Market scorecard

US markets edged higher yesterday. Both the Nasdaq and S&P 500 were up, though gains were capped by government shutdown worries and caution ahead of key jobs data. Nvidia (+2.1%), Uber (+1.1%), and Amazon (+1.1%) were some of the large-cap standout performers.

In company news, New York-based financial services company Jefferies reported record third-quarter revenues. Elsewhere, Google will pay $24.5 million to settle a lawsuit brought by Donald Trump after he was banned on YouTube following the 6 January Capitol riot. Lastly, Boeing is reportedly planning a new single-aisle jet to succeed the 737 MAX. It might be called the 797, but that's not clear.

In short, the JSE All-share closed up 0.51%, the S&P 500 added 0.26%, and the Nasdaq crept 0.48% higher. A good day.

Our 10c worth

One thing, from Paul

Is there something hugely valuable in your garage, attic, or basement storage area? Is your grandpa's old violin actually a Stradivarius? Is your great aunt's Rembrandt print actually an original? Or perhaps the dusty old sports car under a greasy tarpaulin in the extra garage on your cousin's farm is a 1963 Ferrari GTO 250?

It's highly unlikely that a rare gem is hidden amongst your crap, but not impossible. Most people shift their inherited possessions from one dumping spot to another, without ever making a proper inventory.

In March 2025, an anonymous buyer purchased the 1715 "Baron Knoop" Stradivarius violin for $23 million, making it the most expensive one ever sold. Antonio Stradivari was a Cremonese luthier whose output in the seventeenth and eighteenth centuries epitomizes perfection in violin manufacturing.

Mind you, a 19th-century American short-story writer once called a violin an "instrument that tickles human ears by friction of a horse's tail on the entrails of a cat."

Keep in mind that possessions are not investments. Things are worth what other people will actually pay for them. Serious collectors are few and far between.

Byron's beats

Uber has been on the periphery of the Vestact-recommended stock list since it went public in 2019. As the business matures under the helm of its talented CEO, Dara Khosrowshahi, we are warming up to it more and more.

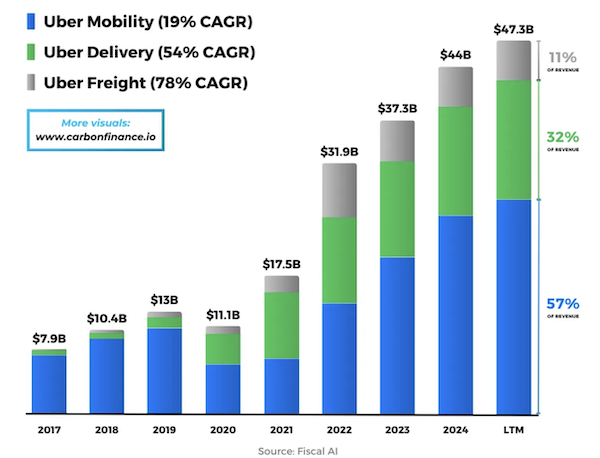

This graph from Carbon Finance breaks down Uber's revenues, and shows the growth over time. As you can see, it is far from being just a ride-hailing app. Delivery and freight now make up 43% of sales and are both growing fast. In fact, the non-ride-hailing side of the business grew 25% in the last 3 months.

These 3 core revenue streams still have lots of room for growth, then you have the robotaxi and self-driving vehicle technologies, which could really push this business to new heights. So far, Dara has a 5-star Uber rating I would say.

Michael's musings

Nike is expected to report quarterly earnings after the market close tonight. The stock has had a very rough four years, but the new management team assembled last year seems to be doing the correct things. The share price is up 30% from recent lows, and analyst ratings have mostly been upgraded since their numbers 3 months ago.

The sporting apparel industry has been a particularly challenging one since the highs of Covid. Nike has the advantage of a long legacy and well-established distribution networks, two things not easily replicated.

We have debated switching our athleisure investment to another company that has rising sales and fewer challenges, like ON Holdings. I think their shoes look great, and they have Roger Federer as an ambassador and shareholder.

The ON share price is basically flat over the last four years, even though they have tripled their sales. The key question for us is whether ON can maintain its momentum. They are currently a status symbol; people want to be seen wearing the shoes. When fads and fashions change, will ON be able to adapt too?

We will let you know tomorrow how the Nike numbers shape up.

Bright's banter

The estate of deceased politician David Mabuza is worth R44 million and has erupted into a dispute. This is a stark reminder of what happens when cultural traditions aren't backed by legal formalities. Two women are laying claim to his pension, one via a long-standing customary marriage, the other through a disputed marriage certificate that was only issued after his death.

The case highlights a key issue: lobola is meaningful, but it doesn't equal legal recognition. For a customary marriage to be enforceable, it must be registered under the Recognition of Customary Marriages Act. Without that, families are left to prove unions through affidavits or witnesses - a messy and painful process.

A will could have prevented this entire fight. It makes intentions clear, protects dependents, and works alongside laws like the Maintenance of Surviving Spouses Act.

The lesson here is simple: lobola is the start, not the end, of financial planning. Register the marriage, write a will, nominate beneficiaries, and protect your legacy.

Linkfest, lap it up

Chile's birth rate has fallen below Japan's. Total fertility rate has plummeted 42% over the past decade - Can Chile maintain a stable population?

Shipping is vital to any economy. Our ports are terrible, but things are changing - The Container Port Performance Index shows RSA ports are improving.

Signing off

Asian markets are mixed this morning. Restaurant Brands NZ surged over 65% on a takeover bid from majority shareholder Finaccess Restauracion, while Orthocell jumped nearly 16.8% after launching its Remplir nerve repair device in Canada.

In local company news, Boxer grew its first-half turnover by 13.9% with like-for-like sales up 5.3%. The group's market cap has climbed above its parent Pick n Pay. Elsewhere, PSG Financial Services expects interim earnings to rise by as much as 30%, helped by strong equity markets.

US equity futures are in the green pre-market. The Rand is looking perky at around R17.25 to the US Dollar.

We just had our first summer rains in Johannesburg. Now it's time for the Jacarandas to flower. Awesome.