Market scorecard

US markets rose for a second day, with industrial and energy shares firming. Monthly retail sales data, though mixed, reassured investors that consumer spending isn't collapsing. Over 90% of S&P 500 companies gained, with Intel, GE Vernova, and Domino's Pizza among the standouts. Trump is busy with deportations and Putin, so tariff concerns might take the back seat for a few days, allowing equities to bounce back from oversold levels.

In company news, Berkshire Hathaway increased its stakes in five of Japan's biggest trading houses, including Sumitomo, Mitsubishi, and Mitsui, to an average holding of about 9.3%. Elsewhere, PepsiCo is acquiring prebiotic soda brand Poppi for $1.95 billion, betting on the growing demand for gut-friendly beverages as traditional sugary drink sales stagnate. Sounds good, don't you think?

At the close, the JSE All-share was up 0.69%, the S&P 500 rose 0.64%, and the Nasdaq was 0.31% higher. A decent day, we will take it.

Our 10c worth

One thing, from Paul

Blackwell is old news, stand by for headlines about Rubin. I'm talking about AI chips from Nvidia. They've only just started shipping the former in a big way, and are already revealing details about the latter.

Nvidia's annual developers conference kicked off yesterday in San Jose, California. It's called the "AI Woodstock" and will have 25 000 in-person attendees.

Nvidia CEO Jensen Huang will launch a souped-up version called Blackwell Ultra at his keynote address later today. But the real interest is in the news about the next generation of AI chips called Rubin. They are expected to show very impressive performance improvements over Blackwell. Keep in mind that Blackwell provided 30 times faster performance than the company's previous generation on AI inferencing.

According to an article I read in the Wall Street Journal, Nvidia's data-centre business will hit about $237 billion in revenue in 2026, and then keep climbing by 30% per year over the next four years. And that's after catapulting by more than seven times over the last two.

This exciting scenario requires that Nvidia's biggest customers, Amazon, Google, Microsoft and Meta keep barrelling ahead with capex spending. To do that they'll have to see meaningful demand from consumers and businesses for premium generative AI services.

Byron's beats

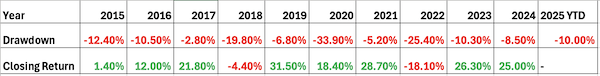

Paul has mentioned to a few concerned clients recently that 10% drawdowns are not unusual and happen every 18 months or so. Let's take a look at the biggest drawdowns for each year going back 10 years in the table below.

Out of the last decade, 6 years experienced drawdowns of 10% or more. Only 3 of them went on to drop more drastically. The fall in 2020 was due to Covid and we recovered all of the losses and more in a few months. Only 2 out of the 10 years closed in the negative.

I like to put these stats out there because we always have new clients who have not lived through these prior events and they are understandably anxious.

We have been through it all, many times, and I hope this historical data helps explain why we are able to remain so calm.

Michael's musings

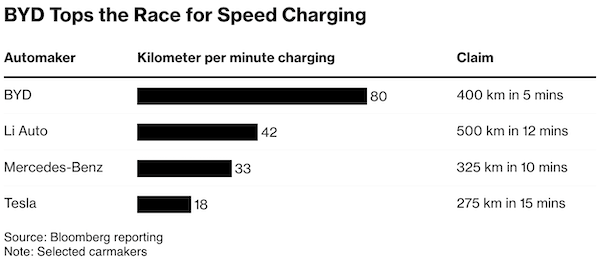

Yesterday, Chinese EV-maker BYD announced a revolutionary charging technology which will allow their newer cars to charge in 5 minutes. This huge upgrade gives them a big lead over rivals and puts them on par with internal combustion engines. All of a sudden, a cross-country journey isn't an issue.

The new technology offers charging power of up to 1 000 kW, twice as fast as Tesla's superchargers, whose latest version offers up to 500 kW of power transfer. For comparison, Tesla's supercharger can add around 275km in range with a 15-minute charge. BYD is giving you 400km with a 5-minute charge - less time than a toilet break.

The technology requires a special battery, which means it won't be available in old BYD cars. I also imagine that the electrical infrastructure supplying BYD's new charging stations will need massive upgrades. A household electrical connection pulls at most around 65 amps (15kW at 230 volts) from your Eskom or CoJ pole outside. A Tesla supercharger needs a 3-phase connection, pulling around 190 amps per phase. BYD will need significantly more than that to put 400 km of charge into a battery in only a few minutes.

It is great to see the rapid speed of technological advances in battery and EV capabilities.

Bright's banter

Foxconn, the world's largest contract electronics maker, has unveiled FoxBrain, its own large language model (LLM) with advanced reasoning capabilities. Developed in-house and trained in just four weeks, the AI is currently designed for internal use, handling tasks like data analysis, mathematics, reasoning, and code generation.

The model was trained using 120 Nvidia H100 GPUs, with Nvidia providing both hardware and technical support. FoxBrain is based on Meta's Llama 3.1 and is optimised for traditional Chinese consumers. While slightly behind China's DeepSeek models, Foxconn says it is approaching world-class performance.

Foxconn plans to open-source FoxBrain for industry collaborations and sees it driving advancements in manufacturing and supply chain management. More details will be shared at Nvidia's annual tech event this week.

With electronics manufacturing facing headwinds, Foxconn is actively diversifying into AI and electric vehicles to future-proof its business.

Linkfest, lap it up

A 19-year-old former US government intern is doing the unthinkable. He's an advisor to Elon Musk's DOGE unit - Powerful friends.

A jury in California awarded $50 million for burn wounds. A delivery driver sued Starbucks after a hot tea landed in his lap as he was collecting an order - Starbucks will appeal the decision.

Signing off

Asian markets rose for a third straight day in a row. Hong Kong's market jumped 2%, with BYD hitting a record high after unveiling the new EV charging system mentioned above.

In local company news, MTN Group's performance took a hit, with a 68.9% decline in headline earnings per share. However, profits rose 10.2% in constant currency. On the plus side, data revenue grew 21.9%, and fintech revenue rose 28.5%.

US equity futures are slightly lower in early pre-market trade. The Rand is looking perky at R18.10 to the US Dollar. The gold price is at a record high of $3 005 an ounce.

The US Fed starts its rate setting meeting today, with the outcome announced tomorrow. There is a slender chance of a rate cut, we shall see.

All the best.