Market scorecard

US markets ended slightly lower last night, as the Trump administration rolled out fresh 25% tariffs on all steel and aluminium imports. The S&P 500 logged its worst two-day drop since August. However, a rebound in Nvidia, Broadcom, Meta, and Tesla helped pare some losses in the tech sector.

Tensions flared between the US and Canada, with Trump threatening to double tariffs on Canadian metals to 50% in response to Ontario's 25% export tax on electricity. White House spokespeople continued to talk rubbish about adding a 51st state. By the afternoon, Ontario Premier Doug Ford and US Commerce Secretary Howard Lutnick reached an agreement to scrap the electricity surcharge in exchange for a relaxation of steel and aluminium tariffs. This sounds more like a playground fight than the discipline needed to run global economies.

In company news, Kohl's shares tumbled 24% after the department-store chain forecast a bigger-than-expected sales decline for fiscal 2025, citing a slowdown in household spending. The biggest gainer in the S&P 500 was AI server maker Super Micro Computer (+10.7%), which has been extraordinarily volatile recently due to some management challenges.

In summary, the JSE All-share was down 0.22%, the S&P 500 fell 0.76%, and the Nasdaq was 0.18% lower. Not great.

Our 10c worth

One thing, from Paul

What's a family office? These are typically small companies set up to manage a rich family's investments, business and legal affairs. Some look after the family's philanthropy too, run their many properties, and render "lifestyle services" like taking the owner's dogs to the vet.

Family offices are usually staffed by well-paid lawyers, private bankers or former asset managers, but sometimes it's just someone that the founder took a shine to. There was a court case recently where an Australian man living in Monaco sent his yoga instructor to establish a family office outpost in London, then sponsored her to engage in pointless litigation against British Airways.

Deloitte estimates that, globally, there will be 11 000 family offices by 2030, with total assets of $5.4 trillion. This is more than the entire hedge fund industry currently manages.

If you are rich enough to be having thoughts about setting up a family office, congratulations! Don't hire idiots, and try to keep the costs down. Don't be lazy, keep doing the key stuff yourself.

Michael's musings

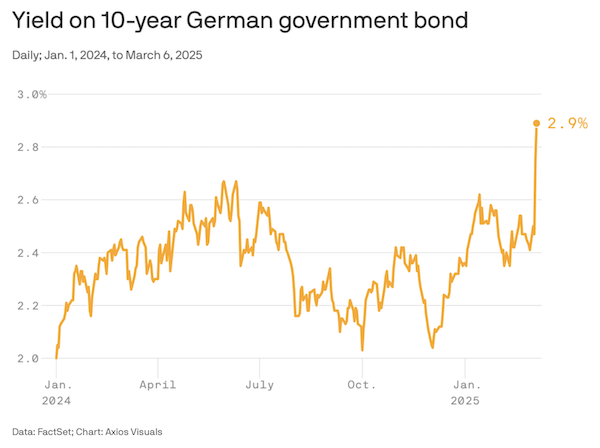

For two years post-Covid, German interest rates, as measured by 10-year treasuries, were negative. Thanks to huge amounts of global government stimulus, there were trillions of Dollars and Euros sloshing around looking for a safe home and buying German bonds was an obvious choice. The country is Europe's factory, it has a very low debt-to-GDP ratio and there are laws in place to restrict excessive government borrowing.

Since then, yields have climbed higher. They went positive in 2022, then got stuck at around 2%, and they have now popped up to around 3%. Very slow economic growth, a pending trade war with the US, and the likely scenario of big borrowing to greatly increase their military capabilities, have all culminated in making German debt more risky.

For comparison, US 10-year bonds yield just over 4% and South Africa is around 10.5%. So Germany is still in a good position, but going from having people pay you for your debt, to now paying 3% interest, is a rather large adjustment.

Bright's banter

Tubi has quietly built the largest content library in the streaming world, boasting over 275 000 titles, surpassing Netflix in sheer volume. The free, ad-supported platform has grown into a formidable player, with 97 million monthly active users and major partnerships, including Fox Sports (Super Bowl simulcast), WWE, and The Black List. It's also gaining traction in markets like Mexico, where it exclusively streams the Concacaf Champions Cup.

But despite its reach, Tubi struggles with public perception. Critics see it as a dumping ground for low-budget, straight-to-DVD-style movies. However, Tubi embraces its unconventional mix, offering everything from 1990s heist films (The Thomas Crown Affair) to obscure cult horror (Leprechaun 4: Lost in Space). As Chief Marketing Officer Nicole Parlapiano puts it, "We're not here to tell you what is good."

Tubi's journey started in 2014, founded by Farhad Massoudi as an ad-tech platform before pivoting into streaming. Unlike Netflix and its competitors, which chase prestige content and exclusive originals, Tubi thrives on accessibility. Inspired by YouTube, the company built a creator-friendly model, attracting independent filmmakers, especially within Black creative circles. Viral low-budget movies like Cocaine Cougar and Amityville in the Hood became internet sensations, helping solidify Tubi's niche.

Tubi was acquired by Fox in 2020 for $440 million, and by 2023, Massoudi exited. The company is now following a strategy similar to Fox's rise in the 1990s, leveraging diverse content before expanding to broader demographics.

Rather than competing head-on with Netflix, Tubi aims to normalise free streaming as a legitimate alternative. It's prioritising partnerships that keep its eclectic catalog fresh, using a mix of licensing deals, revenue-sharing agreements, and original content development. The model is simple: zero barriers, no sign-ups, just press play.

This makes Tubi incredibly competitive. They're Shoprite, they have some of everything, and they're winning because there's no entry cost.

Linkfest, lap it up

Collectors Treasure is a retail building at 244 Commissioner Street in downtown Johannesburg. Its multi-stories are full of books and collectable items (Michael also got engaged there) - Remembering Geoff Klass and his towers of books.

Palmer Luckey, an American vulcan. From building Oculus goggles to remaking the defence industry - Better than Elon.

Signing off

Asian markets are off to a mixed start this morning. Japan, South Korea, and Taiwan saw strong gains, while Hong Kong, India, and mainland China edged lower. Investors are weighing global economic signals like Trump's tariffs and regional noise.

In local company news, Homechoice International delivered strong full-year results, with revenue climbing 20.6%. Profit increased 25.7% to R411 million, driven by growth in its fintech customer base and an aggressive digital expansion strategy.

US equity futures edged higher pre-market as Donald Trump tried to talk up the economy. The Rand is trading at around R18.26 to the greenback.

There is a US inflation reading out today which may be decisive. Our Finance Minister will have another crack at announcing a national budget in Parliament.

Let's all just keep moving along, hoping for the best.