Market scorecard

The S&P 500 shook off early losses to finish higher last night, with about 345 stocks advancing. Markets were muted as most banks and other institutions were closed for Veterans' Day.

In company news, FedEx shares jumped more than 5% after the delivery giant forecast higher quarterly profits. Elsewhere, CoreWeave sank 16.3% because the AI infrastructure company cut its full-year revenue outlook, citing delays in delivering on a major customer contract. Lastly, Google has committed EUR5.5 billion to expanding its computing operations in Germany over the next four years.

In summary, the JSE All-share closed up 0.31%, the S&P 500 rose 0.21%, and the Nasdaq was 0.25% lower. No fireworks, just an average day at work.

Our 10c worth

One thing, from Paul

Uber is a secondary Vestact portfolio holding. It was founded in 2009, and I recall visiting the US around that time, armed with a new smartphone that featured mapping functionality and a GPS chip. I was hooked and have been a loyal user ever since. How often have you said something like "Let's Uber to the party so we can relax and have a few glasses of wine"?

There are 65 Vestact clients that own Uber, including some who bought it on the day that it listed in May 2019 at $42 per share (including me). It now has a market value of $195 billion, and operates in 70 countries and 15 000 cities worldwide. Its headquarters are in Mission Bay, San Francisco. It was founded by a hard-charging guy called Travis Kalanick, but since 2017, it's been led by a very talented CEO, Dara Khosrowshahi.

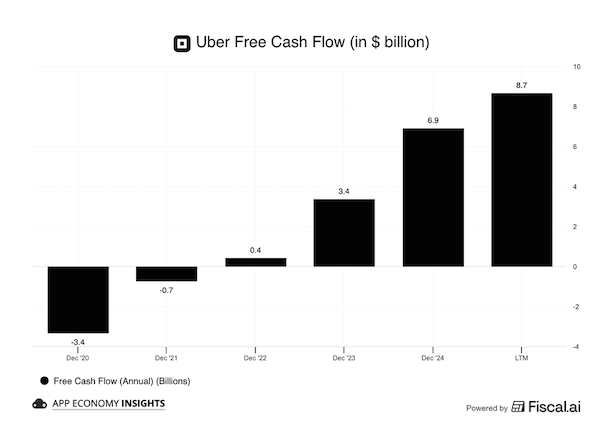

Uber has around 180 million monthly active customers worldwide, growing at about 15% per annum. It provides a livelihood for over 6 million drivers and couriers. Up until 2022, Uber made huge losses, then it raised prices, slowed capital spending and focused on profitable markets. You can see the results of that shift in the chart below. They've since added Uber Eats, Uber Freight, and more recently, Uber One, a subscription product.

The future of mobility is autonomous vehicles. That's still a little hazy, but the major players are Uber, Waymo (Google), Tesla and Nvidia. They are all working with each other in various markets. Nvidia and Uber just announced a new "robotaxi data factory". Uber will provide the data for autonomous model training, and Nvidia will provide the world-class GPUs and physical AI models.

Uber trades at 19 times its forward free cash flow, which will probably grow by 30% this year. Sounds cheap, maybe?

Humans highly value mobility. Uber is a nice one to add to your portfolio if you already have all the other Vestact-recommended stocks. I like them below $100 per share. Buy!

Byron's beats

Let's have another look at tech stock valuations. I know I have been beating on this drum for a while, but it is a very hot topic at the moment and has a direct impact on our portfolios.

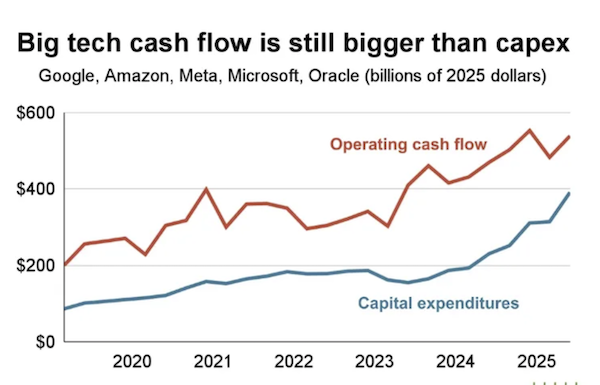

The graph below suggests that tech stocks are not frothy, high-risk investments. As you can see, operating cash flow has been growing very nicely for Google, Amazon, Meta, Microsoft and Oracle.

Their aggressive capital expenditure is easily funded by cash flows, not debt. In other words, these companies are still making a lot more money than they are spending. As an investor, that is the kind of news you like to hear.

Michael's musings

The BBC is in trouble for making a documentary about Trump where they spliced a speech he gave to make it sound like he was inciting violence. In their version, they joined two parts that were around 50 minutes apart. You can watch the original and the edited versions here. What were they thinking?

Fake news is a problem. This is especially true now that AI and social media make it very easy to generate and distribute nonsense. There's just too much news and information out there for us to fact-check everything.

Journalism plays a vital role in society. We need news organisations that are unbiased, do the fact-checking for you, and then publish stories to inform us properly. Some news organisations are run for profit, meaning they are unashamedly biased to their audience's views, like Fox News or CNN. That is okay because we know ahead of time that their reporting leans a certain way.

The BBC is publicly-owned and supposed to be reliable, so this error is unacceptable. There's already some distrust of 'big media', and the BBC has added fuel to that fire. In a time where it is imperative to have bastions of truth, the BBC went in the opposite direction.

Bright's banter

When Neil du Preez first dreamed up MellowVans, he wasn't chasing a trend, he was solving a problem he'd seen first-hand. Watching tuk-tuks dart through traffic on the bustling streets of Southeast Asia, he saw potential in their simplicity but also the opportunity to reinvent them for a new era: safer, sleeker, and electric.

Back home in Stellenbosch, he built his prototype. First for passengers of "MellowCab," and later pivoting toward cargo, when e-commerce exploded and the demand for efficient last-mile delivery surged.

Today, MellowVans serve blue-chip fleets like DHL, Takealot, Spar, and Woolworths, offering 140km of range, 2.5 metres cubed of cargo space, and operating costs as low as R0.15/km. The company has since gone global, gaining EU and UK road certification, landing pilots in Belgium and the Netherlands, and even picking up a logistics award at the Paris Motor Show.

With 70% local content in the vehicles, and financial backing from the IDC, MellowVans has scaled up production while keeping its soul firmly South African. Now, as global cities push for cleaner, smaller delivery vehicles, MellowVans is South Africa's quiet contribution to the electric revolution.

Linkfest, lap it up

What do you think of Grokipedia? It's entertaining, in parts - Grokipedia is the antithesis of everything that makes Wikipedia good.

Facebook has a dating feature that is growing in popularity. It is one way the app is targeting under 30s - The feature isn't available in South Africa yet.

Signing off

Asian markets are broadly higher this morning. In Japan, SoftBank Group is sliding almost 6% after offloading its entire $5.83 billion stake in Nvidia and trimming its T-Mobile holdings by $9.17 billion to refocus on investments in OpenAI. In Australia, Mineral Resources rose more than 9% after agreeing to sell a 30% stake in its lithium operations to South Korea's POSCO Holdings.

Here in South Africa, Tiger Brands is pressing ahead with its portfolio overhaul, agreeing to sell its 74.7% stake in Cameroonian unit Chococam to Africa-focused investor Minkama Capital and BGFIBank Group.

US equity futures are slightly higher pre-market. The Rand is trading at around R17.16 to the greenback.

Keep well.