumped 54% to $13.7 billion, comfortably beating all expectations.

The company's blockbuster drug tirzepatide, sold as Zepbound for obesity and Mounjaro for diabetes, became the world's best-selling medicine, generating a combined revenue of $10.1 billion in the three months, more than double last year's $4.37 billion. That easily topped Merck's costly cancer drug Keytruda, which pulled in $8.1 billion in the same time frame.

The company raised full-year guidance yet again; revenue is now expected between $63 billion and $63.5 billion. The market cheered the numbers, its shares are now up 10% in the last five days and back at record highs. Well done to everyone who bought on weakness earlier this year.

Eli Lilly's next act is a weight-loss pill that could eclipse demand for its weekly injections. It also announced a partnership with Nvidia to build an AI supercomputer for drug discovery, proving once again that the hottest stock in Big Pharma isn't cooling anytime soon.

To widen access, Lilly has struck new partnerships, including discount programs with Walmart to distribute tirzepatide, while investing heavily in capacity ahead of its next-generation weight-loss pill.

Lilly's dominance in the GLP-1 race is reshaping the $100 billion obesity market, even as rivals like Novo Nordisk stumble with production issues and boardroom drama. It's been a bumpy ride for Eli Lilly, but we're glad we stayed the course. Now it's time to be rewarded.

One thing, from Paul

This is one of my favourite investment wisdoms, from the French novelist Michel Houellebecq: "Anything can happen in life, especially nothing".

Houellebecq is a controversial fellow, and the line above was not intended for an audience of investors, but it serves as a reminder that most forecasts about what might happen in the future are useless, especially ones that suggest something dramatic is about to occur.

When markets are at all-time highs, an army of pundits, carpetbaggers, bears and other idiots trot out wild predictions about an imminent crash. They do it for attention, and it works.

People can't help themselves, they believe that they must live in exciting times. But it's not doomsday, it's just Thursday.

Houellebecq's rule reminds us that it's much more likely that nothing bad will happen, and we'll just muddle along as usual, with small wins and smaller losses, and over time, the market will work its way higher.

Byron's beats

I have tried a few times in this newsletter to explain why I believe that the current valuations of US tech stocks are not abnormally high. I may or may not have done a decent job of it. Fortunately, one of the most talented financial writers out there, Josh Brown, has done it for me, which I think is worth sharing with our readers. So here goes:

"One thing was clear by the end of this week - the AI Capex Boom is not only not decelerating, it's actually ramping up into 2026. This kept stocks hovering near all-time highs. Apple's market cap hit $4 trillion this week, while Nvidia's hit $5 trillion. We live in epic times. The semiconductor stocks reacted to everyone's increased capex guidance by adding $1 trillion in new market cap over a period of five days! We've never seen anything like this.

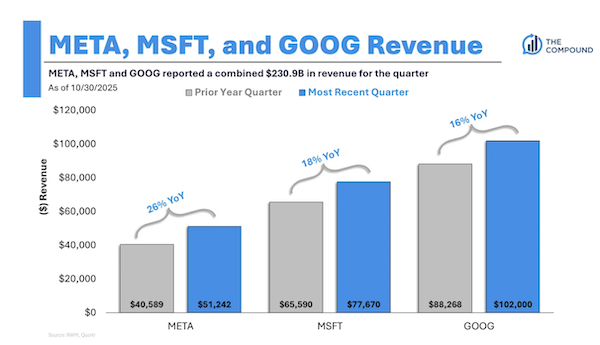

One of the things you hear people casually say about the size of the technology giants that dominate the S&P 500 these days is that their market caps, in the trillions, represent a big concentration problem relative to the rest of the stock market. The thing is, this concentration makes a lot more sense when you consider their revenues. Why wouldn't they dwarf the rest of the public companies in their index representation when they're putting up the numbers they are?

Last thing on this - we're not just talking about sales growth. We're talking about profitable sales growth. Incredibly profitable sales growth for the most part. Microsoft's operating income was up 24% year over year to $38 billion on $77 billion in revenue. This is, to put it mildly, an extraordinary business, the likes of which no investor in the history of the stock market has ever seen. I'd relay the numbers on Apple, Alphabet, Nvidia, Meta, etc, but it would be redundant. Superlative market caps have been on stupendous business success. It's not an accident that these names sit head and shoulders above the market caps of the rest of the S&P index."

And here is the image he paired with those words.

Linkfest, lap it up

When are married people most likely to get divorced? Surviving the first five years is the hardest - Multi-year itch.

Moldova seems to be eradicating orphanages. The country has seen the number of children living in institutional care drop from 17 000 to 700 - What's their secret?

Signing off

Asian markets are mostly higher this morning, led by strong gains in Japan and Australia. The Nikkei is snapping a five-day losing streak, with Konica Minolta up nearly 15%, Fujikura rising 7%, and Nintendo jumping 5%.

In local company news, Vodacom has finally settled its long-running "Please Call Me" dispute with former employee Nkosana Makate out of court for an undisclosed amount, bringing an end to a nearly 20-year legal saga.

Tesla shareholders will vote this afternoon on Elon Musk's $ 1 trillion pay package. To unlock that windfall, he would have to get Tesla to a market cap of $8.5 trillion, grow profits from $16 billion to $400 billion, among many other very ambitious targets. It looks like a win-win?

US equity futures are basically flat. The Rand is trading at around R17.38 to the US Dollar.

All aboard, it's going to be another good day.