Market scorecard

Wall Street was very volatile for a fourth day as the tit-for-tat trade war between the US and China kept investors on edge. The S&P 500 gave up a strong 4% gain to close the day down 1.6%. It was the first time since 1978 that it closed down by over 1% after starting with a surge of that scale. Not good.

In company news, Apple exported over $17 billion worth of iPhones from India in the past year, a massive 54% jump from the year before, but 80% of those iconic smartphones are still made in China. Expect that India number to keep rising. Note, they're not moving production to America. Elsewhere, Shopify's putting AI to the test: no new hires unless managers can prove a human beats the bot.

In short, the JSE All-share was up 2.51%, but the S&P 500 dropped 1.57%, and the Nasdaq was 2.15% lower. Rough.

Our 10c worth

One thing, from Paul

The comedian Steven Wright once said "If everything seems to be going well, you have obviously overlooked something."

In hindsight, the market rally from Trump's election last November to mid-February 2025 was premature because it was based on the idea that US companies would enjoy less regulation and lower taxes. With a man like him in the Oval Office, with a history of irregular economic theories, we were cruising for a bruising.

In other words, I was dead wrong about Donald Trump's second term. This is me, writing in the Vestact newsletter on Monday, 18 November: "I doubt that Trump wants to upset the stock market, or do anything that will dent his personal popularity."

It gets worse. I boldly stated: "What if Trump's main goal was to get elected, and then have fun for a while, while playing more golf?"

I'm sorry, I was being terribly naive. He's been the most activist President in recent history. He's turning the world economy upside down, and clearly loving all the attention. Now we are left hoping that he will calm down.

Byron's beats

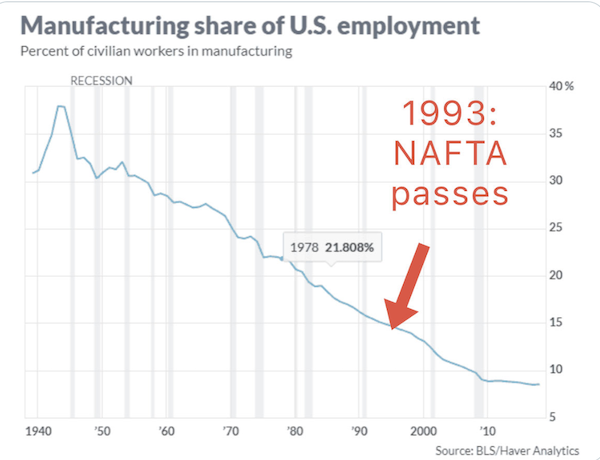

One of the suggestions from the Trump administration is that NAFTA crushed US manufacturing and destroyed industrial cities like Detroit. NAFTA stands for The North American Free Trade Agreement and was signed in 1992 by Canada, Mexico and the US to eliminate tariffs and trade barriers between the countries.

The graph below has been doing the rounds which completely discredits that argument. As you can see, the US manufacturing industry was already tumbling, way before the agreement was signed. This is the natural progression of an economy that is growing and developing, away from manufacturing and towards services. Service jobs are generally more stimulating and pay better.

It's logical to design shoes in America, make them in Asia for $10 and sell them in Europe for $150. American companies make the majority of the money because they own the brand and the IP. It feels ridiculous just explaining it. America is not a victim of this system, in fact they are the biggest beneficiary.

Michael's musings

I remember the excitement around the listing of African Rainbow Capital Investments (ARC) in 2017. It came with a great story and an impressive management team. We only avoided the stock because we felt the management fees were too steep. Buffett likes to call high-fee investment structures: remuneration devices masquerading as an asset class.

The company listed at R8, and the share price went one way from there - down - partly due to those steep management fees. The stock price bottomed out around R2.50 in 2020. Since then, it recovered a bit thanks to investments in Tyme Bank and Rain, and more recently, delisting rumours helped to get it back to the R8 IPO price.

Last month, management offered to buy out existing shareholders for R9.75 per share, which is a premium to the recent share price but a discount to intrinsic net asset value (INAV). The kicker, though, is that management fees are charged based on the intrinsic net asset value. Basically, management is saying that they deserve to be paid fees based on INAV because that is what the assets are worth. But, shareholders shouldn't be paid that amount, because in the real world, the assets aren't worth that.

Interestingly, BDO has given their independent view that the buyout price is 'fair'. That seems like a brave call to me. Anyway, The Finance Ghost has given a nice breakdown of how BDO reached their conclusion - I'm just as surprised as you are.

These sorts of deals give the financial sector a bad reputation; that the small shareholder always comes off second best.

Bright's banter

I recently listened to Malcolm Gladwell's Revisionist History episode, My Little Hundred Million. It is the story of Hank Rowan, a philanthropist who broke the mould by donating $100 million to Glassboro State University (now Rowan University) instead of an Ivy League giant.

That move went against the usual trend, where wealthy donors tend to funnel money into elite institutions that are already overflowing with resources. Rowan, on the other hand, put his money where it could move the needle for students who needed it most.

The episode introduces the concept of "strong link" vs. "weak link" problems. In a strong-link system, like pro basketball, the best player has the biggest impact on the team's success. In a weak-link system, like education, the weakest part determines overall performance, just like a chain is only as strong as its weakest link.

In life, you need to know which scenario needs "strong link" thinking vs "weak link". It's a simple but powerful idea.

In South Africa, weak link areas are abundant. Something small from you can make a disproportionately large positive impact on someone else. More people should take a page from Rowan's book.

Listen to the podcast here.

Linkfest, lap it up

Many employees are disengaged in the office. Sometimes they're working on the wrong thing completely - Musings on productivity and human capital.

Dire Wolves have been extinct for 10 000 years. Thanks to DNA extraction from fossils and edits to the grey wolf genome, they are back - Colossal Biosciences says they are working on a mammoth next.

Signing off

Asian markets had another bad day, down for the fourth time in five sessions. Trump has now hiked tariffs to 104% on all Chinese goods, pouring cold water on any hopes of cooling tensions. Investors are clearly spooked by the idea of a full-blown trade war. China's Premier Li tried to reassure the markets, saying they've got enough policy firepower to cushion the blow, but traders didn't seem convinced.

In local company news, Cashbuild is buying 60% of Allbuildco Holdings for R93 million. The move is part of its strategy to reach a broader range of South African customers across all income levels. The deal includes two stores in Silverlakes and Rayton, near Pretoria.

US equity futures are in the red pre-market. The Rand is trading at around R19.81 to the greenback. Oof, over R20 soon, that will be a first.

Hang in there.