Market scorecard

US markets moved steadily higher through the trading session yesterday, closing at fresh record levels. The Nasdaq led gains with Apple (+4.3%), Nvidia (+3.9%), and Tesla (+1.9%) showing the way.

In company news, Pfizer will buy obesity startup Metsera for $4.9 billion as it scrambles to catch up with rivals in the weight-loss drug race. Elsewhere, Walmart will begin home delivery of refrigerated prescriptions. Finally, Porsche slowed by 3.9% on the news that it will delay the rollout of new EV models.

At the close, the JSE All-share closed down 0.14%, the S&P 500 rose 0.44%, and the Nasdaq was 0.70% higher. These are good times.

Our 10c worth

One thing, from Paul

Some investors are sceptical of the AI revolution, and worry that the investment in massive data centres and teams of uppity AI programmers will never generate a positive return.

This is relevant to our holdings in the major AI spenders - Amazon, Microsoft, Google, Meta and Tesla, as well as the company they are spending a big chunk of the money with, Nvidia. Have they all run too hard?

I'm comfortable that we are on the right track, because the AI services listed below are making a big impact, and more and more users are signing up for them, and paying hefty monthly subscriptions for the premium versions. On top of that, large corporates are spending big on bespoke AI solutions to improve their business processes.

I can think of 6 big opportunities.

(1) Research tools. AI chatbots are better than search engines because they supply plain English answers rather than a list of web links. More than 700 million people already use ChatGPT. Here at Vestact, we just signed up for the subscription workspace product, for all of us.

(2) Office productivity tools. In the hands of sophisticated users, AI tools can generate computer programs, summarise documents and meetings, draft emails and use other software applications, like spreadsheets and online calendars. They are transforming the work of consultants, lawyers, doctors, hospital workers, journalists and more. According to research from McKinsey & Company, about 80% of US businesses have started to use generative AI tools. This is just the start.

(3) AI assistants. Companies are using chatbots to support a wide range of consumer services. These digital assistants pop up wherever they are needed. They are better than help desks staffed by humans with telephones. Now, these digital assistants are getting into sales.

(4) Control systems for complex machines. Self-driving cars, manufacturing tools, domestic robots, digital glasses, and language-translation earpieces require very complicated operating software. Designing and developing them is hard, and requires tons of computing power. Allowing ordinary users to operate them safely in real-time is equally demanding.

(5) AI friends. This sounds a bit creepy, but AI bots can be your best buddy on a messaging app, or other interfaces. Loneliness is real, and this is a new kind of companionship. As these "friends" become more useful, people will pay a lot to subscribe and they'll never sign off.

(6) Complex research and innovation. AI systems are already doing ground-breaking work in technical design fields, financial services and drug development. Lots of number crunching is often the way to crack the problem.

In summary, there's a lot happening here, and you need to be on board as an investor to benefit from these opportunities. Stay long the leaders in the field.

Byron's beats

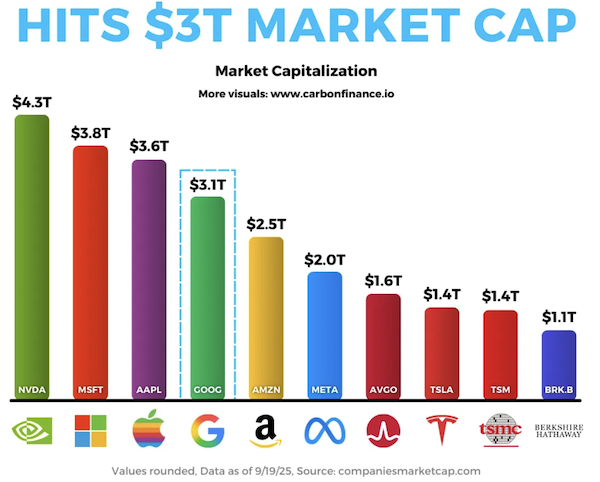

Google's recent share price rally has resulted in it joining the very elite $3 trillion club. Nvidia, Microsoft and Apple are the other three esteemed members. You may have noticed that they are all Vestact-recommended stocks and have been for a long time.

We prefer to invest in very large, well-established businesses because they are less risky, have access to the best talent and capital, and have proven business models. Because they are already large does not mean they cannot get larger. A $500 billion market cap business can get to $5 trillion and be a great 10-bagger investment.

You don't need to go scrounging around at the bottom end of the market, for some unloved maker of spices that trades at a 50% discount to the value of its inventory of dried cinnamon, to get great returns. Keep it simple and stick to quality.

Michael's musings

Many people have been critical of the South African Reserve Bank (SARB) for not cutting interest rates last week. The reality is that you can't lower interest rates when inflation is sitting higher than the target. Cutting rates inappropriately destroys credibility, which would be bad for the Rand and overall asset prices, in time.

I hear you saying that the US just cut interest rates, even though its inflation is higher than the Fed's 2% target. The US is a developed nation, and the market gives it more leeway. We are an emerging market, with Zimbabwe as a neighbour that used to have hyper-inflation. It's not fair, but it is what it is.

Think back to when the EFF suggested nationalising the SARB, which resulted in the Rand and the stock market falling. If we nationalised the SARB, absolutely nothing would change from an operational perspective, but the perception that it would be less independent made global investors nervous. The Fed in the US is publicly-owned, and investors don't bat an eyelid. If President Ramaphosa had bashed the SARB, like Trump is currently doing to the Fed, there would be carnage on our financial markets.

South Africa doesn't struggle with low growth because the SARB didn't cut interest rates, it is because of rampant corruption in public entities, and the absolute implosion of our municipalities, specifically the ANC-run ones.

Having a lower inflation target will mean that inflation levels will naturally settle at a lower level. Less inflation is very good for the poor, and it means that long-term interest rates will be lower.

Bright's banter

Nvidia and OpenAI are joining forces in one of the biggest AI infrastructure bets yet - a plan that could see up to $100 billion invested to build out the next generation of data centres. OpenAI will deploy at least 10 gigawatts of Nvidia systems to train and run its future models, with the first phase slated for 2026, and running on Nvidia's new Vera Rubin platform.

Nvidia will fund the rollout gradually as each gigawatt comes online, tying its fortunes even closer to OpenAI and, by extension, Microsoft, which remains OpenAI's most important partner.

And here's why we own Nvidia and Microsoft. Nvidia is the hardware kingpin supplying the chips and networking equipment, while Microsoft, OpenAI's majority shareholder, is uniquely positioned to capture the upside as those models get deployed across its software empire. Together, they're at the very centre of AI's most valuable ecosystem.

Linkfest, lap it up

Have you noticed people walking backwards at the gym? Doing a 180 on the treadmill can aid with fat loss, back pain relief, leg strength, and coordination - Why you should try it too.

Trying to time the market is a waste of time. The best strategy is to buy when your money is available - Study: The more investors traded, the less they made.

Signing off

Samsung Electronics jumped in Seoul on news that Nvidia had approved its advanced memory chips, while Myer slumped nearly 29% in Sydney after a 30% profit drop, despite slightly higher sales.

In local company news, Canal+'s takeover of MultiChoice is now unconditional, its largest deal yet, with board changes at the CEO and CFO levels giving the French media group representation while MultiChoice retains its independence.

US equity futures are slightly in the red pre-market. The Rand is trading at around R17.35 to the US Dollar.

Keep on keeping on.