Market scorecard

Wall Street continued to move higher yesterday, as Middle East tensions cooled. Trump scolded Israel and Iran for ceasefire breaches, saying "they don't know what the f**k they are doing."

The S&P 500 is now less than 1% off its all-time high, a strong bounce back after those terrible April lows. It's been an eventful year, that's for sure, but the market has shown great resilience.

In company news, Uber is expanding its partnership with Waymo by rolling out driverless rides in Atlanta. Elsewhere, Starbucks pushed back on reports that it's considering a full sale of its China business. Finally, Nektar Therapeutics shareholders scratched an itch; the stock rose 156.3% after strong Phase 2 trial results of a new eczema treatment.

In summary, the JSE All-share closed up 0.80%, the S&P 500 added on another 1.11%, and the Nasdaq shifted 1.43% higher. Hells bells!

Our 10c worth

One thing, from Paul

As a long-term investment adviser, navigating market ups and downs is truly rewarding. Volatility can be caused by elections, wars, pandemics, recessions and company successes and failures. You have to stay up with it all, but mostly, you have to do nothing.

We are all invested in equities personally, so we have skin in the game. We also manage other people's money, so it's even more challenging and exciting.

Hungarian scientist Mihaly Csikszentmihalyi (pictured here) coined the term 'flow state' in 1990 after studying the work of surgeons, painters, dancers, writers, scientists, martial artists, musicians and other creatives.

When professionals are at the top of their game, they enter an all-absorbing state of mind where they feel amazing and are incredibly productive and creative at the same time. I don't want to sound too smug, but I've been feeling that way lately.

If you enjoy volatility, news and drama, then following global stock markets for a full working career can be a delightful experience. Of course, I'm probably only saying this because markets are back around all-time highs.

Byron's beats

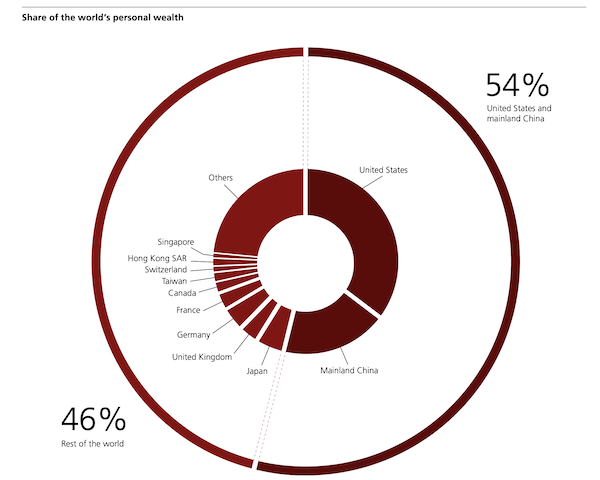

The UBS wealth report, which I wrote about on Monday, contained some other very interesting information. Here is the link if you would like to take a closer look.

The distribution of rich people is uneven. A few high-income nations really punched below their weight, while some lower-income countries had disproportionate levels of wealth. It shows you that there is a big difference between receiving a high salary and owning assets. Getting a corporate to pay you lots of money is nice, but it is how you invest your savings that really makes a difference to your future and that of the next generation. Hopefully Vestact can help you in that regard.

Another interesting stat relates to what UBS call the "Great Wealth Transfer". It is expected that $83 trillion will be inherited over the next 20 years. Because women generally live longer than men, they are expected to benefit more from both inter-spousal inheritance and transfers from parents to children. That's food for thought.

I will leave you with this pie graph from the presentation, which shows you the country shares of global personal wealth. More than half of the total wealth is in the US and China.

Michael's musings

China is in a different league when it comes to renewable power generation. Last month, they installed 93 gigawatts of solar capacity. That is more solar power installed in one month, than any other country installed for the whole of 2024.

To put things further into perspective, Eskom's total installed capacity is around 53 gigawatts. In other words, China added almost two Eskoms to their grid last month.

According to the latest figures released by their National Energy Administration, the nation's total installed capacity of wind and photovoltaic power reached 1.5 terawatts, accounting for 22% of the nation's energy needs last quarter. When you add in other non-fossil energy sources, like nuclear, hydro and thermal, the number jumps to 40%.

Having access to reliable power is key to economic growth, particularly in the AI age. China is making sure that it has the foundations to keep growing.

Bright's banter

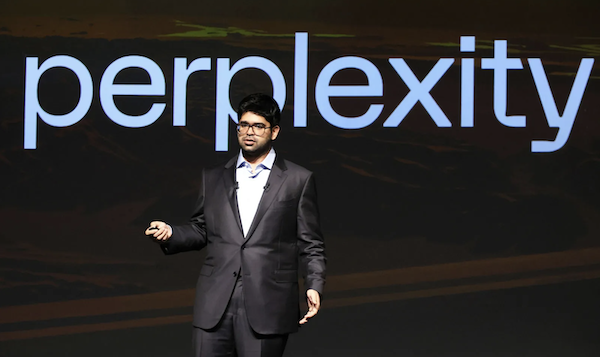

Apple is looking into buying AI search startup Perplexity, as it scrambles to close the gap with rivals in the generative AI race. Senior execs Eddy Cue and Adrian Perica have reportedly held internal talks about acquiring the company, which recently hit a $14 billion valuation after handling 780 million queries in May.

Founded in 2022 by former OpenAI researcher Aravind Srinivas, Perplexity aims to reimagine internet search with conversational AI and real-time citations. It's growing fast and getting sued just as quickly, but it's clearly caught Apple's attention.

A deal this size would be Apple's largest-ever acquisition, far surpassing the current record of $3 billion paid for Beats in 2014. It's a big move for a company known for small, quiet acquisitions, but with Siri delays, underwhelming AI features at WWDC, and a $20 billion search deal with Google facing antitrust pressure, Apple may need to think bigger.

There's also talk of a Perplexity-Samsung partnership, so Apple may need to act fast, either to acquire it outright or bake it into Safari and Siri.

Linkfest, lap it up

AI outputs can be rather unusual. Strange things are going on with their training - Meta's AI model 'memorised' huge chunks of books.

First footage of the elusive Antarctic gonate squid. This creature had only been known from dead specimens found in fishing nets - They've finally seen it alive in the wild.

Signing off

MSCI's Asia-Pacific index rose 0.3% today, adding to yesterday's 2% surge. South Korea's push for developed-market status took a knock as MSCI opted to keep the country in its emerging-market index. It's a setback for Seoul, which has been lobbying for the upgrade to reflect its economic maturity and attract more global capital.

In local company news, Capital Appreciation posted a good set of full-year results, with headline earnings up 25% to R207 million for the year ended March, driven largely by a strong showing from the group's payments division.

US equity futures are marginally higher in pre-market trade. The Rand is rangebound at around R17.75 to the US Dollar.

All the best for the day ahead.