Market scorecard

Wall Street wrapped up the week quietly, with the S&P 500 hovering near record levels and the Nasdaq closing at a fresh all-time high. Both indices gained over 1% during the week as investors bet that this week's Fed meeting will deliver a quarter-point rate cut to keep the rally rolling.

In company news, Union Pacific's CEO has been in talks with Trump as the company pushes for regulatory approval of its proposed $72 billion takeover of Norfolk Southern. Elsewhere, Exxon Mobil says it has cracked a new form of graphite that could extend EV battery life by up to 30%. Finally, Freeport-McMoRan lost 2.6% because its Grasberg Block Cave copper mine in Indonesia remains shut down following a serious mudslide.

On Friday, the JSE All-share closed up 0.51%, the S&P 500 fell 0.05%, and the Nasdaq was 0.44% higher. Stay long.

Our 10c worth

One thing, from Paul

Ben Carlson made a good point in a recent blog post: "There are no rival financial advisory firms, and none of them act like competitors. It's a collaborative industry with no natural rivals. Some firms are better for certain types of clients than others. Some clients want different things. Some firms want to grow while others are happy where they are. There are all different types of firms and business models, and they are all running their own race."

I've found that to be the case too here in Johannesburg, South Africa. There are industry giants that have lots of customers, but they usually have rather mediocre service levels. There are many smaller operators which have a loyal customer base, and do very well. Some focus on general advice, others on one specific investment product. Some target speculators, others seek out long-term investors.

There are plenty of customers to go around. Getting warm referrals from existing clients is the best way to grow. Wealth management is a good industry to be in, provided you are well organised and always put clients' interests first.

Byron's beats

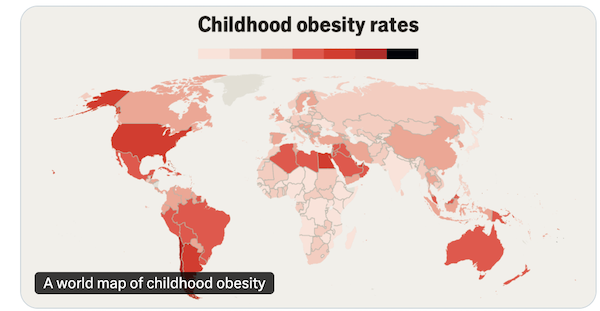

According to The Economist, 20% of children in the world today are overweight. Half of those 20% are classified as obese. The rise of cheap, fast, and heavily processed foods, as well as sugar-filled snacks, is taking its toll on the world's youth.

As a parent of young children, I'm not celebrating this data. Managing the food intake of busy offspring is not an easy task, but certainly a fight worth having. The current weight-loss drugs on the market have not yet been deemed safe for children. Novo Nordisk's Wegovy was approved by the FDA in 2022 for adolescents over the age of 12.

I imagine that most overweight children grow up to be overweight adults which means that demand for weight-loss drugs will remain steady. As a shareholder of Eli Lilly, I believe that GLP-1 drugs will be a big part of the solution. They suppress your cravings for fatty and sugary foods.

Hopefully, adults who are in better shape will push their kids to eat healthier. Eat that broccoli or else!

Michael's musings

One of the strategy courses I completed in my MBA noted that CEOs should protect the culture of the company. I didn't fully understand the statement at the time, but as an investor, I can now see the argument more clearly.

In my reading about the history of large, successful companies, there is often a founder who was dedicated to creating customer value through superior products. Being a customer-centric company was part of the culture, reinforced daily by the founder.

Once a founder has retired, professional managers assume leadership roles, and everything changes. These managers try to boost profits by cutting costs, reducing staff numbers or tweaking the product formulas. If sales stay stable they slash costs further until, inevitably, they end up with an inferior product and declining customer service. The culture has changed, with the new focus on profits, instead of the customer.

Only the CEO can tell everyone that the company is happy to forego short-term profits, to focus on quality, and ultimately earn more money in the long run. Without that culture, people automatically focus on the short-term.

Here are a few examples from large international food brands. Coke in the US switched from cane sugar to corn syrup in the 1980s, to cut costs. That prompted consumers to seek out 'Mexican Coke', which still uses the original cane sugar formula. KFC changed its chicken recipe, which originally required the chicken to be double-fried. Going to single frying saves money. Think of a McDonald's burger today, and how much it has changed since you first had one?

Bright's banter

Vimeo is getting a new owner. The former darling of indie filmmakers is being bought for $1.38 billion by Bending Spoons, the Milan-based software company best known for buying up tired digital brands and trying to breathe new life into them.

Vimeo's story goes back to 2004, when Jake Lodwick and Zach Klein launched it as a quirky offshoot of CollegeHumor. It was the cool kids' alternative to YouTube, the place for high-def shorts and ad-free vibes. But while YouTube scaled into a global monster, Vimeo shifted into enterprise tools and corporate video hosting.

Bending Spoons has been on a shopping spree. Founded in 2013, the Italians have built a reputation for buying well-known companies like Evernote, WeTransfer and Meetup, and then rejigging them with a heavy focus on data and subscriptions.

For Vimeo, this is a chance to unlock value away from the quarterly earnings spotlight. For Bending Spoons, it adds to their collection of "remember-when" internet brands.

Linkfest, lap it up

Americans work a lot of hours per week. They are the second highest in the OECD - A theory on why Americans put in so much time at work.

Your industry determines how much you will make. Being the top of a low income category, still means your earnings are limited - How much people make annually, by occupation.

Signing off

Asian markets are mostly in the green this morning. Japanese bourses are closed today for Respect for the Aged Day, a national holiday honouring the country's seniors. It is still worth highlighting that SK Hynix shares are up 20% in the last week after the chipmaker said it had finished developing HBM4, its next generation of high-bandwidth memory that's set to power the most demanding AI workloads.

In local company news, Ascendis Health jumped 9.8% after announcing plans to delist from the JSE, again, alongside a conditional share buyback offer at 97c a share.

US equity futures are marginally in the green pre-market. The Rand is trading at around R17.38 to the US Dollar.

Have a productive week, give it a full go.