Market scorecard

US markets ended higher on Friday, with a late-day tech rally driving a rebound. Just five minutes before the close, the S&P 500 erased a 1% drop, finishing in the green. That sort of move is usually the result of short covering before a weekend.

In company news, Boeing gained 3.1% after securing a contract for the next-gen fighter jet supplied to the US Air Force. Elsewhere, Nike slid 5.5% on disappointing forecasts as new management struggles to turn the apparel giant around. Lastly, British Airways' parent company IAG lost 2.9% after a power outage shut down London's Heathrow Airport on Friday.

On Thursday, the JSE All-share was down 0.70%, but on Friday the S&P 500 rose 0.08%, and the Nasdaq was 0.52% higher. It was good to have a sideways week, after three sloppy ones.

Our 10c worth

One thing, from Paul

A friend was asking about Vestact's investment strategy, and posed this question: Do you ever hedge?He also wanted to know if we are always "all in" - fully invested regardless of the gyrations of the market, and the noisy headlines?

The simple answers are "no" (we don't hedge) and "yes" (we are always all in). Here's a little background information to explain my stance.

In 2001 I was the CEO of a JSE-listed stockbroking firm that got wiped out in the dot-com meltdown. Our revenues collapsed, but we had cash in the bank and remained solvent. Our anchor shareholder (Sanlam) wanted out, so we were delisted. That company was called Tradek.

I left and set up Vestact in 2002. The market recovered and started to rise nicely in 2003, so our clients were happy. We focused on stocks on the Johannesburg Stock Exchange. We only launched direct investing in the US market in 2005. We evolved into a managed portfolio business, charging advice fees.

The next great market drop was the so-called Global Financial Crisis of 2008-09. Our portfolios got thrashed, but we counselled clients to hold tight. The S&P 500 bottomed in March 2009 and by October 2010 clients were making new highs.

Wind forward to 2020. The market died again when a global pandemic blew in to town. However, the Covid slump was over almost as soon as it started. The inflation crisis in 2022 was more severe. It also took 18 months to recover from that one.

My point is, staying long does work. You just have to be resilient. There is no point hedging, that's a waste of time and money.

Byron's beats

One of the highlights of the Biznews conference was Adrian Gore's talk. While most other speakers were focused on politics and all the negatives, Gore found some positive trends to talk about. His core point was that the central narrative needs to remain strong. There are minority extremists on the far right and left who make lots of noise but it is the centrist majority that should take lead of this country.

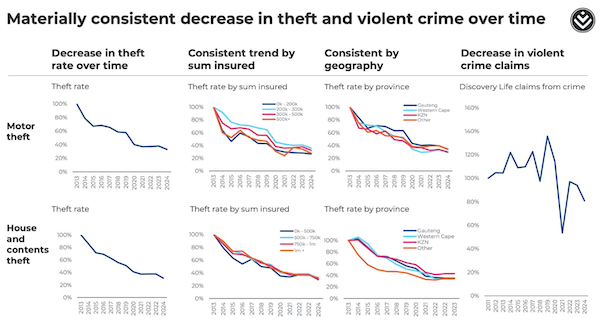

In his presentation, he pointed out that according to Discovery's data, theft and violent crime have come down materially over the last 10 years. If you read the media every day, that good news will be quite shocking. Take a look at the image below which shows those trends. Discovery insures a large portion of the South African middle class, this data is undeniable.

Sadly it probably means that crime is increasing in informal settlements where private security is less effective. But if you live in an established suburb with a strong community that looks after its people, the chances of being touched by violent crime are decreasing. Well done.

Bright's banter

Beijing is stalling approval for BYD's planned Mexico factory, fearing its EV tech could leak to the US. While BYD announced the project in 2023, China's commerce ministry hasn't signed off, prioritising Belt and Road countries instead.

Mexico is shifting its stance on Chinese investments, partly due to US trade pressure, complicating matters. Mexico is balancing relations with Trump, who sees the country as a "backdoor" for Chinese goods and has pushed back with tariffs.

BYD, which sold 40 000 cars in Mexico last year, is doubling down on sales and dealerships, but Mexico's uncertain stance makes building a factory less viable. Meanwhile, BYD's $1 billion Brazil expansion has hit delays over labour violations, adding to its overseas challenges.

Linkfest, lap it up

Video games aren't just fun. They can help improve various cognitive skills like problem-solving, quick thinking, and concentration - Let the kids play outside and online.

Sandton has some historically significant locations. They used to pan for gold in the streams - Not just rich and soulless.

Signing off

Stocks rose in India and mainland China, but the MSCI Asia Pacific index dipped as benchmarks in Hong Kong, Japan, South Korea, and Taiwan declined.

In local company news, Investec is expecting a significant boost in its adjusted operating profit, with an estimated increase of up to 12% to GBP1.076 billion for the year ending March. The growth has been driven by client acquisition, deposit inflows, and higher average advances.

There is talk that the next round of US tariffs due April 2 is poised to be more targeted than the sprawling effort Trump has been waffling about, so US equity futures are moving higher in early pre-market trade.

The Rand has been rock solid at around R18.16 to the US Dollar lately.

Have a prosperous week.