Market scorecard

US markets ended lower yesterday, spoiling a two-day rebound, as hotter-than-expected import price data weighed on sentiment. Big tech bore the brunt of the downturn, with Nvidia dropping 3.4% despite unveiling plans to extend its AI dominance into robotics and desktop systems with next-generation Vera Rubin chips. They are named after the astronomer who pioneered work on galaxy rotation rates and dark matter.

In company news, Apple lost its appeal at Germany's top civil court, meaning it will remain under stricter antitrust oversight alongside other major US tech firms. Elsewhere, coal miner Peabody Energy gained 6.1% after Trump said that he's "authorizing my Administration to immediately begin producing Energy with BEAUTIFUL, CLEAN COAL. " Lol.

In short, the JSE All-share was up 0.42%, but the S&P 500 fell 1.07%, and the Nasdaq sagged by 1.71%. Shame, that's not good.

Our 10c worth

One thing, from Paul

Here at Vestact we work hard to identify the best stocks for future growth and persuade our clients to buy them. We also own them in our own portfolios.

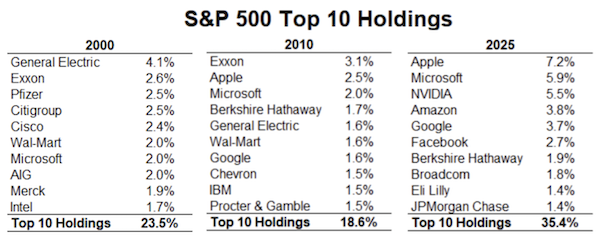

As it happens, we did a very good job of finding the companies that went on to become the top 10 constituents of the S&P 500 in 2025. We own 7 of them in our model portfolios, all bought early on, in the years from 2007 to 2023.

If you look back at the top 10 in 2000 only one company is still on the list now - Microsoft. Looking at 2010 there are two that have survived - Microsoft and Apple. All the others have slipped out of this elite group. Most are still in business, but they've lost prominence.

What are the odds that we will be as successful in the next decade? We will need to hold some, trim some, and buy some others that are probably just outside of the top 10 now. Rest assured; we are laser-focused on that task!

Byron's beats

Amazon and Microsoft are the big powerhouses in cloud services. Google is a distant third but has been pushing hard to grow the business with good success. Fortunately the demand side of the equation for cloud services is very strong.

To be a serious player in this space you need make sure that the service comes with strong security features. This is why Google is buying Wiz, a company which specialises in cloud security, for a whopping $33 billion. This will be Google's biggest deal ever, by some margin.

Kudos to Wiz's management team and board who rejected a $23 billion offer from Google last year July, saying that they wanted to stay independent. I suppose everyone has a price!

Wiz was started by 4 Israelis (pictured) based in New York in 2020. Wow it is a young business! They already have 1 200 employees, focusing on systems that scan computing infrastructure for risk factors that could allow hackers gaps to gain control or steal data. Clearly their platform is good enough to convince Google to part with $32 billion. Well done to them.

Michael's musings

The world is getting smaller, and as a result, competition has become global. Many companies are no longer competing with the store down the road, but with players all over the world. Think of what Shein and Temu have done to local clothing retailers. Added to that, you no longer need to live in the country that you work.

A more connected world means that South Africa needs to play to its strengths if it wants to see any meaningful economic growth. For example, our maths and science scores are terrible, so trying to build an economy centred on the 4th industrial revolution would fail. Many other countries are much better suited to providing the skills needed.

South Africa's competitive advantage is tourism. Our weather is amazing, our country is diverse, our history is interesting and we have great people. It's also a labour-intensive industry, adding much needed jobs to the economy. You don't need a good maths mark to offer quality service with a smile.

I stumbled across this Daily Maverick article from 2023 - The many ways golf drives socio-economic benefits in SA. It highlights that golf tourists spend 120% more than leisure travellers. Our golf courses are amazing, it's no wonder people fly here to play. It seems like low-hanging fruit for the government to promote tourism, particularly golf tourism.

Bright's banter

Ferrari closed out 2024 with strong results, reporting a 21% jump in net profit thanks to a solid product mix and rising demand for customisation. Revenue rose 12% to EUR6.7 billion, while profits shot up to EUR2.5 billion.

Ferrari is seeing a surge in younger buyers, with 40% of new customers now under 40, up from 30% just 18 months ago. The post-Covid YOLO mentality is still going strong it seems. The brand continues to balance exclusivity with demand, sticking to its strategy of limited production despite long wait times. Sounds like the Hermes business model.

Shares surged around 8% when Ferrari reaffirmed its 2025 outlook, expecting revenues to top EUR7 billion and core earnings to grow at least 5%. Ferrari CEO Benedetto Vigna downplayed concerns over US tariffs, but he may be changing his mind after the champagne tariffs were announced last week.

Ferrari is gearing up for a major milestone with the launch of its first fully electric car on the 9th of October, one of six new models planned for this year, marking a new chapter alongside its traditional combustion and hybrid models.

Linkfest, lap it up

Google is spinning off one of its moon-shot businesses. Taara uses towers and lasers to transmit 20 gigs of data a second - Alphabet to keep minority shareholding in Starlink competitor.

Shakespeare's "Othello" is raking in big bucks on Broadway. Starring Denzel Washington & Jake Gyllenhaal, the play is sold out - Highest grossing week in history.

Signing off

In Asia, Grab Holdings is pushing ahead with its bid to acquire GoTo Group, with sources saying the Singapore-based ride-hailing and delivery firm has started due diligence on its Indonesian competitor.

In local company news, African Rainbow Capital Investments (ARC), known for its stakes in Rain, TymeBank and Alexforbes, announced plans to delist from the JSE. Investors are being offered R9.75 per share in cash, with the stock closing 6.5% higher on the news. The only people who made money here were the management team, as the shares have performed poorly.

US equity futures have edged up in early pre-market trade. The Rand is at R18.13 to the greenback.

The Fed will announce its interest rate decision tonight at the conclusion of its latest meeting. Not many analysts expect a cut, so if we get one it will be a nice surprise.

Have a good Wednesday.