Market scorecard

US markets rose again on Friday to end the week at record highs. The Fed's quarter-point cut could mean that more easing is coming later this year and into 2026. If you are keeping count, it was the S&P 500's 27th high water mark of the year. Uber (+4.0%), Apple (+3.2%), and Tesla (+2.2%) led the daily moves.

In company news, Oracle is reportedly in talks with Meta on a cloud deal worth around $20 billion. Brighthouse Financial jumped 27.2% on reports that it's the target of a buyout led by private equity fund Aquarion Holdings. Finally, educational publisher Scholastic tumbled 12.0% after reporting a big earnings miss.

On Friday, the JSE All-share closed up 0.65%, the S&P 500 rose 0.49%, and the Nasdaq was 0.72% higher. It's been an amazing run.

Our 10c worth

One thing, from Paul

On Mondays, I like to write about trends in the asset management business.

The thoughts below come from an entertaining Lunch with the FT column by Robin Wigglesworth, who dined with Jean-Philippe Bouchaud (pictured below), a French physicist who chairs Capital Fund Management, "one of Europe's largest, oldest and least-known hedge funds".

Bouchaud is a proponent of a new financial theory called the "inelastic markets hypothesis" which argues that markets are not efficient, because inflows and outflows are more impactful than previously thought. In particular, they believe that the "gush of money into cheap, mindless passive investment strategies" has pushed US markets to record highs.

I liked Wigglesworth's pushback to this idea. "What about the secular four-decade decline in interest rates? What about the technology industry's engorged corporate profits? Increasingly global companies, with international supply chains and aggressive tax minimisation? The decline in antitrust enforcement?"

This is an interesting debate, but the fact remains that passive fund inflows do push the market higher, creating additional demand for shares of high-quality companies. That's not going to change anytime soon.

We are happy to be directly invested in our favourite large-cap stocks. The regular inflow into index trackers is fine by us, so long as other people get in once we are already holders. They can buy their shares from someone else.

Byron's beats

On Friday, a client sent me the following picture with the caption "In Dubai Mall, and the queue for the new Apple iPhone is probably 1 km long."

Two things come to mind. Firstly, Apple still has it. Despite all the competition and the fact that smartphones have been fully commoditised, people are still willing to wait in a queue for hours (is there anything worse?) to buy one of their latest phones.

Secondly, Apple has an incredibly large and loyal client base. The technology on other smartphones might be better and the prices cheaper, but I would never for a second consider any other device. I am entrenched in the Apple ecosystem and I know what I am going to get. There are a billion other clients just like me.

On that note, I have been waiting patiently for this new iPhone to arrive in SA as my contract is due for an upgrade. I don't like queues so I guess I will have to wait for the hype to die down a bit.

Michael's musings

Our job is to maximise your returns, which is a combination of capital growth and dividends paid by the companies that you own. I learnt last week that there is actually a term for when people are overly fixated on dividends. It is called "free dividend fallacy", which is the mistaken belief that dividends are "free money" or extra income, rather than a transfer of value from the stock's price to the investor.

Research shows that when you chase dividends, you end up underperforming. Generally, good dividend-paying stocks are companies operating in very mature industries, which means future growth is limited, but cash flow is amazing.

Most large US companies now prefer to do stock buybacks over paying excess cash out as a dividend. There are several compelling reasons for this, including the controversial argument that it benefits management's share options.

Buybacks are better from a tax perspective; dividend tax in South Africa is 20%, but capital gains tax is only 18%. Also, dividend taxes are paid up front, before you have a chance to reinvest the money. With share buybacks, the share price increases immediately, but you only have to pay capital gains tax when you sell. Given that we are very long-term holders, that means your money gets to be invested for years/ decades before you have to pay the tax.

Probably the best reason is that when a company buys back a stock, it doesn't have to share profits with that stockholder anymore, whereas with dividends, they have to continue paying money to that stockholder. It is the reason that Berkshire Hathaway doesn't pay dividends, but does share buybacks.

I recently wrote that I was impressed that Larry Ellison still owned 42% of Oracle. If you look back to 2012, he only owned 23% of the company, but thanks to Oracle's ongoing buyback program, his stake almost doubled, without him having to do anything. I'm sure he prefers having access to 43% of the profits, instead of still only receiving 23% of the annual dividend.

In summary, don't be overly focused on dividends.

Bright's banter

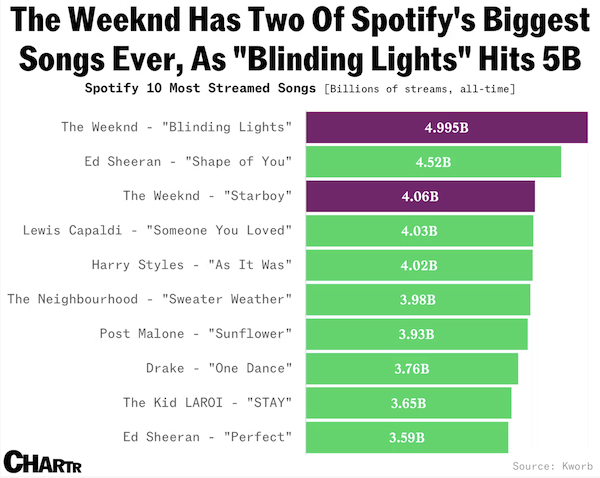

Spotify's most-played track is about to set a new benchmark. Blinding Lights by The Weeknd is days away from hitting 5 billion streams, the first song ever to cross that line.

What makes it remarkable isn't just the headline number, but the durability. Nearly six years after release, the track is still pulling in 1.4 million streams a day; it is proof that some songs become part of the cultural wallpaper.

For The Weeknd, it cements his standing as one of streaming's titans. Starboy sits in Spotify's top three, and another 26 tracks have cleared 1 billion plays. Only Drake, Bad Bunny, and Taylor Swift are pulling in more daily streams right now.

It's a long way from its quiet debut in late 2019, teased on a Mercedes ad in Germany. Since then, Blinding Lights has been crowned the biggest song of 2020, spent a full year in the US Top 10, and even knocked The Twist off its perch as Billboard's greatest Hot 100 hits of all time.

Linkfest, lap it up

South Africa accounts for roughly 40% of all the gold ever mined. At our peak, we produced over 1 000 tons of gold annually, roughly triple the leading country today - South Africa isn't even in the top 10 producers now.

People are constantly on their phones. Sometimes, even during social engagements when they're supposed to be 'present' - Phones have made us all rude.

Signing off

Asian markets are mostly higher this morning, with Australia, Japan, mainland China, South Korea, and Taiwan in the green. In India, shares in Adani Enterprises have risen 8.5% in the last two trading days after regulators cleared some of the claims against founder Gautam Adani.

In local company news, Investec guided first-half earnings broadly flat year-on-year, with operating profit before tax of GBP482 million. Elsewhere, Spar has entered the pet retail market with a new brand called Pet Storey, opening Africa's largest pet store in Boksburg and targeting 100 outlets by 2026.

US equity futures are marginally lower pre-market. The Rand is trading at around R17.33 to the US Dollar.

Have a good week and start prepping for your Heritage Day braai on Wednesday.