Market scorecard

US markets were choppy yesterday, starting badly, then rising, then wilting just before the closing bell. Renewed US-China trade tensions have unsettled investors in recent days, with President Trump accusing Beijing of "economic hostility" for halting US soybean purchases, and China firing back with counter-accusations.

In company news, EasyJet closed up 7.3% after reports that Mediterranean Shipping Co (MSC) is weighing a takeover bid with an investment partner. Elsewhere, Google is betting big on India, planning to pour $15 billion into building an AI infrastructure hub in Andhra Pradesh. Lastly, Goldman Sachs is close to an all-time high after record third-quarter revenue, thanks to a red-hot investment banking performance that outpaced its Wall Street peers.

At the closing bell, the JSE All-share closed down 0.14%, the S&P 500 fell 0.16%, and the Nasdaq was 0.76% lower. Oof.

Our 10c worth

One thing, from Paul

In developed societies, about two-thirds of adult citizens have investments in the stock market. Most people hold listed shares through unit trusts, mutual funds, ETFs, or retirement products. A smaller percentage hold equities directly, meaning they purchase individual companies in a portfolio, like Vestact customers.

According to a recent Gallup survey, the bottom 50% of households in the US by wealth now own $540 billion in equities. That aggregate value is up a lot since 2010, thanks to strong stock market appreciation. So, the bottom half is making progress.

That sounds good, and it is, but consider that the wealthiest 1% hold 50% of stocks, worth $25.6 trillion, according to the Federal Reserve.

Recent research confirms that the richer you are, the happier you feel, and the more options you'll have in life, and there's no upper limit. The upper crust is the place to be, that's for sure.

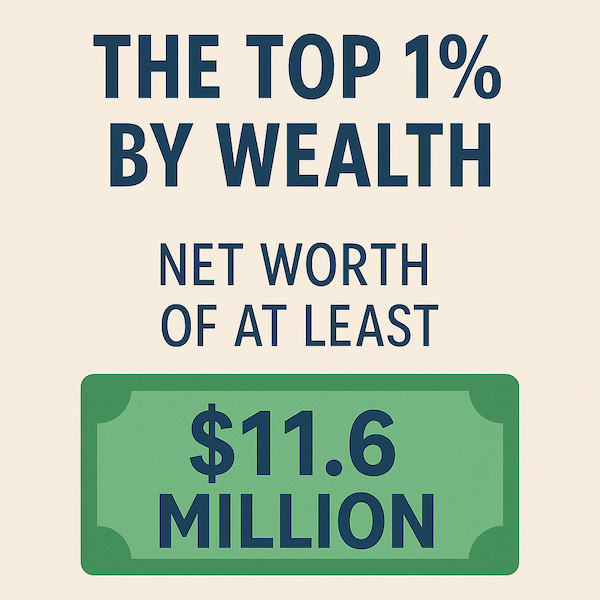

I asked ChatGPT how rich you need to be to make it into the top 1% in the US, and it's $11.6 million. We have 10 clients who have more than that with us already. I'd like to see that number increase in the years to come. Thank you for your attention to this matter.

Byron's beats

There is a lot of waffle lately about stock valuations, geopolitical risks and politics. Thank goodness earnings season is upon us.

If you are new to this letter, earnings season is when US-listed companies report their quarterly numbers. It is when we get to see what has really been happening under the hood of the businesses that are moving markets.

Analysts are expecting earnings to grow by 8% this quarter. But in reality, there is disappointment if expectations aren't beaten. At least we can focus on what matters for a while.

The first to release their numbers are the banks, which have already set a good tone. We will cover the earnings of our recommended stocks in the coming weeks. Stay tuned!

Michael's musings

Over the weekend, the news broke that Penn State, a US college, had fired its football coach due to poor performance, with a payout clause worth more than $49 million. That is a crazy amount of money for university-level sports.

The coach, James Franklin, had been with Penn State for 12 years and was earning $8 million a year. You could probably count on one hand the number of South African sports stars who earn that amount per year. Not many CEOs in South Africa make $8 million a year.

I think this puts things into perspective - US university-level sports are more valuable than most international sports teams. The US is a powerhouse because it has 250 million rich people spending and driving its growth.

Bright's banter

Nvidia just dropped its smallest supercomputer yet, the DGX Spark, and it's set to shake up how smaller players access serious AI power.

The pint-sized machine packs the GB10 Grace Blackwell superchip and can run massive models with up to 128GB of memory, all without the need for a pricey data centre setup.

It's a full-circle moment for Jensen Huang, who hand-delivered the first DGX-1 to Elon Musk back in 2016, the same box that helped spawn ChatGPT. Now, Huang's doing it again, literally handing Musk the first Spark, saying the goal is to "put an AI computer in the hands of every developer".

For investors, this is Nvidia doubling down on its AI dominance, moving from the cloud to the desktop, while still powering giants like OpenAI, Microsoft, Meta, and xAI. The message is simple here, whether it's mega data centres or a single workstation, Nvidia remains the central player in the AI boom.

Linkfest, lap it up

Some say South Africa's BEE policy hurts local growth. A new proposal to voluntarily pay a 3% BEE levy on revenue has business leaders divided - Buying your way into the kingdom of compliance.

Kids have a short memory span these days. Watching lots of catchy 1-minute videos doesn't help - How to raise kids that read in an age of digital distraction.

Signing off

Asian markets are broadly in the green this morning, with Japan and Australia leading gains. Hitachi Ltd rose 5.4% in Tokyo on plans to expand its sales of power grid components for AI data centres.

In local company news, Bytes Technology delivered flat first-half earnings, with gross profit up just 0.4% to GBP82.4 million, but remains confident of meeting full-year targets due to booming demand for cloud, cybersecurity, and AI services.

The Rand is trading at around R17.33 to the US Dollar.

US equity futures are marginally higher pre-market, although no-one really knows what to expect next. ASML, Bank of America and Morgan Stanley are out with results today.

Keep grinding. Have a good day.