Market scorecard

US stocks bounced back on Friday, trimming their losses as fears of a government shutdown eased and no new trade war surprises emerged. Tech stocks led the rebound, with the Nasdaq jumping 2.6% on Friday, narrowing its weekly drop to 2.4%. The S&P 500 gained 2.1% for the day, ending the week down 2.3%. Yikes, it's still a sh1tshow out there.

In company news, consumer-driven names have struggled in recent weeks, with airlines like Delta and United, casino giant Caesars, Live Nation, Expedia, and Ralph Lauren all dropping at least 23% from their recent peak. Elsewhere, Peloton rose by 16.1% after analysts at Canaccord Genuity said the stationary bike company has reached "a turning point." That makes no sense, lol.

On Friday, the JSE All-share was up 0.97%, the S&P 500 rose 2.13%, and the Nasdaq was 2.61% higher. Splendid. We need more days like that.

Our 10c worth

One thing, from Paul

The stock market doesn't care about being politically correct, or kowtowing to the powers that be. It's real people with real money making bets on the outlook for earnings growth, stability, liquidity, inflation, taxation and the rule of law.

The stock market is telling the Trump administration that it does not like tariffs. The consensus has shifted from enthusiasm in December and January to deep concerns about Trump's mercantilist tendencies. Economic sentiment has soured, consumer confidence has taken a tumble and fears about inflation are back.

The S&P 500 has fallen 10% in just 16 trading days. We went from all-time highs on February 19 and everyone feeling marvellous, to doom and gloom.

Humans have a natural urge to try to understand the world around them. That's fine, but it's a problem to assume that your fresh new theory about the world must be applied to your investments, right away. The problem is that the context around us keeps changing, so we assume that means we must keep altering our investments.

Don't do that. Relax, and avoid arriving at deep conclusions in a hurry. Don't overthink things. Keep in mind that our strategy will stay the same: to accumulate shares in quality companies and hold them, on the assumption that everything will be ok in the end.

The current drop is quite normal. We usually get a 10-20% fall every 18 months or so. Perhaps you forgot the last one?

Byron's beats

There has been a lot of rain on the South African Highveld over the last few months. This is not great for Saturday afternoon braais but very good for our dam levels. If that kind of thing interests you, like it does me, take a look at this interactive map provided by the Outsider which looks at every major dam in the country and tells you how full it is.

The South African Dam Dashboard was created by Johan Hanekom and incorporates weekly updates from the national Department of Water and Sanitation.

All the dark blue dots in the North Eastern side of the country shows that we've had a good season and should be well prepared for winter. Whether the municipalities can actually provide that water to the households is another challenge altogether.

Michael's musings

Some employees work shifts, but many are knowledge workers, meaning they are paid to get a job done, not for the number of hours they put in. For example, a shop assistant needs to be at the till for a specific number of hours to ensure customers can pay for their items. Conversely, a logistics analyst should be less concerned about fixed working hours, because their job is simply to optimise the items that go onto a fleet of trucks.

Productivity software company ActivTrak, who followed over 200 000 employees across 777 companies, say that the average workday is ending 42 minutes earlier than it was two years ago. People are leaving work at 4:39, compared to 5:21 in 2022. Even though people are leaving work earlier, they are working longer work weeks.

More people are logging a few work hours on weekends and evenings. The theory is that the rise of flexible work hours has made more employees comfortable with working outside of traditional work hours. Increased flexibility and higher productivity, it sounds like this is a win for everyone.

Bright's banter

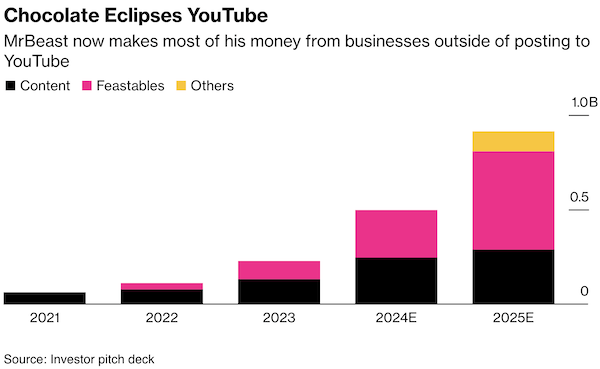

MrBeast's business empire is pivoting to profitability, but not from where you would assume. His chocolate brand, Feastables, is raking in the dough, with $250 million in sales and $20 million in profit last year. That's outpacing his media business, which posted similar revenue but lost $80 million.

Beast Industries has secured $450 million in funding. The company is investing in various ventures, from snacks (Lunchly) to software (Viewstats), with gaming, beverages, and wellness plays on the horizon.

Valued at $5 billion after a $300 million funding round led by Alpha Wave, Beast Industries is gunning for profitability by 2026. New CEO Jeffrey Housen is tasked with slashing $100 million in costs and driving $300 million in earnings.

As MrBeast's media empire takes a backseat, his consumer products business is taking center stage. With fans converting to customers at scale, it seems that MrBeast's future fortunes lie in selling physical products.

Linkfest, lap it up

Anora cleaned up at the Oscars. The movie took $6 million to make and only made $46 million in worldwide sales - The lowest-grossing Best Picture winner in history.

Manchester United is having a tough time on the field. They've cut jobs and hiked ticket prices - Man-U reveals plans for the 'world's greatest' soccer stadium.

Signing off

Asian markets got a boost from stronger Chinese consumer spending numbers, with benchmarks rising across the region.

In local company news, Outsurance's half-year results looked good, with a 52.9% boost in earnings to R2.16 billion. Strong premium growth, lower claims, and higher investment income all contributed to the uptick.

US equity futures are down slightly in early pre-market trade. The Rand is exchanging hands at R18.20 to the US Dollar.

Have a productive week. It's a short one in South Africa, with a public holiday coming up on Friday.