Market scorecard

US markets held steady near record highs yesterday. The S&P 500 was flat but still within 1% of its all-time peak as the Israel-Iran ceasefire held firm. Nvidia rose 4.3% to hit a fresh lifetime high, cementing its position as the most valuable company in the world. What a winner!

In company news, Google is rolling out a new AI coding assistant in a move to catch up with rivals including OpenAI's Codex and Anthropic's Claude Code. European defence contractors like Rheinmetall and Thales climbed after NATO members agreed to increase spending to 5% of GDP. Lastly, BP rose on reports that it might be acquired by Shell.

Izolo, the JSE All-share closed down 0.60%, the S&P 500 was literally unchanged, and the Nasdaq was 0.31% higher.

Our 10c worth

One thing, from Paul

The S&P 500 is just a whisker away from its highest ever intraday level of 6 147 points. The stock market seems to like the way that the 12-day war between Israel and Iran was concluded. For now, anyway.

Eddy Elfenbein pointed out that the market usually sells off when war breaks out. In 1950 (75 years ago), North Korea invaded South Korea and the Dow Jones industrial average fell 5%. That was the single worst day for the market between 1937 and 1962.

Iran no longer has the ability to make nuclear weapons, which is good news.

War is a nasty business, for sure, but pre-arranged attacks on evacuated sites, with remote-controlled bombs and missiles seems acceptable to global capital markets.

Byron's beats

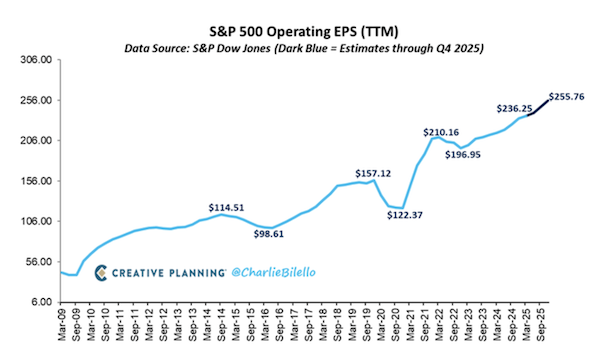

Given all the uncertainty in the world at the moment, it may surprise you that US markets are doing so well. When I'm asked why this is the case I point out that underlying company earnings are at all-time highs and are expected to carry on growing steadily.

Take a look at the graph created by my favourite chartist, Charlie Bilello. The dark blue tip at the end of the wavy line shows the expected growth in earnings up to September 2025. That looks very bullish to me.

The next most important question is what is driving the earnings growth and can it continue? I believe the biggest contributor to this momentum is the AI boom we are experiencing. The Magnificent 7 are leading the charge and their underlying earnings growth is very healthy.

We are still in the early stages of a revolution that will fundamentally change how businesses operate. The market is far more interested in earnings growth than pockets of conflict around the world.

Michael's musings

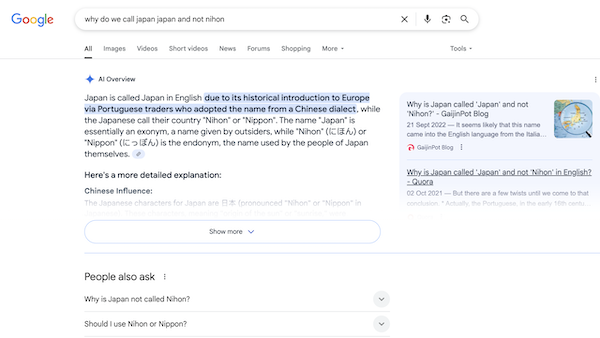

When you need to know something, do you still go to Google or do you use an AI app on your phone instead? If you do go to Google, how often do you click away to a link in the search results? For me, I know that I rarely go past the AI summary presented at the top of the search query.

This change in behaviour to favour AI-generated answers is causing issues for content creators who rely on internet traffic to generate profit. One estimate suggests that traffic to popular sites has decreased by over 50% from three years ago. Ouch.

Lower traffic means lower profits, which has resulted in a number of news websites scaling back their staff numbers, and poorer information output. Unfortunately, this is material that AI bots are using to give us answers.

It appears that the news industry is coming full circle, where paying for quality content will once again be commonplace. Some of the AI companies are already partnering with news outlets to get access to their full archive of content. Recent deals include the New York Times with Amazon, and OpenAI's tie up with the Wall Street Journal (including Barrons and MarketWatch). I wouldn't be surprised to see more transactions like these.

The usefulness of AI is dependent on the quality of the data being fed to them. This is especially important in a world full of fake news.

Bright's banter

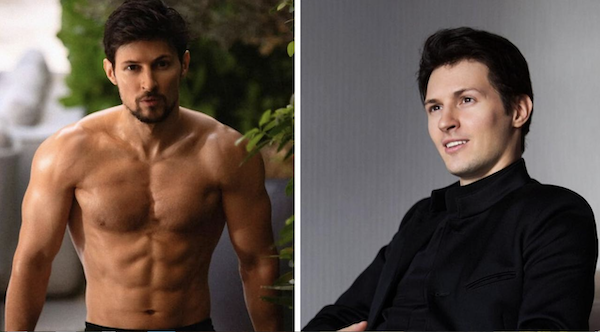

Pavel Durov, the founder of Telegram and one of tech's more eccentric billionaires, just made headlines for something other than encrypted messaging - his will. In a recent interview, Durov revealed that his $13.9 billion estate will one day be split between over 100 children he's biologically fathered, including the six he has raised and at least 100 more conceived through years of sperm bank donations.

Each child could stand to inherit around $132 million, but there's a catch: they'll only get access 30 years from now. He wants them to live normal lives first, to build character.

"I make no difference between my children," Durov said. "They all have the same rights." Whether they were conceived naturally or via anonymous donation, he's treating them equally in the will. The only complication: many of those children might not even know they're related to him.

According to fertility experts, if Durov was a "directed donor," those families may already know. But if he donated anonymously, some of these Gen Alpha heirs could be completely unaware they're set to become multimillionaires, unless they take a paternity test. Their parents will have to decide.

Other billionaires like Bill Gates and Laurene Powell Jobs are not leaving much to their children. Durov, on the other hand, is going full legacy mode, literally and biologically.

Linkfest, lap it up

In today's world it seems everyone is taking shortcuts. But if you want a lasting impact, you have to prioritise integrity over financial gain - You are what you won't do for money.

Some people are worried that AI will make us stupid. To be frank, many other new technologies caused similar concerns when they launched - The Great PowerPoint Panic of 2003.

Signing off

Over in Asia, TSMC's overseas unit plans to issue $10 billion in new stock as it looks to expand chipmaking capacity and navigate a volatile Taiwanese dollar.

In local company news, Nedbank may be looking to exit its Ecobank stake, with top executives now in advanced talks about the group's long-standing investment in Central and West Africa. A sale is on the table, potentially ending a relationship that began in 2008 and saw Nedbank acquire 21% of Ecobank in 2014 for around $500 million.

US equity futures are in the green again pre-market. After the market closes tonight, Nike will report its latest earnings. The company has been struggling lately, so it is important to see a turnaround in the numbers.

The Rand is trading at R17.69 to the US Dollar. It feels like it has been at this level for ages.

Today marks the official halfway point to Christmas. Start planning your roast meat dishes and presents for your family.

Over and out.