Market scorecard

US markets ended higher yesterday as traders shrugged off Iran's limited retaliatory strike on a US air base in Qatar. The S&P 500 climbed nearly 1%, helped by news that Qatar intercepted the attack with no casualties.

Meanwhile, oil prices dipped, with Brent falling 10% to $69, as Iran and Israel agreed to a ceasefire. The pullback in energy prices also helped cool inflation worries, giving markets some breathing room.

In company news, Tesla shares popped 8.2% after the EV giant finally launched its long-awaited driverless taxi service, offering rides to a select group of users in Texas. Elsewhere, Novo Nordisk pulled the plug on its partnership with Hims & Hers Health less than two months in, accusing the company of using "deceptive marketing" to push knockoff versions of its hit weight-loss drug, Wegovy.

Here's the lowdown, the JSE All-share closed up 0.44%, the S&P 500 rose 0.96%, and the Nasdaq was 0.94% higher.

Our 10c worth

One thing, from Paul

There have been three positive updates from Eli Lilly in recent days. I keep drawing attention to these, because the company's share price has done nothing lately, so I feel the need to spread the good news. Lol.

The first, and most important update was that the oral tablet-form GLP-1 continues to show promising results for weight loss and blood sugar control. That product is called Orforglipron but will surely get a new name once it's finally FDA approved by the end of 2025. In our view, these pills will sell very well, alongside the weekly self-injectable version, Mounjaro, which competes with Novo Nordisk's Ozempic.

The second good update was the news that a new Eli Lilly drug called Bimagrumab, when taken along with Zepbound or Wegovy, significantly reduces the loss of lean muscle mass. Muscle loss is one of the only worrying side effects, particularly in older patients.

Finally, another new Eli Lilly drug called Efsitora has been found to work well for Type 2 diabetics, requiring only a weekly injection. Currently, most diabetes sufferers have to inject themselves daily. That's 300 fewer shots per year.

Eli Lilly shares are going sideways at around $770 per share, about $200 per share away from their all-time high. We are happy to hold, waiting for it to go back there, and then higher still.

Byron's beats

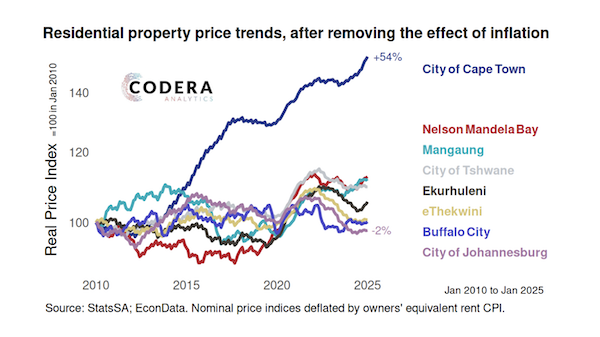

Property price movements in South Africa are a constant conversation around the braai. Codera Analytics put the below graph together to compare the price of properties in cities over the last 15 years. As expected, Cape Town has comfortably outperformed the rest.

I did, however, expect it to have done better - 54% after 15 years isn't great. I have heard a few Joburgers, with ambitions to move to the Cape in a few year's time, suggest that they should buy property there now before it goes even higher. I strongly advise against that idea.

The costs of owning a second property are always more expensive than you think. But most importantly, you lose flexibility. What if your career path moves you somewhere else? Or what if you see the light and realise that Joburg is, in fact, the best city in South Africa?

Rather buy US shares which have comfortably outperformed property in the Cape and when or if you decide to move, you can then sell some shares and take the plunge.

Michael's musings

Yesterday Prosus/ Naspers released their annual results. Usually, the numbers are a non-event because Tencent remains such a significant part of the group's overall value that it doesn't really matter what the other businesses do.

This time it was different. Tencent closed down 0.3% but Prosus popped 3.1%. I can't think of the last time there was such divergence between those two prices. The market really liked the news that Prosus is doubling its dividend, meaning that it is a smidge short of tripling the payout value over three years.

The non-Tencent part of the business is also going in the right direction thanks to management's new focus on sustainable growth. Operating profits have swung from a loss to a profit, free cash flow is up and so too is cash on hand. Prosus also expects to see five Indian IPOs from its portfolio companies this year.

Since the group started its major share repurchase program in 2022, funded by Tencent share sales, Prosus has reduced the shares in issue by 29% and Naspers by 27%. Amazing. The whole process helps to return capital to shareholders and to reduce reliance on Tencent.

We are happy holders of these businesses.

Bright's banter

There are some big moves in basketball, and not just on the court. After shocking the NBA world in February by landing Luka Doncic, the Lakers are now making headlines off the hardwood, with reports that the Buss family is selling the team after more than four decades. Guggenheim's Mark Walter, is expected to drop a cool $10 billion for the team.

That number reflects more than just trophies. It's about brand power, global reach, and a team that now boasts both LeBron and Luka. It also marks one of the biggest franchise sales ever, and continues the recent trend of mega-deals across US sports.

In fact, 6 of the 10 priciest sports franchise deals in history are now NBA teams, with the Boston Celtics going for $6.1 billion earlier this year, the previous NBA record.

Safe to say, other team owners are probably taking a few calls this weekend. But let's be honest, not everyone has Showtime history and Luka magic on the roster.

Linkfest, lap it up

Microbes are everywhere. They have an uncanny ability to survive and thrive in unusual places - Can microbial alchemy save us?

Loadshedding is mostly gone. That hasn't stopped the solar industry from growing - Wetility secures R500 million from Jaltech for expansion.

Signing off

Asian markets opened on a positive note this morning. The upbeat mood followed US President Donald Trump's announcement that a "complete and total ceasefire" between Iran and Israel is expected within hours. That's good news for all.

US equity futures are in the green pre-market. The Rand is trading at around R17.88 to the US Dollar.

It's a tough winters day on the highveld, blue skies and 20 degrees. Have a good one!