Market scorecard

US markets ended higher yesterday, snapping a short losing streak. Fed Chair Jerome Powell reassured investors that the economy remains solid and the central bank won't be rushed into action despite trade tensions. Chipmakers led the gains on news that the Trump administration plans to roll back some Biden-era restrictions on the sector, giving the S&P 500 a lift after two days of declines.

In company news, Uber slipped 2.6% after missing quarterly revenue estimates, with growth in its core ride-hailing business slowing to the weakest pace since the pandemic. Elsewhere, Walt Disney jumped 11% after delivering a bullish outlook that cheered investors. In comparison, Alphabet tumbled 7.5% following Apple's announcement that they are actively looking at redesigning its Safari browser to spotlight AI-driven search. This potential shift could dent Google's dominance on Apple devices.

Here's the lowdown, the JSE All-share closed down 0.58%, the S&P 500 rose 0.43%, and the Nasdaq was 0.27% higher.

Our 10c worth

Byron's beats

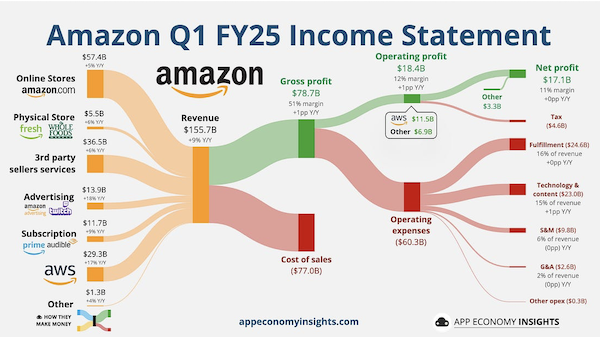

Last week, Amazon released some strong numbers for their first quarter. Revenues grew by 9% thanks to a solid push from AWS (+17%) and advertising (+18%). Online retail sales were up 5%.

As you can see from the Sankey diagram, the net profit column on the top right is not as thick as the other tech giants. That's because a large part of Amazon's business is retail, which naturally has low margins. The upside is that the online retail business allows for all the high-margin advertising and prime subscriptions. AWS was mostly just an incredibly successful side hustle.

Amazon made the news last week because there were rumours that they would specify on their site how much tariffs were increasing the prices of each item for sale. Cheeky. They backed down, but they do talk about it in the earnings guidance for the rest of the year. Thousands of Amazon sellers have already raised their prices, some by as much as 30%. Nothing impacts voters more than their wallets.

According to Synergy Research Group, AWS has a 29% share of the cloud services market. Microsoft Azure has 22% and Google Cloud has 12%. For the quarter, AWS lost 1 point to Azure, remember Microsoft's recent blowout cloud numbers? That's not too concerning, despite the ebbs and flows, all three manage to produce solid growth every quarter.

These were solid numbers from a fantastic company. Amazon is another core Vestact holding and will remain so for many years to come.

One thing, from Paul

I'm currently in Chicago, doing some early-morning remote working, followed by leisurely days of jogging, eating and going to comedy shows, in the company of my youngest (adult) son. We were in New York before coming here.

This kind of travel is dependent on two important services: (1) commercial air travel and (2) comfortable hotels.

On this trip we are flying on United Airlines. I like their direct service between Johannesburg and Newark, although the latter airport has been having some problems lately.

As an aside, did you know that the first scheduled jet airliner passenger service began with a British Overseas Airways Corporation (BOAC) Comet from London to Johannesburg in 1952? They carried 36 passengers.

On this trip we are staying at Four Seasons hotels. They are headquartered in Toronto and ┐their 71% shareholder is Bill Gates' investment company. I always use Booking Holdings to make the reservations. They are the world's largest online travel company, and Nasdaq listed with the share code BKNG. If you like traveling, as I do, consider investing in their shares.

Michael's musings

I was reminded by financial blogger, Morgan Housel, about how only a few decisions have a massive impact on the trajectory of our lives and investment journeys. Warren Buffett and Charlie Munger have also touched on the topic a few times. Many people sweat the small things, but don't pay enough attention to the big decisions.

From a personal finance perspective, the car that you decide to drive and the house you live in (including the area), are generally the biggest influencers of a person's ability to create wealth. For the average person, they spend 50% of their monthly income on housing and transport. So you could decide to skip your morning take-away coffee for a year, and that would be almost meaningless when compared to the choice of car in your garage.

Who you decide to marry and what industry you end up working in, will probably be the biggest influencers of your broader life's trajectory.

Make sure that you spend time thinking about the big decisions. Get those right and you can almost run on autopilot, things will be fine.

Bright's banter

Ferrari fired on all cylinders in the first quarter, with net profits up 17% year-on-year to EUR412 million. Demand for personalised models continues to drive margins higher, helping the luxury carmaker post double-digit growth in all key metrics, despite barely increasing unit shipments.

The company flagged a potential drag on profitability should US import tariffs on EU-made cars go ahead, warning of a possible 0.5% hit to its profits and margins. To cushion the blow, Ferrari plans to raise prices by around 10% on select models, which could add up to $50 000 to the sticker price of some cars.

Still, guidance for 2025 remains upbeat: Ferrari expects revenue above EUR7 billion with profits of at least EUR2.68 billion.

Their long-awaited electric car, the Elettrica, won't break cover until spring 2026, with deliveries penciled in for later that year. Rather than rushing it to market, Ferrari plans to take investors on a "journey of discovery" at its capital markets day, where it will showcase the tech platform behind the EV.

As always with Maranello, pricing power and exclusivity are part of the magic formula.

Linkfest, lap it up

Wrexham has been promoted to EFL Championship. This is one level away from the Premier League - They are the first team to be promoted 3 years in a row.

Tax is a sensitive topic. How big should a government be and how should it be funded? - Correcting the top 10 tax myths.

Signing off

Asian markets opened higher this morning, with the MSCI Asia-Pacific index reversing earlier losses of 0.5%. Optimism around an imminent resolution to tariff disputes helped lift sentiment. Meanwhile, shares of Chinese defence manufacturers surged on the back of renewed tensions along the India-Pakistan border.

In local company news, Datatec is set to deliver a robust set of full-year results, with earnings expected to climb as much as 83%, driven by strong performances from its Westcon and Logicalis units. This is thanks to solid demand in networking, security, and cloud-based services. Elsewhere, Absa's chairperson Sello Moloko has stepped down just three years into the role, citing a desire to focus on his business interests and community commitments.

US equity futures edged higher pre-market. The Rand held steady at around R18.25 to the US Dollar.

Totsiens vir nou.