Market scorecard

Wall Street advanced modestly yesterday, notching a fifth straight day of gains. Large-cap tech stocks lifted both the Nasdaq and the S&P 500 to their 30th record close of the year, even as the US government shutdown dragged into a second day.

In company news, Berkshire Hathaway agreed to buy Occidental Petroleum's petrochemicals arm for $9.7 billion in cash. This may be the last deal that Warren Buffett is actively involved in. Fair Isaac, the company which creates FICO credit scores, rose 17.6% after saying it would sell them directly to mortgage lenders and resellers. Finally, Tesla fell 5.1% despite recording good quarterly vehicle sales, the last before government EV subsidies fall away.

Izolo, the JSE All-share closed down 0.52%, the S&P 500 rose by a mere 0.06%, and the Nasdaq was 0.39% higher. We'll take it.

Our 10c worth

One thing, from Paul

Here's a suggestion for Friday: become a better writer.

Don't use AI tools, other than for initial research and data gathering. People can tell if you send them AI-output as a finished product. Don't be a purveyor of slop, try a bit harder.

Instead, use John McPhee's four-draft process. He's a 94-year-old non-fiction writer based in Princeton. That's him in the picture. Here are the steps.

(1) Brain dump draft - Capture every possible idea, fact, and angle without editing or judgment.

(2) Structure draft - Organize ideas into logical sequences and identify the core narrative thread.

(3) Ruthless cut draft - Remove everything that doesn't serve the primary message or which confuses the reader.

(4) Polished draft - Refine prose, fix grammar, and ensure each sentence drives toward your goal.

This is how we try to write this newsletter. Thanks for reading it.

Byron's beats

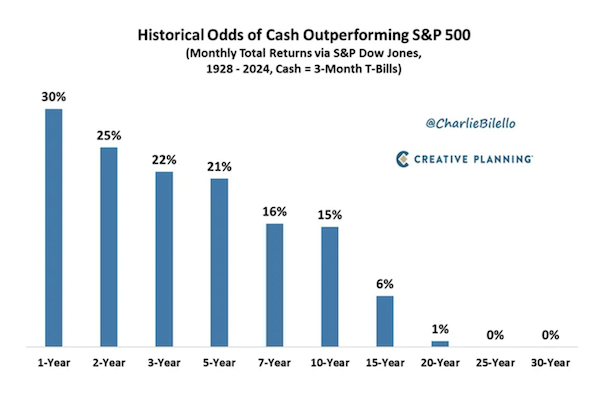

Cash might be useful in the short term, but in the long run it can be a drag. This graph will tell you why. The historical odds of cash outperforming the stock market in 1 year is 30%. That's a fair chance, not great, but wait, read on.

Over a 10 year period those odds halve to 15% and over 30 years the odds of cash beating the market are literally zero.

I have said it before and I'll say it again, being all-in on equities over the long term is not high-risk investing. The longer you own equities, the lower the risk.

Cash is the inverse, low risk in the short term but you are guaranteed to lose in the long run. It is up to each individual to find a happy balance between the two. Maybe this data will shift your reference point more towards shares.

Michael's musings

Last month, I wrote about Larry Ellison briefly becoming the richest person in the world, before slipping into a close second place. Fast forward a few weeks, and he's still second, and $100 billion ahead of third-place Mark Zuckerberg, but he is also $100 billion behind Elon Musk, who has surged into the top spot.

On Wednesday, Musk became the first person in history to be worth $500 billion. Since then, the Tesla share price has slipped a bit and he's back to being worth 'only' $450 billion.

So, the three richest people are worth $250 billion, $350 billion, and $450 billion, respectively. That level of wealth boggles the mind. South Africa's GDP is $400 billion. ChatGPT tells me that all the residential properties in the greater Cape Town area are worth a cumulative $70 billion - Musk could buy the whole area 6 times over and still have change.

Financial blogger Morgan Housel always highlights that you can't separate the wealth earned, from the life that person needed to live to get there. Would I want to be Musk, worth $450 billion? No thanks, I'm happy with my life.

Bright's banter

Almost a decade ago, Starbucks leaned into Italian romance, talking up "the craftsmanship of the Milanese barista" as it launched its first store in Italy. Now the coffee chain is chasing a very different consumer vibe. Starbucks just rolled out a new menu twist: protein-infused cold foam and protein lattes or "profee".

America is in the middle of a protein craze, where the measure of a good drink isn't just flavor, but how many grams of protein it contains. Dutch Bros - an Oregon-based chain with "broistas" behind the counter and entire menu sections of protein coffees and energy drinks saw Q2 2025 quarterly sales jump 6.1%.

Starbucks' US same-store sales in the same period were down 2%. It's tough out there, but they are trying.

Linkfest, lap it up

Do women live longer than men? Statistically speaking, yes - Guinness World Records golden girls.

Petrol has a role in most economic activities. In South Africa, 30% of the final price per litre is tax, but it's still cheaper than many other parts of the world - Global petrol prices in 2025.

Signing off

Asian markets were mixed this morning. Japan and Australia traded higher while New Zealand, Singapore, Taiwan, Indonesia, Hong Kong, and Malaysia fell. Mainland China and South Korea remained shut for holidays. We are having an Aussie stock week, and here's today's story. Melbourne-based Mesoblast jumped over 9% after US Medicare and Medicaid programmes backed broader access to its Ryoncil therapy.

In local company news, Naspers/Prosus has completed its R83 billion (EUR4.1 billion) takeover of Just Eat Takeaway.com, securing over 90% shareholder support and EU approval. The deal makes it the world's fourth-largest food delivery group, with 60 million customers across 17 markets.

US equity futures are in the green pre-market. The Rand is trading at around R17.22 to the US Dollar.

Have a happy Friday. Make sure you eat a big lunch.