Market scorecard

US markets moved higher on Friday after a sluggish start to the session. The major indexes all turned positive as the day went on, snapping a three-day losing streak. Solid inflation numbers earlier in the day offset some wild tariff proposals from the White House.

In company-specific news, Intel rose 4.4% and GlobalFoundries over 8% after rumours that the US hopes to reduce reliance on foreign-made chips. Elsewhere, video game company EA jumped by 14.9% because it's close to a $50 billion deal to go private. Finally, legendary retailer Costco Wholesale beat earnings expectations, but shares lost 2.9% because of slowing same-store sales.

On Friday, the JSE All-share closed up 0.85%, the S&P 500 rose 0.59%, and the Nasdaq was 0.44% higher. Pleasing.

Our 10c worth

One thing, from Paul

It's been a while since we featured a Jack Bogle quote in this newsletter. The founder of investment giant Vanguard, he lived from 1929 to 2019 and was the man who popularized passive index funds.

Bogle was very disparaging about short-term speculation, saying: "The stock market is a giant distraction to the business of investing."

Another important insight that Bogle really brought to the fore was the focus on keeping costs low. Actively-managed funds, insurance company wrappers, hedge funds, structured products, and other fancy financial instruments can have annual fees as high as 5%, plus performance charges.

The best Bogle quote on this topic: "In investing, you get what you don't pay for."

As a reminder, Vestact portfolios are actively managed, but we call ourselves actively passive. We pay attention, but we don't get scared out of the market, or chop and change our recommended holdings. Dealing is expensive, so we keep it to a minimum. We charge a flat 1% per annum advice fee. The long-term performance belongs to the client.

Thanks to low fees and getting into focused portfolios of major tech sector stocks very early, we've beaten the S&P 500 handily over the last two decades.

Byron's beats

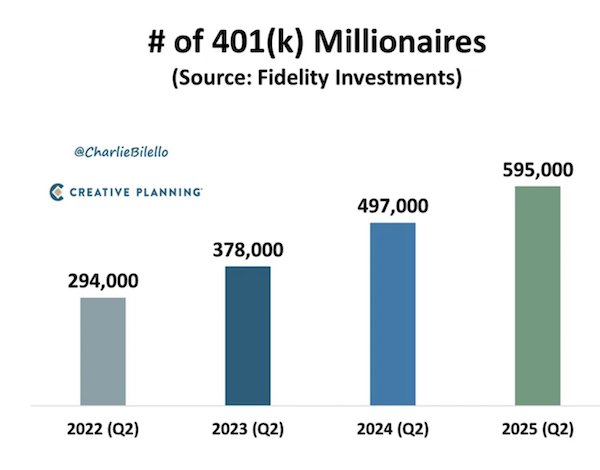

A 401(k) is a retirement savings plan that lets US employees invest their pre-tax income. As of June 2025, the number of 401 (k) accounts worth more than $1 million has soared to 595 000. That's a lot of people with a lot of money invested, mostly in listed equities.

At the same time, assets in money market funds have also reached all-time highs, now sitting at $7.7 trillion, having tripled over the last 8 years. US investors are currently getting good returns in shares and decent returns on cash, at historically above-average interest rates.

The wealth effect from both these savings pots is huge. These people can buy cars, iPhones, holidays, eat out at good restaurants, etc, because they feel comfortable that they can afford such luxuries. US GDP has just been revised higher, this probably helps explain why.

Michael's musings

Last week, Meta announced that it will offer paid, ad-free versions of Instagram and Facebook in the UK. The monthly cost is GBP2.99, which is roughly R70 a month.

The reason for having to offer the paid version is because under EU law, Meta has to get user permission to use their data. If you don't want Meta to use your personal information, then you need to pay to compensate the company for lost advertising revenue. Seems fair to me.

Would you pay R70 a month to have an ad-free version of Instagram? My default is to pay more to have ad-free services. With Instagram, I would probably make an exception, because I find many of the ads useful. The ads are usually well-curated and visually appealing, unlike the clickbait slop often found at the bottom of some webpages.

Thanks to Meta's amazing algorithms, the adverts served are generally relevant to me. I have even bought a few things thanks to an Instagram ad appearing at an opportune time. I'm happy to continue to see the ads.

Even though this option isn't available to us in South Africa, it's an interesting thought experiment.

Bright's banter

After a year of drama, the US finally has a TikTok deal. President Trump signed an executive order forcing ByteDance to divest, clearing the way for a new US-based joint venture.

Oracle, Silver Lake and Abu Dhabi's MGX will each take around 15%, giving US investors 45% in total. ByteDance will be capped at 19.9% to satisfy national security rules, with the rest split among existing backers like Sequoia, Susquehanna, and General Atlantic.

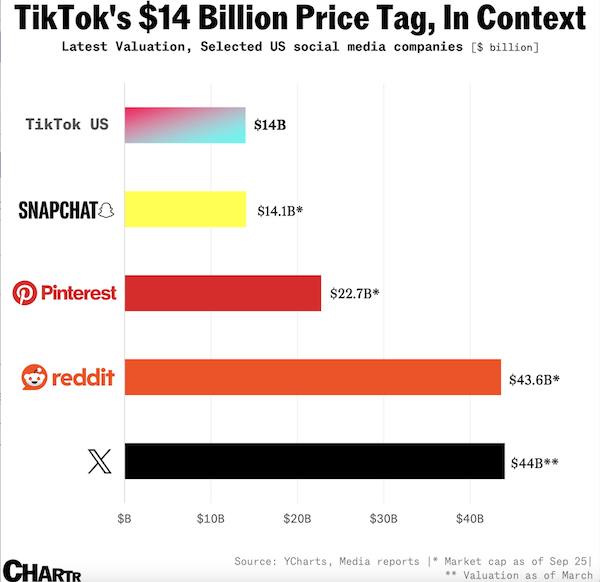

The consortium will invest in TikTok US at a valuation of just $14 billion. For an app with 180 million US users, that looks absurdly cheap, with some already calling it "daylight robbery". Earlier estimates had TikTok's US business worth closer to $50 billion. Compared with other social platforms, this looks like a steal.

Linkfest, lap it up

How you frame data is very important. Data findings can be easily manipulated to suit your argument by changing the focus - Denominator blindness.

In August 1833, the British abolished slavery. This helped free over 800 000 enslaved Africans - The cost of freedom.

Signing off

Asian stocks traded mostly higher this morning, tracking Wall Street's Friday gains. In Australia, Novonix jumped 17.7% after delivering its first mass production of synthetic graphite to a major US client. In New Zealand, Synlait Milk jumped over 15.7% after agreeing to sell its North Island assets to Abbott for NZ$307m.

In local company news, Gemfields swung to a $24.6 million first-half loss as unrest in Mozambique and competition in Zambia hit revenue, but a cash raise, Faberge sale, and new ruby plant should steady the miner, hopefully.

US equity futures are in the green pre-market. The Rand is trading at around R17.31 to the US Dollar.

Two more days to go, then we will be in the final quarter of the year. Enjoy.