Market scorecard

US markets bounced back yesterday after February inflation numbers came in lower than expected. Big tech stocks rallied hard with Tesla (+7.6%), Nvidia (+6.4%), Oracle (+4.7%), Meta (+2.3%), Broadcom (+2.2%), and Google (+1.8%) leading the way. That's nice, but the Nasdaq remains over 12% below its all-time high.

In company news, Scopely, backed by Saudi's Savvy, is buying Niantic's gaming division, including the popular augmented-reality game Pokemon Go for $3.5 billion. Elsewhere, Adobe dropped 4% in late trading after issuing a weaker-than-expected revenue growth forecast for the current quarter. Finally, Roche climbed 4% because the Swiss pharma company made a bid for Danish weight-loss drug maker Zealand Pharma, which soared 41.1%. Novo Nordisk fell 4.25% on the news.

At the end of the day, the JSE All-share was down 0.27%, but the S&P 500 rose 0.49%, and the Nasdaq was 1.22% higher. Ok then. We are hopeful, but no one really knows what is going on.

Our 10c worth

One thing, from Paul

Despite all the drama in the news, humanity is making steady progress. Each new generation is better off than the last. If you think things were better 50 years ago, that's just old age and nostalgia talking. Sorry, but facts are facts.

In general, there is less poverty, and humans are living longer, more comfortable lives. Technology is advancing, most people are online on mobile phones and getting smarter. We are exercising more and eating healthier foods.

You want evidence? How about this story that I picked up in a Bloomberg newsletter last week.

At a two-day summit in Manila last week, the World Instant Noodles Association unveiled guidelines to make their products healthier and better for the environment.

Invented in Japan by Momofuku Ando in 1958, instant noodles provide a cheap source of carbohydrates to the masses, mostly in Asia. Consumers get through around 120 billion servings a year. The world's biggest manufacturers are Japan's Nissin Foods, Nestle India, Indonesia's Indofood and the Philippines' Monde Nissin. They were all present at the Manila meeting.

Instant noodles used to be blamed for high-sodium content and unhealthy fats, and their lack of dietary fibre. Manufacturers are responding with recipe tweaks and packaging changes.

Michael's musings

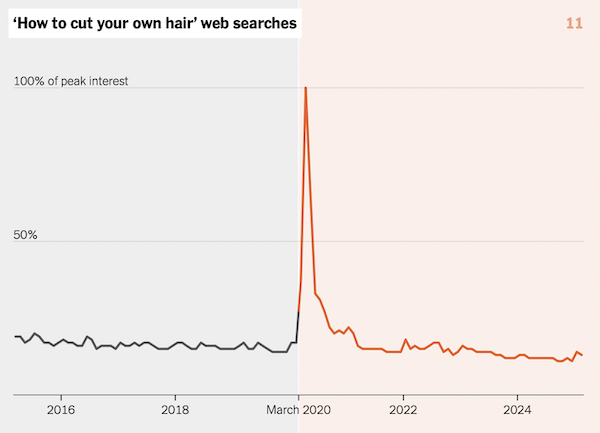

The New York Times compiled 30 charts which show how Covid impacted society. In most cases, life has returned to normal and is on a similar trendline to before 2020.

There are some rather sad, longer-lasting changes though. Time spent at home has more than doubled post-Covid. Surprisingly, the number of hours watching TV is below 2019 levels. I would assume that more time at home would mean more TV, but the data says otherwise. Are people still baking their own bread? Maybe it's TikTok?

Being at home isn't in itself a bad thing, but time spent socialising with others has also plunged and is only slightly better than it was during the pandemic.

Remember those sad lockdown days when a "social gathering" was meeting your friends on a Zoom call? That was grim.

Bright's banter

Is now the time to buy European defence stocks? Germany-based Thyssenkrupp is in a unique spot. If a Ukraine-Russia ceasefire holds and reconstruction begins, they benefit as a key supplier of infrastructure materials. If the war drags on, their Marine Systems division stands to gain.

Thyssenkrupp shares surged 20%, their biggest jump in over four years, after announcing plans to take its submarine-making unit, Marine Systems, public. This is the same business that made U-boats during World War II. The move comes as Europe boosts defense spending, with NATO relying heavily on the unit's non-nuclear subs.

An IPO could attract new investors previously restricted by ESG rules, and analysts say Marine Systems could be worth half of Thyssenkrupp's market cap if valued as a defense business rather than a steelmaker.

The listing, expected in late 2025 or early 2026, follows failed talks to sell the business to private equity giant Carlyle. The German government is considering taking a 50% stake, while Italy's Fincantieri has shown interest in a partnership.

We are not motivated to invest in the defence sector given its lumpy earnings. Government spending on war is very hard to anticipate.

Linkfest, lap it up

Is God a mushroom? New research into the role of psychedelics upends our understanding of spirituality - Tripping leads to deep visions of the cosmos.

The Tesla Model Y was the world's best-selling car last year. With increasing competition from Chinese cars, they probably won't do it again in 2025 - Most-sold vehicles of 2024.

Signing off

Asian markets are mostly flat this morning as investors took a breather after two weeks of volatility. The MSCI Asia-Pacific index hovered around break-even, with China, Hong Kong, South Korea, and Taiwan seeing some swings, while India and Japan posted modest gains.

In local company news, Growthpoint Properties delivered good results, with distributable income up 4.3% to R2.5 billion on revenue of R6.9 billion for the six months to December. The boost came from stronger occupancy levels in key South African assets like the V&A Waterfront. Thanks Cape Town.

US equity futures traded lower pre-market. The Rand is trading at around R18.35 to the greenback. It's been at around this level for the last five years. Make of that what you will.

Enjoy yourself, wherever you are. Count your blessings.