Market scorecard

US markets kicked off the week on a strong note. Chipmakers rallied, driving the Nasdaq and S&P 500 to fresh record highs. The S&P 500 notched its seventh straight gain, its longest winning streak since May, as this bull market approaches the three-year mark with its momentum still intact.

In company news, AMD surged 23.7% after announcing a multibillion-dollar partnership with OpenAI to build AI data centres powered by its processors. Elsewhere, Comerica jumped 13.7% after Fifth Third Bancorp proposed an all-stock deal to acquire the lender. Finally, Boeing rose 1.6% on reports that the company aims to churn out up to 42 new 737 MAX jets per month.

At the close, the JSE All-share closed up 0.13%, the S&P 500 rose 0.36%, and the Nasdaq ended 0.71% higher. Wow, look at that.

Our 10c worth

One thing, from Paul

I'm always amused by the products that the financial services industry comes up with, to drum up more trading activity. They know that people love to gamble. The allure of "easy money" is irresistible.

The latest craze on sites like Robinhood: perpetual futures. These contracts give traders access to extreme leverage. They are derivatives, but lack expiration dates or strike prices. Gains or losses are based on the moves of an underlying asset. The one that features most often is bitcoin, naturally, what else?

This is how they work. A trader opens a bullish position with $500. He gets 10 times leverage, which means he controls $5 000 worth of bitcoin. If bitcoin prices jump by 10%, his initial investment doubles. He just made $500. Of course, a 10% price drop means he is wiped out.

The best thing about these contracts is that their trade name is "perps". In my book, the word "perp" refers to someone who has committed a crime.

Crypto and options trading drove almost 80% of Robinhood's transaction-based revenues in the second quarter, while ordinary stock trading made up just 12%.

Stay away from this nonsense. Invest sensibly, don't speculate.

Byron's beats

Business messaging on WhatsApp now brings in $10 billion a year in revenue for Meta. This is an area they are really targeting for growth, especially in India.

According to Meta's MD in that region, India is their single biggest country by number of users. There are 800 million people with access to the internet in India, and only 200 million are online shoppers. Of the 63 million small businesses in the country, only 5 million have an online presence.

Travel ticketing has recently been launched on WhatsApp in India. There are already 7 million transactions a month with expectations to reach 100 million a year by December.

Many Vestact clients are excited about the prospects in India and so are we. But you don't have to buy Indian companies to benefit from the country's growth. Meta and Amazon are great companies to own to get exposure in the right areas of that economy.

Michael's musings

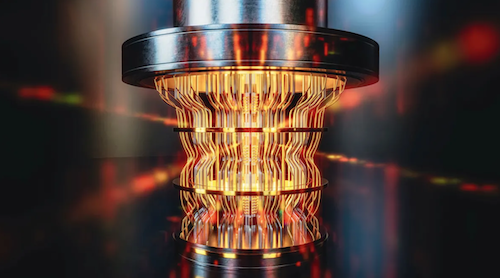

The next big technology revolution will be quantum computing. AI has been a productivity game changer, quantum computing will be used for solving complex problems. A quantum computer will be able to easily map and forecast small changes in intricate systems. The most obvious applications will be things like designing new drugs very quickly, or inventing strong, but lightweight building materials. We might finally solve the holy grail of energy production, fusion.

Currently, the technology is at least a decade away from widespread implementation. It's hugely expensive to run even small queries on a quantum chip, and it gets exponentially more expensive to run more complex queries. Apart from the cost limitation, the error rate in the results also increases as the problems get bigger. You have to back scientists to come up with solutions to those problems.

Last month, IBM and HSBC announced that they had teamed up to use a mix of quantum computing and conventional computing to model bond trading. The result was a 34% improvement in forecasting if a trade would match. When Wall Street thinks that they can make money from a technology, you can be sure that there will be funding to develop it further.

I think our future will be unrecognisable once AI and quantum computing team up to solve some of humanity's biggest issues.

Bright's banter

Once best known for assembling iPhones, Hon Hai Precision (Foxconn) is fast becoming an AI manufacturing powerhouse, supplying the servers that house Nvidia's chips. That puts them right at the centre of today's data centre buildout. They reported 11% sales growth last quarter to NT$2.06 trillion ($67.6 billion).

While geopolitical risks remain, especially around US-China trade tensions, Hon Hai is diversifying its production base and expanding AI server capacity in Wisconsin and Texas, partly to support OpenAI's massive $400 billion Stargate project that includes Oracle and SoftBank.

We like Nvidia because its ecosystem is at the centre of this entire infrastructure boom - not just chips, but the global supply chain that fits around them. Every major AI project, from OpenAI to Meta, starts with Nvidia's hardware, making it the clearest long-term play on the world's transition to intelligent computing.

Linkfest, lap it up

American Express has a strong brand. It also has high-spending clients and an exclusive allure- The history of Amex.

Humans have been drinking beer for thousands of years. The production process is relatively simple, but the cost around the world is wildly different - Global beer prices.

Signing off

Asian markets traded mostly higher this morning. Japan and Taiwan led the gains, while Australia and Malaysia edged lower. Mainland China remains shut for National Day, Hong Kong is closed for Mid-Autumn Festival, and South Korea is celebrating Chuseok.

In local company news, Discovery Green signed a landmark 20-year deal to supply Glencore's Mpumalanga coal mines with renewable power (the irony) from 2027, one of SA's largest private energy agreements to date.

US equity futures are marginally lower pre-market. The Rand is trading at around R17.18 to the greenback.

Maintain a buoyant spirit in these trying times.