Market scorecard

US markets logged their third straight day of declines, despite the release of some good economic data. Second quarter US GDP was revised up to 3.8% from the expected 3.3% and weekly jobless claims eased. Big movers on the day included Oracle, which fell 5.6% after completing some bond sales for its AI push, and second-hand motor dealership CarMax which plunged 20.1%.

In company news, Microsoft restricted some software use by the Israeli military after reports that its products were linked to civilian surveillance. Elsewhere, Starbucks will shut around 1% of its stores and cut 900 jobs as part of a $1 billion restructuring plan under new CEO Brian Niccol. Lastly, Amazon will pay $2.5 billion in penalties and refunds and simplify Prime cancellations to settle an FTC lawsuit.

At the close, the JSE All-share closed down 0.83%, the S&P 500 fell 0.50%, and the Nasdaq was also 0.50% lower. Boo hoo!

Our 10c worth

One thing, from Paul

Paul Salopek, the guy who has been walking around the world since January 2013, writes as he leaves Japan:

"Yearning, to be sure, might be the universal human condition: inescapable, without any particular geography. You experience it everywhere and often while walking through the world. The stranger on foot, provided that she or he moves slowly, and seems empathetic, or at least forbearing, becomes a fleeting vessel of buried hopes and cracked dreams."

So, here's some Friday advice: don't try to be "polite", just go ahead and ask people personal questions.

Ask them who they voted for in the last election. Ask them how much they get paid every month. Ask them why they got divorced. Ask them why they are so fat, or so thin. Ask them when their hair fell out. Ask them why they never had any children. Ask them what they think of immigrants. Ask them if they were happy when they were growing up. Ask them what they think of inequality. Ask them if they believe in God. Ask them if they still like their parents.

In my experience, most people don't mind answering probing questions, they find it flattering that you are interested enough to enquire. You'll learn a lot about human nature in the process. You won't waste any time on meaningless conversations, you'll go straight to the heart of the matter.

Byron's beats

Gold bulls are shouting from the tops of the mountains about how well the price of the metal has done recently. I have seen a few cherry-picked graphs showing how gold has outperformed the S&P 500 over the last 10 years. Since 2015 the S&P 500 is up 190% while gold is up 210%.

I was quite surprised to read that gold has only just surpassed its 1980 peak, when adjusted for inflation. In other words, if you bought gold at that top in 1980, your investment would have tracked inflation since then. Put differently, since 1980, gold has returned around 3-4% per annum. $10 000 invested back then would be worth $80 000 today. That's not taking into account storage fees for your bullion, or the worry that your Kruger Rand went "missing" when you moved homes 5 years ago.

$10 000 put into the S&P 500 in 1980 would be worth well over $1 million today, thanks to the annual return of around 11%. Here at Vestact, we much prefer investing in productive assets because, well, numbers don't lie.

Michael's musings

There's an AI land grab going on at the moment. Companies are scrambling to stake their claim of the new AI-centric future; they only get one chance to do this because once the industry settles, there won't be much room for new major players. It's very exciting to see how things are unfolding, as organisations roll out new models, compete for talent, and do their best to secure the latest Nvidia chips.

Even with the rapid expansion of the sector, there is some consolidation happening. For example, Nvidia taking stakes in Intel and OpenAI, and Microsoft incorporating ChatGPT and Anthropic into its services. Yesterday, rumours surfaced that Meta plans to use Google's Gemini to assist in their ad targeting.

The partnership makes sense given that Meta signed a major six-year cloud computing deal with Google Cloud last month, valued at more than $10 billion. Meta seems to be admitting that its own AI, Llama, is lagging behind that of Google. Meta's CEO, Mark Zuckerberg, is pushing hard to ensure that future versions of Llama are industry leading - from hiring the best in the industry to spending over $100 billion a year on computing power.

About two years ago, the Alphabet share price slumped because the market assumed that it had already lost the AI wars. Remember when Gemini's picture generator was trying to be politically correct, and created images with dark-skinned Nazis? A lot has happened since then, and Google is solidly in the mix as the best in the AI industry.

Bright's banter

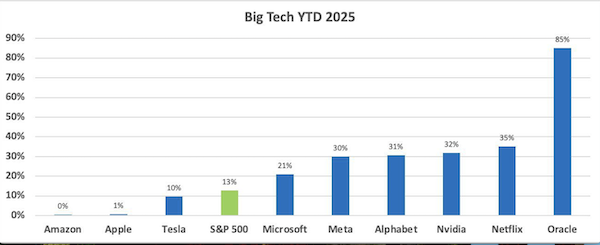

Big Tech's scoreboard for 2025 has a clear winner - Oracle, up 85% year-to-date. The old-school database giant has reinvented itself as an AI infrastructure player, scooping up monster cloud deals.

Right behind it are the usual suspects of the AI trade (and our model portfolio stars), Nvidia (+32%), Microsoft (+21%), Alphabet (+31%) and Meta (+30%), all comfortably outpacing the S&P 500 (+13%). Add in Netflix (+35%) helped by subscriber momentum and a string of successful content drops.

We're happy to see some of our recommended names right in the thick of it, delivering exactly the kind of leadership we expected. In a year where Apple and Amazon went sideways, it pays to be invested in the companies driving the next leg of tech's growth story.

In our business, there's no time to sleep at the wheel. We are reading widely, staying plugged in, trying to spot the next wave of growth, and finding the companies best positioned to ride it.

Linkfest, lap it up

Divorce later in life is becoming more common. Scientists are trying to find how it impacts adult children and their relationships - Greying and splitting.

Huntington's is a terrible disease. Symptoms resemble a combination of dementia, Parkinson's and motor neuron disease - Genetic intervention from uniQure shows promise.

Signing off

In Asia, Riyadh's Tadawul All-Share Index has climbed as much as 7 per cent over the past two days on reports that laws might allow foreign investors to take stakes higher than 49% of listed companies.

In local company news, Fairvest said it will beat its 8% to 10% distribution growth target for the 2025 financial year, with retail strength, positive rental reversions, and fibre infrastructure investments offsetting higher vacancies and pressure in offices. Elsewhere, Naspers/Prosus subsidiary OLX will acquire La Centrale, a leading vehicle selling platform in France.

US equity futures are in the green pre-market. In overnight news, President Tariff announced measures to hit imported drugs with extra taxes. Our pharma holdings, Eli Lilly and Amgen should dodge these problems since they are US-based.

The Rand is trading at around R17.46 to the greenback.

Have a strong end to the week.