Market scorecard

After Wednesday's euphoric bounce, markets slipped back yesterday because of the new and laughably high tariffs on US trade with China. Trump seems to think that free trade made Americans poor, when it actually made them rich. To "fix" this "problem" he implemented the one policy idea that almost every economist alive says is bad.

The US imports a lot of basic goods from China: $45 billion in textiles and garments, $19 billion worth of furniture, and a whopping $206 billion worth of electronics and machinery. Doubling the final price of all that is going to be disastrous.

In company news, gold mining stocks climbed. Two companies with South African roots that are listed in New York shone - Harmony Gold rose 10.5% and Gold Fields gained 8.5%. Elsewhere, Disney fell 6.8% and Warner Bros Discovery lost 12.5% after China said it would restrict imports of US films.

In short, the JSE All-share was up 4.31%, but the S&P 500 stumbled by 3.46%, and the Nasdaq drifted 4.31% lower.

Our 10c worth

Byron's beats

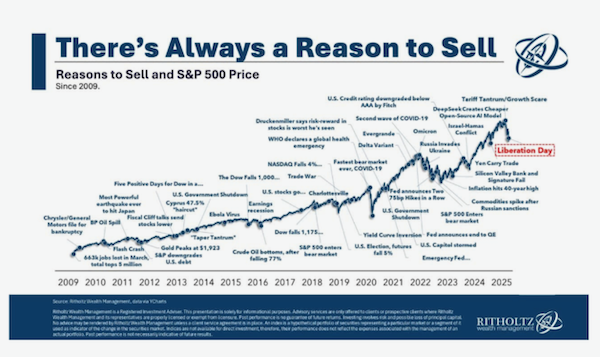

The "There's always a reason to sell" graph has a new notch in its belt - the Trump Tariff Tantrum. I have been in this game for 15 years and this is the fourth market correction (a 20% drop or more) I have seen in my career. I wear those badges with honour, like the boomer portfolio manager that is unfazed because he has seen it all.

Despite Wednesday's eye popping rally, I don't think we are out the woods yet. The trade war with China is just heating up, and of course, the tariffs have only been suspended for 90 days. But that changes nothing. As the graph clearly points out, holding through the dips, while the market generally trends upwards, is the best way to invest.

One thing, from Paul

After a crazy week, it's time for some commentary from me that's not market related. Here goes: being rich will make you feel like earning more money.

If you can afford it, and you haven't done so yet, try flying business class on a long-haul flight. Once you arrive at your destination, stay in a five-star hotel. Rent an electric car. Eat at award-winning restaurants.

When you're flush, you have options, and those options are great, so you'll want to work harder, make more money and do more fun stuff.

This will affect where you live, how you travel, what you eat, what you drive, and the people you'll choose to hang out with.

At some point, instead of seeing luxuries as unnecessary, they become motivators to increase your income so you can afford them effortlessly.

True financial freedom is not about hoarding wealth; it's about using money to enhance your life, open doors, and live large.

Michael's musings

It's Masters week, one of the biggest sporting events of the year. It's a special event because the organisers are not trying to wring every last dollar out of the tournament. The Masters generates revenue of about $150 million a year, but some analysts estimate that they could be making $450 million a year.

For starters, the TV rights are free, which, if sold, would fetch at least $100 million a year. Giving the rights away means that organisers get to dictate terms to broadcasters, who can't air more than 4 minutes of adverts an hour. Watching live action without being bombarded by commercials is amazing. There's also no advertising on the course, which is visually pleasing.

Food prices at the venue are very reasonable. A club sandwich is $3.00, which is cheaper than the Woolies sandwich I had for lunch yesterday! Contrast this to the Vegas F1 race, where almost every open space had a sponsor's logo and the burgers cost over $20 each.

The Masters comes with some cool traditions too. One of them is that you get a chair that you can place next to a tee box or green, leave, and then come back later when the action has reached that hole. No one will take your spot. Amazing!

By not chasing money, The Masters has been able to create the best sporting spectacle in the world.

Bright's banter

Warren Buffett's Berkshire Hathaway has accumulated a record $334.2 billion in cash, marking the tenth straight quarter of hoarding reserves. He also sold down 25% of his Apple position in the third quarter of 2024, just as the stock hit a tough patch due to these nasty tariffs.

Buffett's been building up this war chest for over a decade. He barely budged during COVID, missing the sharpest rally in recent memory. Truth is, he's an old cat these days with no pressure to perform. The man's already won the game.

It will be interesting to see how Berkshire's strategy evolves when Buffett steps away from the company for good. For now, it's a useful safe-haven vehicle, for more conservative investors.

Linkfest, lap it up

Wine was a staple in ancient Troy. Residues have been found on both expensive goblets and common cups - Everyone has always loved boozing.

The grass at Augusta National looks incredible. An extensive network of pipes help with drainage and control airflow - Keeping the roots cool.

Signing off

Asian markets took another knock as Trump's tariff war rolled on, sapping what little risk appetite was left. The MSCI Asia Pacific Index is heading for its third straight week in the red. If you are shipping goods from China to the US this week, good luck and Godspeed.

In local company news, Life Healthcare's latest trading update shows steady progress with earnings per share from continuing operations expected to be up as much as 12.3%.

The Rand is trading at around R19.36 to the US Dollar.

US equity futures are rising in pre-market trade. Who knows why? We don't.

This week feels as if it has gone on forever. Is it too much to ask that not much happens today? Probably.