Market scorecard

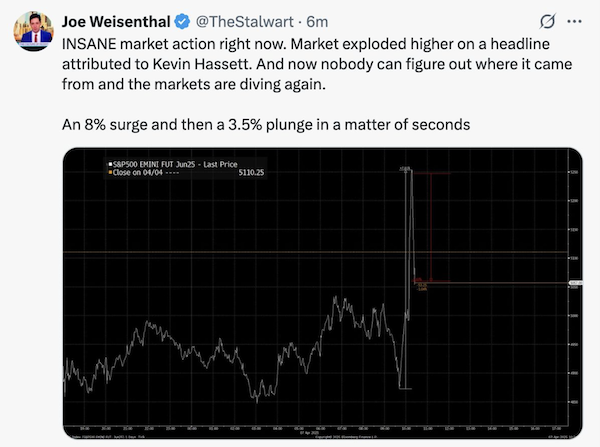

US markets had a wild ride yesterday. A mid-morning Fox News story that tariffs might be delayed for 90 days sparked a sharp intraday rally, with the S&P 500 jumping 8% off its lows, only for those hopes to be dashed when the White House denied that in a post to X. These wild swings are most upsetting, but at least everyone is quite clear what the problem is (Trump) and what the solution might be (also Trump).

In company news, US consumers are scrambling to upgrade their iPhones and other Apple gear ahead of expected price hikes, fearing that the latest round of tariffs will force Apple to pass on the cost. Elsewhere, Microstrategy fell 8.7% after conceding that it has a $5.9 billion unrealized loss due to bitcoin purchases at higher prices.

At the close, the JSE All-share was up 0.75%, the S&P 500 dropped 0.23%, and the Nasdaq was 0.10% higher. That's not too bad, but hold your horses, overnight China said "the US threat to escalate tariffs on China is a mistake on top of a mistake. If the US insists on its own way, China will fight to the end."

Our 10c worth

One thing, from Paul

Trump's people (Lutnick, Navarro, Bessent) keep saying that a short period of market pain must be endured, before good things happen. They suggest that within weeks there will be an explosion in new US manufacturing projects, with lots of new factory jobs. They wax lyrical about the billions of dollars that tariffs will bring in, allowing the Federal government to cut income taxes dramatically. Corporate profits would soar.

If they were right, the stock market would be going up, not down, because it's forward-looking. Instead it's been falling because the consensus view is that these interventions will cause lasting damage. It will remain weak, until they withdraw these dumb ideas.

Byron's beats

It's wild out there, and many clients are sending me clips of smart people trying to explain what is going on. I really have tried to listen to the Trump/Bessent/Lutnick side of the story but it just makes no sense. Some say they are trying to crash the market to push down bond yields. Others point to their desire to bring manufacturing jobs back to America. Neither of those theories hold any water.

If you are following this stuff closely here is some advice. Don't confuse a budget deficit (government spending more than it brings in) with a trade deficit (a country importing more than it exports). A budget deficit can be fixed by less spending and higher income from taxes, preferably through economic growth. A trade deficit is not a problem if your unemployment rate is 4% and GDP per capita is constantly growing. When looking at trade, you also need to consider trade in goods and services, not just goods, which is Trump's current fixation.

Here is great analogy of why a trade deficit is not a bad thing, from a fellow called Spencer Hakimian on X.

"I have a 100% trade deficit with the lady that irons my suits. She offers something way more efficiently and at a much better price than I can do myself. And in exchange, I spend the time I would otherwise be wasting on pressing my suits, offering financial services at 1 000x the hourly GDP rate as I paid her to afford me this time. Am I getting ripped off by her? Should I start steaming my own suits instead of offering financial services?"

This is no laughing matter but I am finding it fascinating to follow. My opinion is that either sense will prevail or these tariffs will be blocked internally by the legal system or by a Republican revolt. Something has to give.

Michael's musings

We are long term investors. A key part of this strategy is to stay fully invested through volatile times. Research shows that only a handful of days account for most of the gains for that year. Put differently, if you are on the sidelines during those few days, you will have some serious underperformance.

Yesterday, just the rumour that Trump would postpone tariffs for 90 days caused the market to jump 8% almost instantly. The rumour ended up being fake, but it shows why it is important to be invested. We are biased, but I don't think it will be too much longer until that rumour becomes real. When that does happen, make sure that you aren't sitting in cash.

In a similar vein, selling now to buy back later when the market bottoms is not a viable strategy. When will the market bottom? There is always a reason to be nervous about stock prices, and it is impossible to know if a market dip will be 2%, 20% or 40%.

I've seen my fair share of market pullbacks. Roughly speaking, the bottom is usually when it feels like the market is about to collapse into a heap. The market usually turns before sentiment does. When the market starts to go higher, the initial positive days feel strange and temporary.

In my experience, when people sell to buy back when the market calms down, they usually end up buying back at a much higher price.

Keep your head down, this too will pass.

Bright's banter

Trump's new tariffs are essentially a tax on global trade, and markets hate it, with good reason. It means higher costs for businesses, weaker global growth, and tighter margins. That's why we've seen the significant market drop last week, with the Nasdaq Composite going into correction territory. The market is pricing in slower growth ahead.

But here's the thing: these headline-driven dips are exactly the kind of noise long-term investors should ignore. The fundamentals haven't changed overnight, just the mood. If anything, this panic is creating bargains across quality companies.

Meanwhile, companies selling must-have items rather than nice-to-haves, tend to ride out these storms best. Think Amgen, Eli Lilly, Amazon, Microsoft etcetera.

If you've got dry powder, now's a great time to put it to work. As always, time in the market is more important than timing the market. Let us know if you'd like to top up.

Linkfest, lap it up

"Minecraft a Movie" opened this weekend. It set the record for a video game adaptation - If you missed the game, consider the motion picture.

Humans are not robots, they have feelings. Listen to and affirm your loved ones - People like being seen and understood.

Signing off

Asian markets bounced back sharply after a brutal selloff, with Japan leading the charge, up over 5.5% on hopes it'll get favourable treatment in upcoming US trade talks. Meanwhile, China and Hong Kong got a lift from state-backed buying and fresh promises of central bank support. Stocks in Taiwan are still in the toilet.

In local company news, Combined Motor Holdings (CMH) put out a trading statement for the year ended February, and it's not pretty. Headline earnings per share are expected to fall by 20% to 30%. They are hoping for a rebound in new car sales, especially from their Foton range.

US equity futures are in the green, for now. The Rand is looking very wobbly at R19.60 to the US Dollar. It seems that our local political problems are now a real cause for concern.

Let's see where markets go today. Keep a smile on your dial.