Market scorecard

Markets took a deep breath and exhaled. After a jittery Friday, calm returned as tensions between Israel and Iran appeared to cool, at least for now. The S&P 500 bounced back almost 1%, oil prices dipped, and even gold lost some shine as traders shifted back into risk-on mode. Reports that Tehran may be open to reviving nuclear talks helped ease nerves, with investors betting the conflict won't spiral into something bigger.

In company news, Meta is finally cracking open the monetisation vault on WhatsApp, with plans to roll out ads inside the world's most popular messaging app. It's a bold move aimed at unlocking fresh revenue just as the company doubles down on long-term bets like AI. Elsewhere, over in streaming land, Roku and Amazon have teamed up, making it easier for advertisers to reach over 80% of US connected households.

On Friday, the JSE All-share closed down 1.76%, but yesterday the S&P 500 rose 0.94%, and the Nasdaq was 1.52% higher.

Our 10c worth

One thing, from Paul

When I was a child, my friends, siblings and I used to roam about the streets of the suburb where we lived in eastern Pretoria, on foot or on our bicycles, in the afternoons, or in our school holidays.

The Moreleta Spruit was nearby, so we went on all-day fishing and fort-building expeditions on the river. My parents thought this was fine, we just had to be back in time for supper. At some point there was a bilharzia scare, so we had to stay out of the actual water for a few months.

Another rule was not to take candy from strangers. Or get into their cars. In fact, we were told to avoid all dubious characters, and automatically be distrustful of anyone with a bullsh1t story.

These rules have served me well in later life. I'm instinctively dismissive of investment-related scams, Ponzi schemes, turnaround stories, penny stocks, hedge funds, complicated ETFs, structured products, endowment policies, and annuities. I delete and block spam SMS senders and terminate callers from unknown numbers or random call centres.

Byron's beats

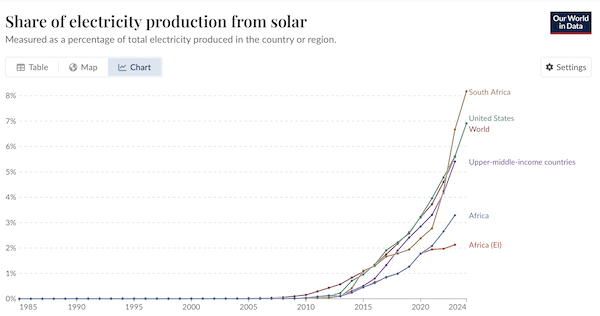

A friend of mine sent this graph to me a few weeks back and I think it's worth a share. South Africa has one of highest percentages of solar production in the world, thanks to Eskom, loadshedding and private enterprise seizing the opportunity.

The scale-up between 2021 and 2024 is quite remarkable. That inflection point coincided with high levels of loadshedding and some technological advancements, so installing solar was both essential and cost-effective.

Due to the consistent supply of electricity from the grid these days, the uptake will probably slow down. But as Eskom increases prices and the cost of solar generation comes down, we should still see growth in the percentage of solar power in sunny South Africa.

Michael's musings

Humans are irrational, probably more so than we would think. One example is cognitive dissonance, where we can hold conflicting ideas in our minds simultaneously.

Most people view their property as a core asset which means having positive equity, and not overcapitalising. Conversely, we all know that cars depreciate, so we don't give much further thought to the value lost over time.

Many people I speak to would never overcapitalise their house by R500 000, but they will happily drive a car that will lose R500 000 in value over the next few years. They are both large-value purchases, where we generally use debt to buy them, but we view them differently.

If you live in Joburg at the moment, it is very easy to overcapitalise. Our property market is dead, and property prices are nowhere near building or replacement costs. If you make improvements to your house, you are unlikely to get that value back.

As for me, I only spend 15 minutes a day in my car and around 15 hours a day at my house. I have overcapitalised my home to make it comfortable, but I'm sticking with my 13-year-old VW Golf. If all goes according to plan, I'll live in my house for the next twenty years, getting the full value from all the upgrades - maybe not financially but definitely from enjoyment. Perhaps I'll be lucky enough to see some property price appreciation during that time as well.

Bright's banter

Chime Financial just made a splashy debut on the Nasdaq, jumping 59% and landing a valuation of $18.4 billion. The stock opened at $43 (above its $27 IPO price) and settled just shy of $40.

Chime makes most of its money from debit card swipe fees and still only serves a tiny sliver of its target US market. CEO Chris Britt is leaning into the underbanked American story, chasing more of the 200 million Americans earning under $100k a year. It provides fee-free mobile banking services, early access to salary payments, negative account balances without overdraft fees, and high-yield savings accounts.

If this rally holds, expect some fintech unicorns to start polishing their prospectuses. Klarna, Cerebras, Gemini and dare I say Stripe, we're looking at you.

Linkfest, lap it up

Humans have eaten molluscs for millennia. But they weren't always viewed as elite treats - The history of snails and oysters.

There is nothing like the Comrades. The vibe along the route is amazing - A Comrades marathon spectator survival guide.

Signing off

Asian markets opened slightly in the red this morning as geopolitical tensions in the Middle East ratcheted up another notch. Iran is reportedly gearing up for what it's calling the "largest and most intense missile attack in history" on Israeli soil. Meanwhile, Israeli Prime Minister Netanyahu poured petrol on the fire, saying that taking out Iran's Supreme Leader wouldn't escalate things, it would end them.

In local company news, Karooooo's founder and CEO Zak Calisto is cashing in some chips to the tune of R1.3 billion. He's offloading 1.5 million shares in a secondary public offering, priced at $50 a pop. It's always interesting when a founder sells a sizable chunk. It could be for diversification, or just buying himself something nice, like an entire suburb.

US equity futures are in the red pre-market. The Rand is holding steady at around R17.81 to the US Dollar.

Have a good (short) week.