Market scorecard

US markets kicked off the week with strong gains on news that the record-long US government shutdown will soon be over. The Senate approved a deal to reopen the government last night, which will now go to the House, so most of last week's market losses were promptly erased. The tech-heavy Nasdaq led the rally, with Nvidia up 5.8% and Google up 4.1%.

In company news, grocery delivery giant Instacart beat expectations with solid order growth and issued an upbeat outlook. Elsewhere, TSMC reported slower monthly revenue growth, but its share price still rose 2.9%. Finally, Eli Lilly hit a new all-time closing high, and is now just a stone's throw away from trading above $1 000 per share.

At the close, the JSE All-share was up 1.83%, the S&P 500 rose a stellar 1.54%, and the Nasdaq zoomed 2.27% higher. Splendid!

Our 10c worth

One thing, from Paul

In life, we are taught to take action. Don't sit on your bottom, looking at a problem, do something about it. Make a start and figure out the best solution as you go along. If your house is a mess, get busy fixing it. Don't procrastinate. If your paunch is spreading, pull on some tackies and get outside, etc, etc.

The problem is that when it comes to investing, the opposite is true - you need to have a bias towards inaction. You have to avoid responding to market chatter. You have to ignore silly headlines about market concentration, imminent corrections, credit concerns and the blathering of anti-market politicians.

Barry Ritholz said it well recently: "fiddling with your portfolio acts as a salve to reduce your anxiety, because it gives you the illusion of control. Doing something makes you feel like you have influence over random events, which you decidedly do not."

In general life, the best advice is "don't just sit there, do something", but when you are invested in high-quality blue-chip stocks, the best advice is "don't do something, just sit there."

Byron's beats

When clients look at their portfolios, they often focus on the stocks that are not doing well. That's understandable, they want the best possible outcome from their investments and getting rid of the weakest links sometimes makes sense.

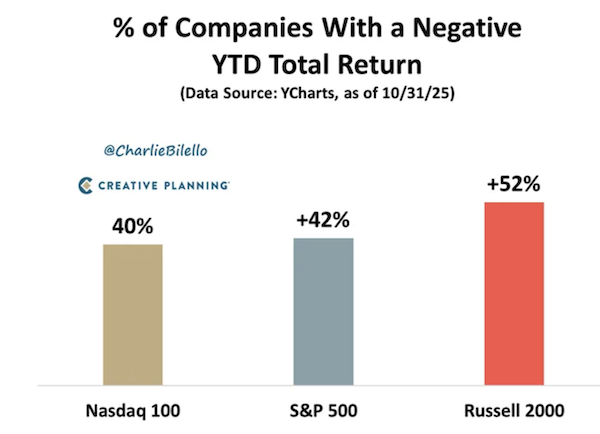

Take a look at this image for some perspective. It shows that despite the general market going up 14% so far this year, 42% of S&P 500 stocks are down. It's very hard, nearly impossible, to pick a portfolio of only winners.

Remember too that certain sectors and businesses are cyclical. Just because their share prices are down, does not mean a stock should be sold. In fact, sometimes it is a good opportunity to be buying some more.

We are slow movers when it comes to selling underperforming stocks because we have seen the likes of Nvidia, Meta, Google, Amazon and Tesla roar back to life after prolonged periods of poor share price performance.

The trick is to be patient, because not all shares in your portfolio will go up all of the time and at the same time.

Michael's musings

In the US, buying a house is expensive, with many people saying that they can't afford current prices. The majority of buyers use financing to buy their properties, so the price of the home isn't as important as the monthly bond repayment amount. As such, 30-year mortgages are popular because their monthly repayment is lower than the traditional 20-year option that we have in South Africa.

TTo help more Americans afford houses, government officials are now proposing 50-year mortgages. Over that time frame, people are essentially paying only the monthly interest on the loan, with almost zero capital repayment. This is especially true given that most people don't live in the same property for 50 years.

A 50-year mortgage might help people afford houses today, but that extra demand pushes prices up, meaning that in a few years from now, the same segment of the population who can't afford them today, won't be able to afford them then. Economics tells us that the only way to stabilise housing prices is to increase supply.

Bright's banter

Prediction markets just went mainstream. Intercontinental Exchange (ICE), the NYSE's parent, announced last month that it was investing up to $2 billion in Polymarket, valuing the crypto-native betting and forecasting platform at around $8-9 billion and minting 27-year-old founder Shayne Coplan as one of the youngest self-made billionaires tracked by Bloomberg.

Coplan launched Polymarket after diving into economist Robin Hanson's work on prediction markets. The product is simple and addictive: trade event outcomes (elections, policy moves, sports) with prices that double as live probabilities.

After early regulatory run-ins, growth has exploded as retail investors and professional traders use these markets for real-time signal - exactly the kind of high-frequency, sentiment-rich data ICE can package and distribute to institutions.

ICE wants in because they want to generate fees from rising volumes in event contracts, differentiated data for clients, and a beachhead in tokenised market infrastructure. Prediction markets are evolving from curiosity to an asset class.

Linkfest, lap it up

Social drinking in moderation isn't a bad thing. Skipping after-work drinks might be better for our bodies, but the social side of things suffers - Don't be boring.

How will AI impact labour forces around the world? India is betting that the needs from the AI industry will outstrip those of call centres - Meet the AI chatbots replacing India's call centre workers.

Signing off

Asian markets are the usual mixed bag this morning. Australia is slightly lower, though some energy names are moving higher - Santos, Origin Energy, Woodside and Beach Energy are all up 1% or more. The market in Japan is modestly higher, buoyed by a 5% surge in SoftBank and a 2% rise in Uniqlo-owner Fast Retailing.

In local company news, Shoprite delivered strong half-year results, growing group sales 8% and adding 81 new stores as it pushes ahead with an aggressive expansion strategy that's expected to create over 10 000 jobs this year.

US equity futures are slightly in the green pre-market. The Rand is trading at around R17.15 to the US Dollar.

It's very wet this morning in Joburg, the summer rains have really arrived early this year. Have a good day.