Market scorecard

US markets bounced back in style after Friday's slump, with the S&P 500 and Nasdaq logging their biggest gains since May. The rebound came as President Trump and his team struck a softer tone on China, easing fears of a fresh trade war. Trump said on Truth Social that "it will all be fine", while Treasury Secretary Scott Bessent hinted the threatened tariff hike may never materialise, enough reassurance to send traders back into risk-on mode.

In company news, Amazon plans to hire 250 000 seasonal workers for the holidays, matching last year's intake and standing out as one of the few big employers still adding staff in a cooling labour market. Elsewhere, OpenAI has struck a multi-year deal with Broadcom to co-develop custom chips and networking gear, another move to boost its computing firepower as demand for AI infrastructure continues to explode.

In summary, the JSE All-share closed up 0.91%, the S&P 500 rose 1.56%, and the Nasdaq was 2.21% higher. That's more like it!

Our 10c worth

Byron's beats

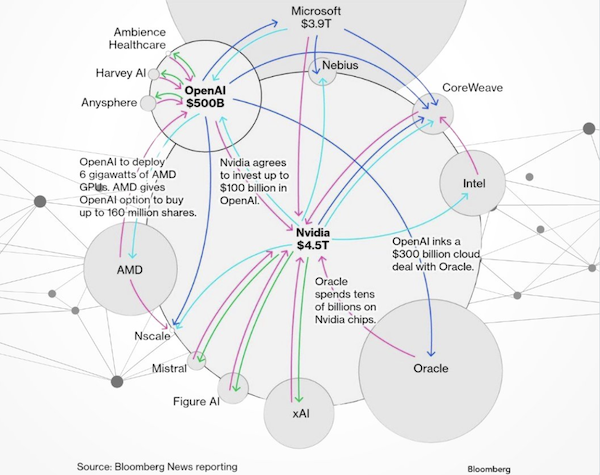

There have been a few images doing the rounds which shows the intertwined funding relationships of the AI ecosystem. This one from Bloomberg got a lot of attention.

Let me simplify what is happening here. Demand from the end user is red hot. The service providers need to buy GPU chips (mostly from Nvidia) to meet that demand. You know that irritating lag you get when you are waiting for ChatGPT to make a picture? That delay will worsen if new computing power isn't purchased, as thousands of new users are added daily.

The service providers have two major constraints, access to energy and cash. Nvidia can solve one of those problems because it has too much cash, currently sitting on $60 billion and printing more every quarter. So they invest in their clients who can then buy more Nvidia chips.

This will unravel and pop if the demand dries up. Do you believe that will happen? I don't. If the demand continues to grow, Nvidia fixes the cash bottleneck problem and ends up with stakes in software companies that will continue to be their clients for many years and will most likely start making big profits themselves. Seems like money well spent to me.

Michael's musings

Do you remember Tesla's semi-truck announced back in 2017? It was an exciting launch, and was meant to be the start of a new era in heavy-load transportation. Since then, Tesla has delivered a handful of trucks, but that project seems largely forgotten.

I was surprised to read that 22% of trucks sold in China for the first 6 months of this year were electric, with forecasts of 50% market share in the next three years. I thought electric trucks were used in some niche situations, and mostly for good PR. According to the International Energy Agency, though, 90 000 electric trucks were sold last year, meaning they are becoming more mainstream.

The biggest restriction to long-haul trucking is battery life. Given the size of the batteries needed, even the rapid charging stations aren't very quick. The Chinese solution is to do battery swap-outs, which requires extensive industry collaboration to get right.

The infrastructure to support an electric truck industry is impressive in itself. Truck batteries are one megawatt-hour in capacity (more power than the average house uses in a month), and in most cases, a truck will use all of that power in less than a day. No wonder China installed more solar capacity in 2024, than the rest of the world combined.

You can read an interesting article on the subject here - China won the electric car race. Up next: freight trucks.

Bright's banter

Ferrari shares plunged as much as 15% on Thursday, their worst fall in nine years, after releasing slower growth forecasts than the market expected. The luxury carmaker also trimmed its electric ambitions. EVs will now make up 20% of its lineup by 2030, down from the 40% target set in 2022. Their first electric model, the Elettrica is debuting next year.

Ferrari forecast adjusted earnings of at least EUR3.6 billion by 2030, up from EUR2.72 billion this year, implying a slower growth pace than promised three years ago. The outlook was perceived as "light" versus lofty expectations, with margins and cash targets both falling short of consensus.

The update overshadowed incremental upgrades to this year's revenue and profit guidance. For a stock that trades more like Hermes than Porsche, the bar was sky-high, and Ferrari's cautious tone left investors wanting more horsepower.

Linkfest, lap it up

How much luck is involved with success? Twitter founder Jack Dorsey once totally rejected the role of luck in life - Never deny the existence of chance.

China is in a different league when it comes to EVs. A focus on improving battery technology is one reason they are global leaders - How did China come to dominate the world of EVs?

Signing off

Asian markets were mostly higher this morning, taking their cue from Wall Street's upbeat finish amid renewed optimism over US-China ties. In Australia, SRG Global jumped over 25% after the engineering group announced a "transformational acquisition" of Total AMS, a move set to significantly expand its footprint in marine infrastructure and bolster future growth prospects.

In local company news, Aspen shares climbed 3.5% after winning Sahpra approval to market Mounjaro as a chronic weight-management drug, expanding its diabetes treatment into the fast-growing obesity care market.

US equity futures are marginally lower pre-market. The Rand is trading at around R17.33 to the US Dollar.

Good luck to Bafana Bafana tonight. To qualify for the Football World Cup for the first time since we hosted in 2010, they need a win, and for Nigeria to beat Benin.