Market scorecard

US markets closed in the green after the Federal Reserve reaffirmed its outlook for rate cuts this year, downplaying inflation risks from tariffs. They did not cut rates at this meeting, but the tone of their statement was dovish. Well done to Jay Powell and his colleagues.

In company news, Boeing's share price jumped 6.8% after its CFO reassured investors that its business turnaround is on track. Elsewhere, Vitol is set to acquire stakes in West African oil and gas assets from Italy's Eni. Finally, Intel's five-day winning streak ended but its stock price has picked itself off the floor after the appointment of a new CEO.

At the closing bell, the JSE All-share was up 1.41%, the S&P 500 rose 1.08%, and the Nasdaq was 1.41% higher. Solid!

Our 10c worth

One thing, from Paul

Are we being foolish to stick with US stocks in the face of the current political instability there?

Global fund managers are selling shares in US-listed tech giants and using the proceeds to buy European defence contractors. That's the "hot trade" right now. One might say they are shooting first and thinking later.

Bank of America has just recorded the biggest single drop in allocations to US stocks on record in its monthly survey of fund manager flows. It's been an astonishing shift, unprecedented in the data series that goes back to 2001. Investors went from being overweight US equities in February (net +17%) to heavily underweight in March (net -23%).

We've always preferred US companies. They are more innovative, more profitable and generally more shareholder-friendly. The US legal system protects them from capricious regulations. Well, mostly, if not lately. As a result, they trade on higher multiples to their expected earnings.

US politics will settle down again soon. Trump's MAGA movement is having a fine time now, but the wheel will turn, and US liberals will probably find a way to return to power.

We will stay put. That's our game, ignoring short-term noise and accumulating shares in quality companies.

Byron's beats

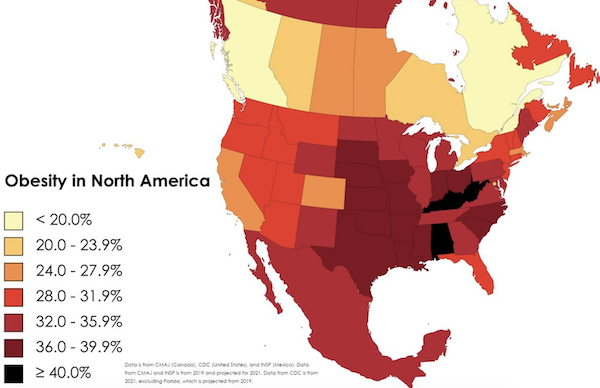

As you well know, we are big fans of Eli Lilly and their weight-loss drugs. I was astounded to see this map showing the obesity levels per state in America.

The vast majority of states have levels of 30% or above. Some in the mid-west are above 40%. I really do believe that use of these weight-loss drugs is going to skyrocket, resulting in some serious behavioural shifts.

Healthcare costs are going to go down and food consumption patterns are going to change drastically. I certainly wouldn't want to be invested in any snack food maker or fast food chain right now.

Michael's musings

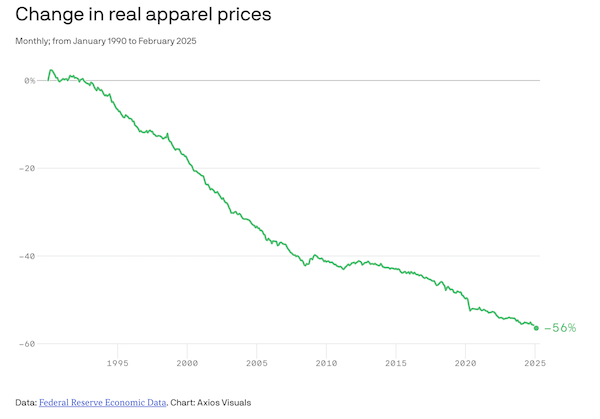

I was very interested to see that the price of clothing in the US has dropped by 56% over the last 35 years. The rest of the world won't have experienced the same reduction, but the trend will be similar. Lower garment prices are due to specialisation, mass production, technological improvements and imports from lower-cost nations.

Some might argue that moving jobs from the US to Asia is a problem, I'm not so sure. Working in an Asian garment factory isn't a great job, and for a rich country like the US, they would want something better for their citizens.

Here in South Africa there has also been a loss of garment manufacturing jobs. That's been awful, because we desperately need them.

A big advantage of cheaper clothes is that people now have more money to spend elsewhere. For example, shoppers can now go to Pep to buy clothes and have funds left over to get a Spur burger on the way out of the mall.

Cheaper clothes are often lower quality. Fast fashion is on the rise, and customers may buy an outfit that they only wear for one season and then throw it away. It would be better for the planet, and wallets, if customers spent more on better quality items that could last for many years.

The price drop reflected in the graph below can be observed for many other products. It is one of the reasons why the globe's average standard of living is consistently on the rise - people's incomes can go further.

Bright's banter

Leonardo is making a big push into space, planning to launch nearly 40 satellites by 2028 to support both military and civilian needs. The EUR1.35 billion project, partly funded by Italy's Ministry of Defence, aims to offer Europe an alternative to Starlink.

The company also raised its targets, expecting EUR18.6 billion in revenue and EUR1.66 billion in profits by 2025, with orders growing to EUR26.2 billion. European defence budgets are set to rise, Leonardo is preparing to scale up production and has lined up a partner to turn around its struggling Aerostructures unit.

Every time Elon Musk gets sidetracked, whether it's by politics or social media spats, competitors quietly eat into his market share. Tesla loses ground to BYD, X drives users to alternative platforms, and even SpaceX faces growing competition. His influence is undeniable, but focus matters.

Linkfest, lap it up

Self-made people are inspiring. Even though the Forbes list is dominated by men, women are making their mark too - America's richest self-made women.

Global GDP is expected to grow at 3.2% this year. South Africa, with all its potential, is bumbling along at below 1% - The world's fastest-growing economies in 2025.

Signing off

Asian markets gained momentum after Wall Street's rally, with the MSCI Asia-Pacific index hitting its highest level since November.

Elsewhere, Turkish assets tumbled as police detained Istanbul's mayor, Ekrem Imamoglu, a key rival to President Erdogan. The lira dropped over 3% against the dollar, while the Borsa Istanbul 100 index plunged more than 9%. It's a reminder that we are lucky to have transitioned to the GNU without any strongman tactics from the ANC. Erdogan is a disgrace.

In local company news, Resilient delivered good results for 2024 and declared an 8.4% increase in their dividend. Earnings available for distribution rose, driven by cost savings from its energy strategy and offshore investments.

US equity futures are up nicely pre-market. The Rand is trading at around R18.09 to the US Dollar.

Nike will report after the market closes tonight. Hopefully, the new management team will report some market-beating numbers.

If you are in South Africa, have a good long weekend.